Posted originally on the conservative tree house on November 13, 2022 | Sundance

If CTH had a small part in helping people to reset their reference points around modern electioneering, well, that’s a good thing.

The difference between “ballots” and “votes” is previously explained {SEE HERE} and absolutely critical to understand before moving forward.

Thankfully a large percentage of conservatives, intellectually honest independents and even some establishment republican donors have read our research and are now starting to have the ‘votes‘ vs ‘ballots‘ conversation. That understanding is critical, because any conversation that does not accurately identify and accept the problem is futile.

Having said that, please do not think we are smarter than the RNC. We are not. Miss this point and you miss the next ‘ah-ha‘ moment.

The RNC club knew exactly what the DNC club were doing in their 2022 midterm “ballot submission assistance” program. Yes, that’s exactly what “ballot harvesting” is called now. “Ballot Harvesting” is illegal in many states, “Ballot Submission Assistance” is not.

Progressive political activists in the state of Arizona are now scrubbing the footprints of their ballot submission assistance programs. Wait, Arizona(?) you say. Yes, Arizona a state where “ballot harvesting” is illegal, but email, fax, online and in person drop-off is possible. Ballot assistance is essentially the same harvesting process but in a smaller and more individualized scale.

REFERENCE and CONTEXT is critical to understanding.

After Eric Holder left the Obama administration as Attorney General, he was hired by the State of California to defend against the Trump administration in early January 2017 (LINK).

Why?

When Eric Holder left the Obama administration, his firm was contracted by California during a process of linking the motor vehicle registration files to the Secretary of State voter registration system. Holder was advising on part of a technology system being constructed to bridge the DMV and SoS offices. You might know this as a “Motor/Voter” process. However, former AG Eric Holder had a very specific function in the construction of this technology bridge.

The process of adding voters to the registration rolls when they receive or update their driver’s license was seen as an opportunity to expand the voter rolls. Making the voter rolls as big as possible is the key to the utilization of mass mail-out balloting. I will skip the part where California started giving illegal aliens drivers licenses for a moment – you can obviously see how that would play with motor/voter rolls – instead I am choosing just to focus on the specifics of the Holder aspect.

The DMV needed to connect to the SoS office. This was simply a part of a tech system that needed to be built. CTH has previously spoken with the lead engineer, a member of a very small technology group, who worked in the California information technology (IT) unit that was tasked with building the system that connected the DMV to the SOS. [NOTE: I invite the state of California to sue me as they will likely claim what you are about to read is not true.]

In the process of connecting the two state networks together, there needed to be a “flag”, essentially a check box, where the applicant to the DMV would attest to being legally authorized to vote. It is a positive affirmation, a check box, that says the Driver’s License holder affirms they are legally eligible to vote. That affirmation (the technical flag in the process), when affirmed, then transmits the information to the SoS office with the DL operator identity, and the California driver is automatically added to the SoS rolls and registered to vote.

During the time when Eric Holder was the legal counsel for the California Secretary of State, the technology team was constructing the internal data processing systems.

The lead engineer in the unit was instructed to code the data transfer in such a way that even if the “check box” was left unchecked, the registration data would transmit from the DMV to the SoS office.

Essentially, instead of only those who affirmed their legal eligibility by checking the box, everyone -including those who did not check the box- would get a DL and would automatically have their information transmitted to the SoS office. Everyone who received a driver’s license or state issued id was automatically going to be registered to vote, regardless of their legally authorized status. That request led the engineer to contact me.

I wrote about it, published the details, then the engineer freaked out as he/she realized there was only a very limited number of people who could expose the issue. He/She was worried about his/her safety and family and asked me to remove the article. This background is how I know the details of who, what, when and why the California mass mailing ballot process was being constructed.

In the 2018 midterm elections we all watched the outcome of that process surface in the weeks following election day. As each day passed more and more California mail-in ballots were being counted and day-by-day Republicans who won on election day 2018 watched their lead evaporate.

What happened in the California 2018 midterm election surrounding state-wide ballot distribution, collection (harvesting) and eventual presentation to the counting and tabulation facilities, was the BETA test for the 2020 covid-inspired national ballot mailing process.

The outcome we are seeing from the 2022 midterm ballot collection program was not just similar to the 2020 general election ballot collection program, it is a direct outcome of the refined BETA test from 2018. Now we have multiple states following the California mass distribution of ballots approach. Washington state, California, Arizona, Colorado, Pennsylvania, Wisconsin, New York, New Jersey, Michigan, there’s a long list.

In many states mass mailing of ballots is now codified in election law. Activist election lawyer Marc Elias now coming in behind the construction team of Eric Holder with the legal arguments to support the ballot collection programs.

The Importance of Election Rolls – As you can see from the California initiation point (Motor/Voter), in order to most effectively use the mass distribution of ballots as an electioneering process you first need a massive state secretary voter file in order to generate, then mail, the physical ballots.

Remember, votes require people – ballots require systems.

Any institutional system that can link people into the SoS system to generate a larger registration file for ballot distribution is a net positive. The key point is not to generate voters, the key is to generate ballots – the more the better. Mass printing of ballots is the origin of the electioneering process.

Any state or federal system that links a physical identity to the secretary of state voter rolls is good. Any system, like the USPS postal change of address system, that would remove physical identities from the state voter rolls is not useful. The goal is to maximize the number of systems that generate registration, that eventually generates ballots.

Beyond the Driver’s License issue, it’s everything. Sign up for public assistance, get registered to vote. Sign up for state benefits, get registered to vote. Sign up for a state id, get registered to vote. Sign up for state college, get registered to vote. Sign up for a grant, get registered to vote. Sign up for unemployment, get registered to vote. Sign up for any state system and get registered to vote. Get married, change names, change addresses, etc, that’s how the voter rolls expand and that’s how the massive distribution of ballots is created.

The states then fight against anything, any effort, any process, that would purge voter rolls or fix incorrect voting rolls. To use the new electioneering system, the system operators need ballots created, they no longer need votes. They need ballots.

Downstream from this process that’s where you find the “ballot submission assistance” programs. This is where the local community networks, regional activist groups and widespread community organizers come into play. Instead of advertising or the previous electioneering systems around candidate promotion and Get Out The Vote (GOTV) efforts, the majority of donations to the DNC are now used in the ballot assistance programs.

SIDEBAR – Now keep in mind, the origination of the ballots starts with expanded voter rolls. The rolls contain the registry status of people, regardless of their accuracy or inaccuracy.

If you were going to hire a printing company to send out fancy wedding invitations, you would need to provide that third-party with the names, addresses and details of the invitation recipients, right? Now, overlay ballots into a similar framework. Do you remember the recent issue of Konnech (CEO Eugene Yu), an election technology company, indicted for transmitting the data files of every registered voter in Pennsylvania (and more) to China?

Inside that Konnech story is how the modern ballot creation issue connects to the activity of Eugene Yu. Did pre-printed ballots arrive en-mass, in the U.S.A, as a result of the massive data files transmitted to China? That might be a sticky-widget for quite a few interests. Then again, what state just dropped the charges against Yu on the day after the midterm election? Oh, California. I digress…

The RNC and DNC are Corporations. Please understand that both the RNC and DNC are not government entities. They are each private corporations with their individual agenda, rules and memberships. These are corporations that function more like private clubs.

When it comes to ballot collection as a newly enhanced modern electioneering process, the RNC club isn’t incompetent or stupid, they knew what the DNC club was doing.

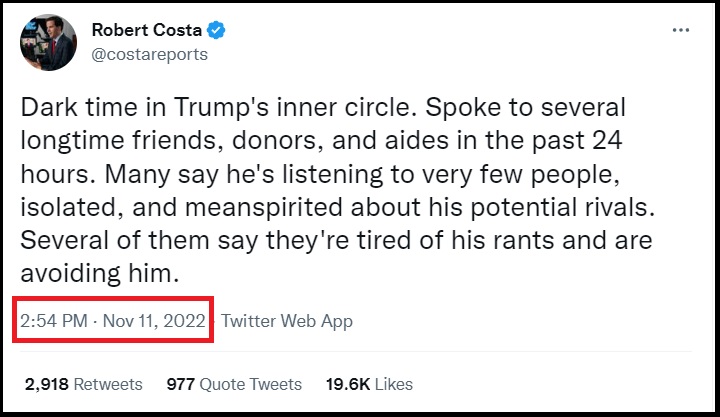

The RNC club operated in the 2022 midterm election to support (willful blindness) the DNC club effort. Why? Because the RNC club wants to remove the problems they have with the populist movement. The issues are big.

The RNC Club wants, as billionaire donor Ken Griffin explained from his discussions with Ronna McDaniel, Ron DeSantis and Kevin McCarthy, to remove the populist elements within the Republican party, vis-a-vis MAGA, and realign with the multinational corporations on Wall Street. “He wants to improve the diversity of the GOP and blunt the vein of populism that has complicated the party’s relationship with the corporate world — two things he’s consulted with House Minority Leader Kevin McCarthy about.” (link)

As you can see, the issue of “votes” -vs- “ballots”, is not a singular issue for American voters. We have a mixed bag of mutually aligned common enemies in this process.

Republican politicians will support any process, including mass mailout ballot distribution and collection, regardless of its corrupt status, that will eliminate what they define as the problem within their club.

Their problem has a face….

.