Posted originally on the conservative tree house on July 13, 2022 | Sundance

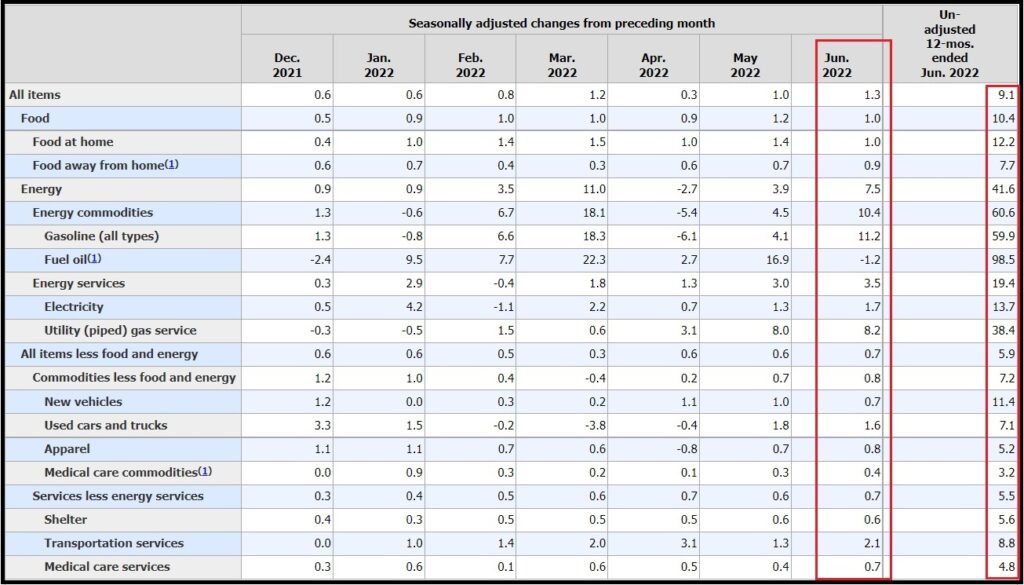

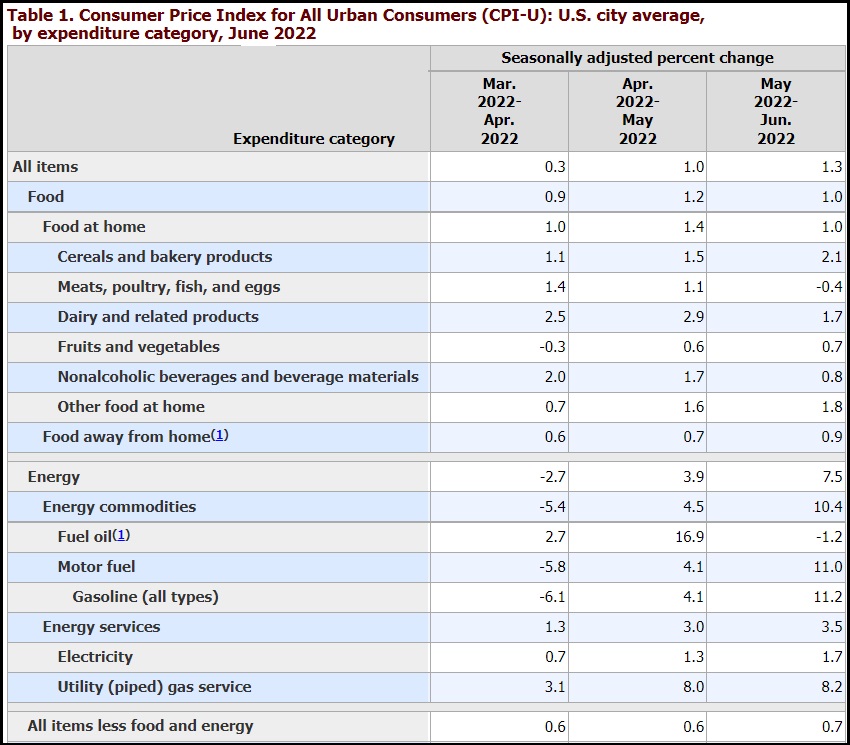

The Bureau of Labor Statistics (BLS) has released the June Consumer Price Index (CPI) [DATA HERE] showing yet another “surprising” increase in overall inflation. For the month of June overall inflation increased 1.3% bringing the annual rate of inflation to 9.1% as calculated.

Economists and financial pundits are “shocked”, “surprised” and the proverbial “unexpected” is running amok again amid the typeset. The reality of Joe Biden energy policy being the origin of our current inflation crisis is being avoided at all costs by the pretenders. The federal reserve raising interest rates can only impact the demand side, but it’s the supply side (total energy policy) creating the problem. Table-A shows the overview.

(CNBC) – […] The consumer price index, a broad measure of everyday goods and services related to the cost of living, soared 9.1% from a year ago, above the 8.8% Dow Jones estimate. That marked the fastest pace for inflation going back to November 1981.

[…] “U.S. inflation is above 9%, but it is the breadth of the price pressures that is really concerning for the Federal Reserve.” said James Knightley, ING’s chief international economist. “With supply conditions showing little sign of improvement the onus is the on the Fed to hit the brakes via higher rates to allow demand to better match supply conditions. The recession threat is rising.” (read more)

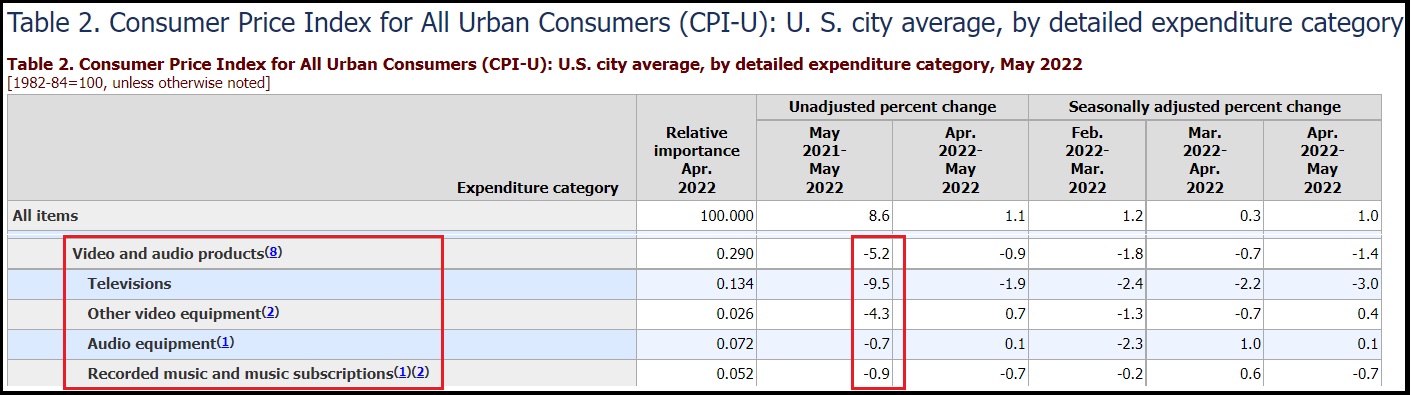

If you dig into the details, the inflation picture shows just how deep the energy policy is hitting. Everything is impacted by Joe Biden’s radical energy policy. Table-1 breaks down the data a bit more specifically. However, even this data is skewed by the BLS putting a weighting factor on the importance.

♦ The rate of annualized inflation for natural gas is now running at almost 100%. Meaning if things continue, the current price will double again by this time next year.

♦ The rate of annualized inflation for gasoline is running at 134%.

♦ The annualized rate of energy inflation overall is running at 90%.

These are the results of the people behind Joe Biden implementing the Green New Deal program by executive fiat.

Also, keep in mind the current increases in farming costs at the field have yet to reach wholesale and retail. The fertilizer, oil, diesel, packaging, transportation and energy costs at the field will not arrive to the fork until later this fall. That is when food inflation will surpass energy inflation.

Current cattlemen and ranchers are finding it more cost-effective, due to drought and high feed costs, to take their cattle to slaughter. There is a temporary drop in beef prices for the next several weeks before the supply roller coaster sets up a scenario for massive increases in beef costs this winter. Consider buying and freezing now for use later this year and into the winter. Try to buy directly from cattle ranchers.

Later this year the next wave (#3) of food inflation will surpass the last two waves. Things will get ugly because there are also predictably shortages of food coming. Higher farm costs and global food supply shortages equals much, much higher U.S. prices. Prepare.