Published on Nov 30, 2018

Tag Archives: progressives

Did Obama Throw Out Fox News?

Armstrong Economics Blog/Press

Re-Posted Dec 2, 2018 by Martin Armstrong

QUESTION: Did Obama throw Fox News out of the press conferences?

HJ

ANSWER: No. That is not true. Obama hated Fox News just as Trump hates CNN. Obama called Fox “destructive” for the country. They are just lucky I am not President for I would immediately restore the Fairness Doctrine and force them all to present an UNBIASED balanced report. We like in the world of FAKE NEWS because everything is twisted to the political views of the journalist – that is NOT what free press was all about.

Alexandria Ocasio-Cortez equate the Holocaust to the Caravan Trying to Get In to the USA

Armstrong Economics Blog/Uncategorized

Re-Posted Dec 2, 2018 by Martin Armstrong

All the hype over Alexandria Ocasio-Cortez who was elected and waiting to take office come January is interesting insofar as the Democrats saw her as the future of the Party, they really have to take a closer look. She compared the caravan from Central America to the Jews fleeing Germany. Republican Sen. Lindsey Graham of South Carolina had some words of advice for Alexandria Ocasio-Cortez. “I recommend she take a tour of the Holocaust Museum in DC,” Graham tweeted. “Might help her better understand the differences between the Holocaust and the caravan in Tijuana.”

It looks like we are going to have some interesting crazy dialog coming out for the next two years.

The Business Cycle & the Suicide Rate

Armstrong Economics Blog/Economics

Re-Posted Nov 30, 2018 by Martin Armstrong

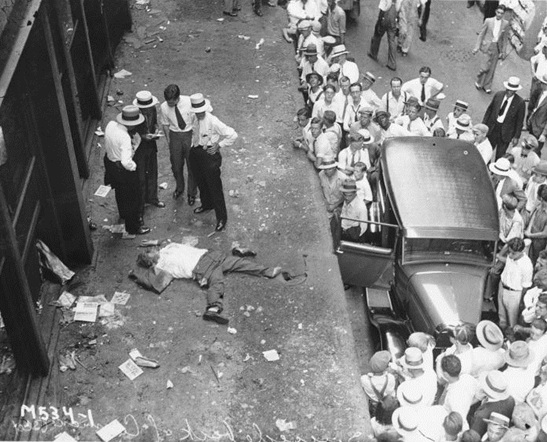

The press is all abuzz about the suicide rate is up 33% in 20 years and they blame the lack of funding as if this alone will cure the problem. They never seem to simply correlate this with economics. Now we have more than 47,000 Americans committed suicide in 2017, according to the Centers for Disease Control and Prevention. They also said that this is contributing to an overall decline in U.S. life expectancy rate. Even in Japan, there is a place known as the Suicide Cliffs. People jump from the cliffs in Japan cyclically. They jump during financial crises more than during any other period. They also will commit suicide when winter ends and the sun returns. People then see the requirement of returning to a routine they view as their torment and misery. In Japan, the intense pressure of Japanese schools has also been seen as a major contributing factor.

As the largest continent in the World, Asia accounts for about 60% of World suicides with China, India, and Japan accounting for about 40% of the World’s suicides. On an international basis, there are about 1 million suicides that take place every year. The difference in the suicide methods between the Western and Asian countries is rather significant. While in financial centers jumping from buildings also took place in New York and Chicago during the Great Depression, there were also jumpers in Japan from the Panic of 1990. The use of firearms is the favored suicide method in many Western countries, but not in Asia perhaps due to the lack of access. Asian suicides often take the form of pesticide ingestion, charcoal burning, and self-immolation. Hanging seems to be also a leading suicide method both in the East and the West, as well as in prisons. Prison suicides will also take the form of deliberately trying to create a lethal confrontation with someone to get killed as they are compelled to engage in self-defense.

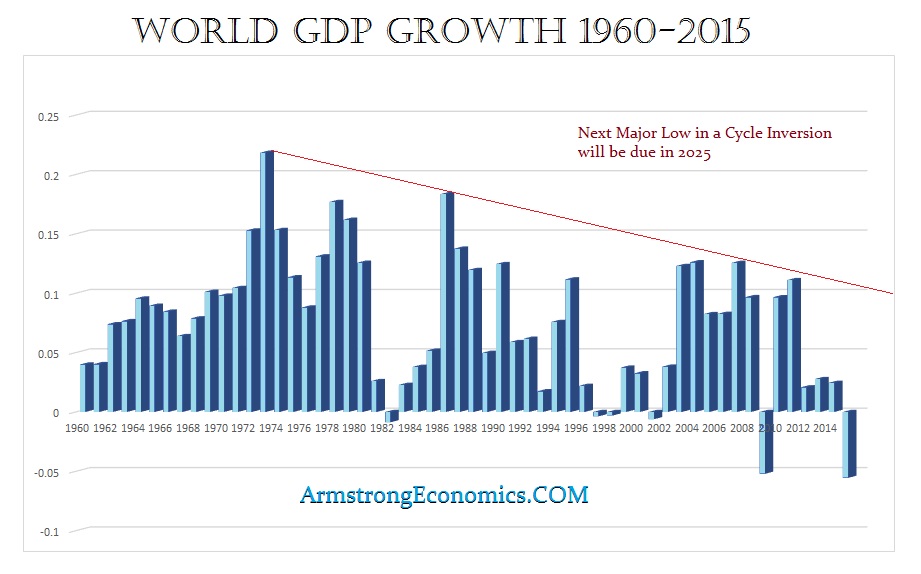

Suicides correlate to economic hardship which can be personal or imposed upon by society and the business cycle. The higher the tax rate and the lower the standard of living is also a key factor for people will be driven to commit suicide facing economic failure. As the world economy continues to decline in real growth, it is not surprising that the suicide rate has increased by 33% since 1999 in the United States alone. This trend is part of the cycle. When people face that decision of whether to stay or to go into the light seeking relief and peace, sometimes they will take their entire family with them because the pain is so great yet they have responsibilities they also cannot leave behind. They will take their family in their mind relieving them of the same pain.

US Bank Reserves 10% – EU Bank Reserves 1%

Armstrong Economics Blog/Banking Crisis

Re-Posted Nov 30, 2018 by Martin Armstrong

QUESTION: What mechanism prevents banks from creating fraudulent electronic deposits of currency?

As an IT systems admin, I have the ability to add / subtract / adjust ERP systems inventory / costing outside the normal users ability. I could add widgets to the system at will, but fraud can’t be sustained very long, as the physical widgets can’t be sold, they only exist in the system. Electronic currency, however, is only a ledger entry, and since new currency units are created as loans – What prevents any bank from just changing the numbers in their systems to create more currency units at will? Can’t get my head around this.

Thanks for all you do from a little guy just trying to get by!

ANSWER: The creation of money electronically in the banking system is the degree of leverage. Reserve Requirement Ratio at the Federal Reserve was increased on January 18th, 2018. It required that all banks with more than $122.3 million on deposit maintain a reserve of 10% of deposits. Banks with $16 million to $122.3 million must reserve 3% of all deposits. They create money that is purely electronic and we do not see it. I deposit $100 and they lend it to you. Now we both have $100 on deposit and the reserve requirement will be $20 for most banks. They then lend it out a third time and there is now $300 on deposit requiring $30. They cannot create entries out of thin air. They are audited and the reserve ratio is strictly enforced in the USA. The Fed will raise and lower that reserve ratio as they see fit based upon economic conditions.

At the European Central Bank, things are substantially different. Eurozone banks are required to hold a specified amount of funds as reserves on AVERAGE in their current accounts at their national central bank in each member state which are called “minimum reserves”. Remember, each member retained its own central bank! A bank’s minimum reserve requirement is set for six-week periods called maintenance periods. This minimum reserves level is therefore calculated on the basis of the bank’s balance sheet prior to the start of each six-week maintenance period.

At the European Central Bank, things are substantially different. Eurozone banks are required to hold a specified amount of funds as reserves on AVERAGE in their current accounts at their national central bank in each member state which are called “minimum reserves”. Remember, each member retained its own central bank! A bank’s minimum reserve requirement is set for six-week periods called maintenance periods. This minimum reserves level is therefore calculated on the basis of the bank’s balance sheet prior to the start of each six-week maintenance period.

Banks have to make sure that they meet the minimum reserve requirement only on an AVERAGE over the course of the maintenance period. This introduces serious risk. The bank can dip below the minimum reserve in the middle of a crisis and at the end of the six-week period, there can be no reserves remaining. So they do not have to hold the total sum in their current accounts at the central bank on a daily basis! Therefore, this is a flexible arrangement that allows the banks to react to short-term changes in the money markets, but it exposes them to tremendous risk in a financial panic. The design was claimed to help stabilize the interest rate banks charge each other for short-term funds. I totally disagree with this concept.

Up until January 2012, European banks had to hold a minimum of only 2% of certain liabilities, mainly customers’ deposits, at their national central bank. As the economic crisis has continued in Europe, this 2% level has been to 1%! The total reserve requirements for Eurozone banks stand at only around 113 billion euro currently.

Perhaps now people will understand why I have been warning about a MAJOR financial crisis starting in Europe and spreading thereafter around the globe. The general media and the public will NOT understand the reserve ratio disparity so a banking crisis in Europe will be assumed to be the same around the world. Unfortunately, what happens in Europe will NOT stay in Europe. This is also why I STRONGLY urge Europeans to create a stash in the US banks for now. The ECB is seriously looking at creating a cryptocurrency to defeat hoarding just canceling Euro notes. That will end hoarding and they will be able to then enforce negative interest rates. From the ECB view, they are concerned about the coming bank crisis in Europe so the best way to prevent a bank run is to eliminate cash! Europeans should open accounts outside the Eurozone before it is too late.

And Prime Minister Theresa May wants to stay linked to Europe. This is when we need people who REALLY are qualified to understand the world financial system. I cannot express how dangerous it has become with politicians who are clueless about how the world economy even functions. UK banks operate under a completely different scheme.

And Prime Minister Theresa May wants to stay linked to Europe. This is when we need people who REALLY are qualified to understand the world financial system. I cannot express how dangerous it has become with politicians who are clueless about how the world economy even functions. UK banks operate under a completely different scheme.

In May 2006, the Bank of England began paying interest on bank reserve deposits at its official Bank Rate. This inspired US banks to demand the Fed pay interest on excess reserves. The Bank of England had the ‘reserves averaging’ regime back then whereby the quantity of each bank’s reserves that the Bank of England would pay interest on was restricted to a range around a ‘target’ level of reserves that the bank was obliged to pre-declare. The used to be set on a daily basis but was changed at this time to an average over each monthly maintenance period. The objective was to establish a marginal cost of reserves to the banks which would remain very near to Bank Rate. However, this was dependent upon the provision if the Bank of England supplied the right amount of reserves to enable the banks’ reserve deposits to be within this range.

In view of the Bank of England’s desire that wholesale market rates should remain close to Bank Rate was considered to be an improvement over earlier procedures prior to 2006 when reserves were mot paid interest and the Bank of England then had to supply reserves in quantities that exactly matched demand. Consequently, market interest rates tended to move towards the boundaries of the corridor formed by the Bank of England’s deposit and lending facilities. Nonetheless, under the new reserves-averaging regime post-2006, the Bank of England still had to supply reserves in appropriate amounts to meet demand, but it was more flexible. However, the new regime was still ill-equipped to cope with the expansion of reserve supply that the Bank of England then undertook to overcome the breakdown of interbank markets during the financial crisis of 2007-2009. To maintain interest rate transmission within the reserves averaging regime, the Bank of England then widened the range of reserve deposits that they paid interest on from 1% to 60% trading around the Bank of England’s targets. This required the Bank of England to then take steps to reabsorb the excess reserves.

The introduction of Quantitative Easing, which began in March 2009, merely created another problem from the reserve perspective. Suddenly, Quantitative Easing caused another larger expansion increase in reserve deposits. Rather than trying to offset this by selling other assets or making further adjustments to the reserves averaging scheme, the entire scheme was simply suspended in favor of paying interest unconditionally on ALL reserve balances.

Consequently, I have stated NUMEROUS times before, all central banks are NOT the same!!!!!!!!!!!!!!!!!!!

| Central Bank Reserve Ratios | ||

| COUNTRY | Bank Reserve Ratio | |

| ALBANIA | 10.00% | |

| ANGOLA | 24-May-18 | 19.00% |

| ARMENIA | 24-Feb-14 | 2.00% |

| ARGENTINA | 28-Sep-18 | 44.00% |

| ARUBA | 11.00% | |

| AZERBAIJAN | 1-Mar-15 | 0.50% |

| BANGLADESH | 3-Apr-18 | 5.50% |

| BARBADOS | 5.00% | |

| BELARUS | 16-Mar-16 | 7.50% |

| BULGARIA | 28-Nov-08 | 10.00% |

| CAMEROON | 7-Apr-16 | 5.88% |

| CAPE VERDE | 16-Feb-15 | 15.00% |

| CEN. AFRICA REP | 7-Apr-16 | 0.00% |

| CHAD | 7-Apr-16 | 3.88% |

| CHINA | 15-Oct-18 | 14.50% |

| DEM. | 8-Apr-15 | 2.00% |

| REPUBLIC | 7-Apr-16 | 5.88% |

| COSTA | 15.00% | |

| CROATIA | 11-Dec-13 | 12.00% |

| CZECH REPUBLIC | 20-May-99 | 2.00% |

| CURACAO | 10-Oct-13 | 18.00% |

| DENMARK | 2.00% | |

| EGYPT | 3-Oct-17 | 14.00% |

| EQUATORIAL | 7-Apr-16 | 5.88% |

| EUROZONE | 18-Jan-12 | 1.00% |

| FIJI | 7-Jul-10 | 10.00% |

| GABON | 7-Apr-16 | 5.88% |

| GAMBIA | 19-Jun-13 | 15.00% |

| GEORGIA | 13-Jun-18 | 5.00% |

| GHANA | 12-Nov-14 | 10.00% |

| HUNGARY | 1-Dec-16 | 1.00% |

| ICELAND | 1-Jun-16 | 2.00% |

| INDIA | 1-Jul-13 | 4.00% |

| INDONESIA | 18-Feb-16 | 6.50% |

| IRAQ | 1-Sep-10 | 15.00% |

| ISRAEL | 6.00% | |

| JAMAICA | 1-Jul-10 | 12.00% |

| JORDAN | 12-Mar-09 | 8.00% |

| KAZAKHSTAN | 2.50% | |

| KENYA | 5.25% | |

| KYRGYZ REPUBLIC | 14-Dec-15 | 4.00% |

| LITHUANIA | 3.00% | |

| MACEDONIA | 9-Sep-13 | 8.00% |

| MALAWI | 23-May-08 | 15.50% |

| MALAYSIA | 16-May-11 | 3.00% |

| MALDIVES | 20-Aug-15 | 10.00% |

| MAURITIUS | 2-May-14 | 9.00% |

| MOLDOVA | 4-Sep-18 | 42.50% |

| MONGOLIA | 23-Mar-18 | 10.50% |

| MOROCCO | 21-Jun-16 | 5.00% |

| MOZAMBIQUE | 26-Oct-17 | 14.00% |

| NEPAL | 11-Jul-18 | 4.00% |

| NICARAGUA | 15-Jun-18 | 10.00% |

| NIGERIA | 22-Mar-16 | 22.50% |

| PAKISTAN | 12-Oct-12 | 3.00% |

| PERU | 30-Apr-17 | 5.00% |

| PHILIPPINES | 24-May-18 | 18.00% |

| POLAND | 31-Dec-10 | 3.50% |

| QATAR | 16-Mar-17 | 4.50% |

| ROMANIA | 6-May-15 | 8.00% |

| RUSSIA | 27-Jun-16 | 5.00% |

| RWANDA | 5.00% | |

| SERBIA | 19-Jan-11 | 5.00% |

| SOUTH | 2.50% | |

| SRI LANKA | 14-Nov-18 | 6.00% |

| TAIWAN | 1-Jan-11 | 10.75% |

| TAJIKISTAN | 20-Mar-17 | 3.00% |

| TANZANIA | 21-Mar-17 | 8.00% |

| TRINIDAD & TOBAGO | 17.00% | |

| TUNISIA | 1.00% | |

| TURKEY | 13-Aug-18 | 8.00% |

| UNITED STATES | 27-Oct-16 | 10.00% |

| URUGUAY | 1-Apr-13 | 25.00% |

| UZBEKISTAN | 1-Sep-09 | 15.00% |

| VENEZUELA | 25-Oct-13 | 19.00% |

| VIETNAM | 1-Sep-11 | 3.00% |

| WEST | 16-Mar-17 | 3.00% |

| ZAMBIA | 21-Feb-18 | 5.00% |

Why Has Farmland Exploded in Price? The Accidental Trend Correlation

Armstrong Economics Blog/Agriculture

Re-Posted Nov 29, 2018 by Martin Armstrong

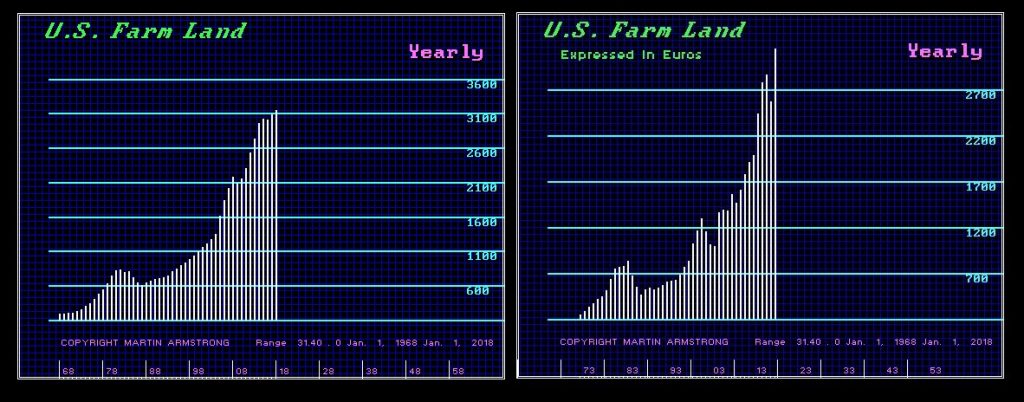

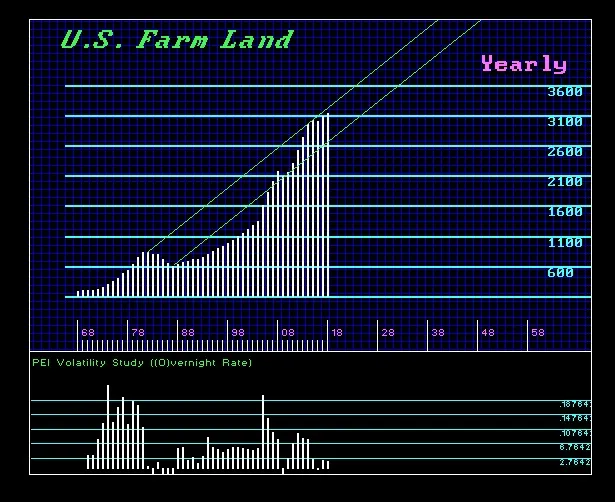

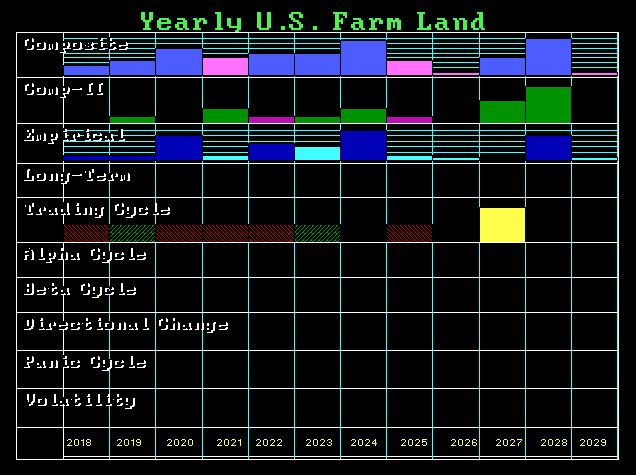

Most people have little idea WHY big money was targeting buying farmland in Canada, USA, and Australia. It was more than just Chinese investment. With interest rates down to negative, capital has been looking for returns. They were buying farmland and then renting it out generally for 5%. This created what many call the farmland bubble which has now begun to burst in some Corn Belt states, such as Iowa, as interest rates begin to rise. In 2015, the average increase of 2.4% percent on the low end and up to 8% in some states where the crop yields were best. This has not been a small investor or spec market. This was driven by the big boys seeking yield thanks to particularly the European Central Bank (ECB).

The nominal high came in 1982 and the commodity boom peaked in 1980 and interest rates peaked in 1981. The rising dollar caused the correction in nominal terms declining into its low in 1987. The market began to recover while the days of inflation and goldbugs faded forging the final low in gold during 1999. As is often the case, people just never look at assets in terms of international value. The surge in prices of latter that domestic analysts have called a “bubble” truly reveal more of a Phase Transition type rally more than doubling in price when plotted in Euros. The key to any market lies hidden within the depths of international capital flows which are driven foremost by currency values.

The lack of individual investors infiltrating this market leaving the big agricultural bets being placed not on expectations of global food demand will increase over time, but looking simply for yield, has led most analysis astray. Institutions, like the pension fund TIAA-CREF, have been the big buyers throughout 2017. They have been looking for bargains as farm real estate values have started to decline. Small farmers are finding it difficult to borrow from the banks for a crop season which can involve loans into several millions of dollars. If crops are wiped out, then they have a real problem.

The lack of individual investors infiltrating this market leaving the big agricultural bets being placed not on expectations of global food demand will increase over time, but looking simply for yield, has led most analysis astray. Institutions, like the pension fund TIAA-CREF, have been the big buyers throughout 2017. They have been looking for bargains as farm real estate values have started to decline. Small farmers are finding it difficult to borrow from the banks for a crop season which can involve loans into several millions of dollars. If crops are wiped out, then they have a real problem.

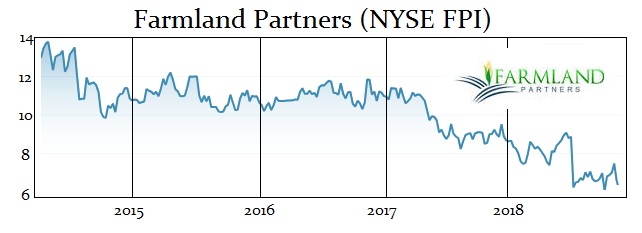

There have been stocks issued seeking to capitalize on the boom. Farmland Partners (FPI, NYSE) has been down about 20% since it was floated in 2014. It is a REIT which is a company that owns, operates or finances income-producing real estate. REITs were modeled after mutual funds to gather investors to collectively own valuable real estate and provide the opportunity to access dividend-based income and total returns. On its website, it states: “Farmland Partners Inc. is an internally managed, publicly traded (NYSE: FPI) real estate company that owns and seeks to acquire high-quality farmland throughout North America addressing the global demand for food, feed, fiber and fuel.” However, the play has NOT been the boom in commodities, but the yield from renting out the land.

Investors should be very careful with REITs because they tend to be illiquid and volatile.

When we look at the Array, we see turning points lining up for 2020/2021 and 2024 followed by 2026 and then 2028. The commodity cycle appears to be pointing to 2024. That is when we should see farmland values peak in real terms but keep in mind that it will all depend upon the particular region. The weather is going to kick in and that will reduce crop yields. Keep in mind that most of these REITs have entered this sector of the market for the wrong reason. It was not truly a commodity boom expectation as it was simply to get a 5% yield when interest rates were below that level. As interest rates rise above that 5% threshold, we will begin to see the big players bailout and begin to dump farmland at losses. Anyone looking to borrow against their land should use FIXED RATES only. If you decide to sell your land to the big boys while rates are still below 5%, the include a right of first refusal to buy it back at a reduced price when they decide to cut and run – which they will inevitably always do at the precise wrong time.

The LEI is the Means to an End in the Hunt for Global Taxation

Armstrong Economics Blog/Regulation

Re-Posted Nov 28, 2018 by Martin Armstrong

QUESTION: Hi Marty,

I wanted to ask you if you know anything about the LEI (legal entity identifier) that brokers are now requesting from clients who trade forex and other derivatives and who have accounts under a business structure?

I recently opened a trading account under a business structure (company/trust) and was only told yesterday I have a month to get an LEI (which I have to pay for myself and renew every year) otherwise I cant trade.

I have tried to gather info on it but there is only limited info and it is mainly info from the perspective of the reporting entities (such as brokers) and virtually nothing from the traders perspective. It seems like something that has been imposed by the EU.

I was wondering if you have also had to obtain an LEI?

Cheers

D

ANSWER: A Legal Entity Identifier (or LEI) is a 20-character identifier that identifies distinct legal entities that engage in financial transactions. The LEI is a global standard, designed to be non-proprietary data that is freely accessible to all so they can track what entities are doing worldwide. More than 600,000 legal entities have registered from 195 countries. This was created as a consequence of the 2007-2008 Financial Crisis. It is interesting how all governments manage to expropriate more power and control with each financial crisis. It was the CDOs created by Goldman Sachs which blew up the world just as the Black & Schol models in options blew up the financial world back in 1998 with the Long Term Capital Management crisis. But the legal entities that have created these catastrophes are NEVER punished. Not a single entity lost its license and not a single director ever when to jail. The people who blow-up the world are always UNTOUCHABLE and the rest of us lose our rights and freedom in the process.

The argument back during the 2007-2009 financial crisis was that there was no way to identify corporations and financial institutions to recognize the counterpart corporation on financial transactions. Therefore, the GOVERNMENTS could not figure it out while the counterparties knew who they were dealing with and accepted their credit position. Accordingly, it was impossible for governments to identify the transaction details and track the money flows of individual corporations and institutions. Governments argued they needed a simple identification method of everyone in the world.

In 2011, the G20 (Group of Twenty) called on the Financial Stability Board (FSB) to provide recommendations for a global Legal Entity Identifier (LEI). They wanted a cross-border entity to track everyone in the world. This led to the development of the Global LEI System which began issuing these LEIs to create a unique identification of legal entities acting within the entire world economy. The G20 claims this is necessary so they can know the total risk amount in a crisis. However, the G20 is still incapable of estimating individual corporations’ and the financial institution’s amount of total risk exposure. They are incompetent when it comes to analyzing risks across the entire global marketplace. They cannot even resolve the failing financial institutions in Europe because of local regulation that prevents cross-border solutions within the Eurozone.

The G20 blames this lack of knowledge was one of the factors that made it difficult for the early detection of the financial crisis, they will NEVER act to prevent anything in the first place. Adding more regulation simply reduces liquidity and shrinks the world economy. The G20, in response to these inabilities of financial institutions to identify organisations uniquely, claim that was the problem so that their solution was that financial transactions in different national jurisdictions can be fully tracked. Currently, the ROC (Regulatory Oversight Committee), a coalition of financial regulators and central banks across the country, cannot possibly act in advance for they fail to comprehend the dynamics of the world economy.

Hence, this is just another means of collecting data to be able to hunt for global taxation.

USA v Euro Capital Flows

Armstrong Economics Blog/Capital Flow

Re-Posted Nov 27, 2018 by Martin Armstrong

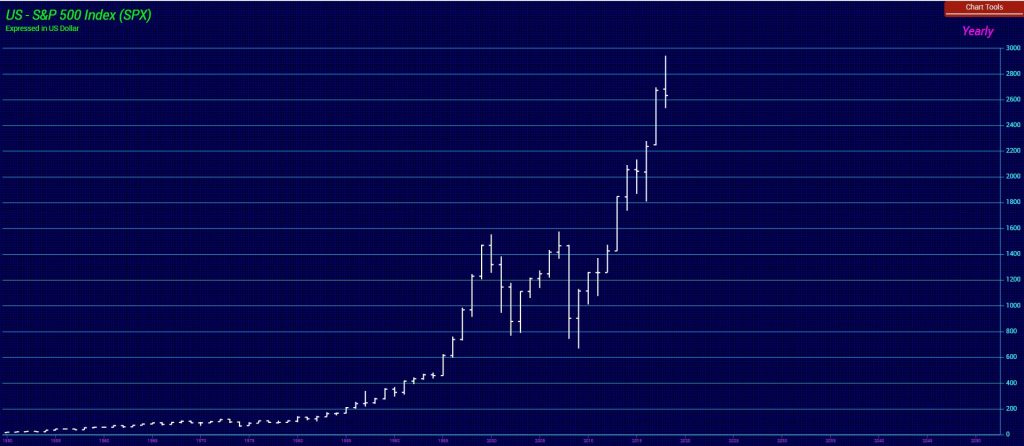

QUESTION: Mr. Armstrong; Your forecast that the capital flows would shift from the EU to the USA I believe has been confirmed by both the European bond markets and share markets. The German DAX is trading below the low created in 2017 while the USA is trading above it. Is this confirmation that your models are indeed correct on global capital flows?

HJG

ANSWER: Yes. It is amazing to me that people will argue with me and claim I am wrong yet they never bother to just look at the charts. The Dow and S&P500 index, however, are trading below the 2017 high. The capital flows have been rather intense. Because interest rates have been negative in Europe, the capital has been fleeing around the world. Spanish banks were buying Turkish debt and pension funds were running to buy farmland in Australia and then rented it out to farmers at 5% annually Lowering interest rates to negative by the ECB has created one huge mess in international capital flows. The capital went everywhere BUT Europe and the ECB ended up buying the bulk of government debt because they singlehandedly destroyed the European bond market. Just total insanity!

Britain Tops Economic Growth in Europe Proving it Does NOT need the EU

Armstrong Economics Blog/BRITAIN

Re-Posted Nov 27, 2018 by Martin Armstrong

What I have found totally shocking is that the British government under Prime Minister Theresa May is this need to surrender all rights just to remain in the customs union. She has not figured out that the UK has been at the top of the list of the European Union’s ‘Big Four’ economies in terms of economic growth ever since it has voted for BREXIT. The third-quarter Gross Domestic Product (GDP) growth grew by o.6%, while Germany’s economy shrunk by -0.2% and France came in at 0.4%, according to estimates published by Eurostat. Italy saw ZERO growth.

It is really astonishing how Britain cannot negotiate to save its very life. Under May, the negotiations are tieing the UK to a sinking ship and there is really nothing any rational person seems capable of doing. Meanwhile, Brussels is so desperate to punish Britain to set an example in hopes of deterring others from leaving. The UK is the BIGGEST market for German autos in Europe. We are looking at the economic decline of Europe into 2020 which may even be a rather hard landing.

Central Banks Looking at Creating Their Own Cryptocurrencies

Armstrong Economics Blog/Cryptocurrency

Re-Posted Nov 26, 2018 by Martin Armstrong

The IMF has recommended that all Central banks should issue their own cryptocurrencies. Indeed, they are looking at using Block Chain to keep track of taxes and to enforce negative interest rates with cryptocurrencies which would allow them to impose negative interest rates whenever necessary. With adopting cryptocurrencies that governments would control, we will come one step closer to losing all our freedom. Central banks could enforce negative interest rates with cryptocurrencies and thus people would find their accounts just garnished. You could not hoard cash and withdraw it from banks. They are also looking at this as a way to manage a banking crisis stopping runs on banks. This technology is also causing those in the hunting of tax revenues to lick their lips.

The issuance of digital currencies would allow central banks to remain in control of the money supply far more so than they are today. Sweden is moving forward and there we see that the use of cash is rapidly disappearing.

Cryptocurrency technology would allow also the taxman to just cometh and take whatever he desires in the midst of the economic crisis we face. The Central Banks would be able to maintain greater control over the creation of money through the process of leverage (bank lending).

While policymakers in Canada have already researched the idea, other highly socialist governments are doing the same. The IMF head Christine Lagarde called on central banks to focus on issuing digital currencies. All of this attention is being applied as the fear of rising interest rates in the marketplace is really beyond the control of central banks. They are also in fear of what to do in a banking crisis that is inevitable in Europe. It is true that central banks can control the short-term rates, but long-term rates are established by the free market. This is why the Federal Reserves was buying in 30-years bonds hopefully to impact the long-term rates which the Fed cannot directly control.

The best thing to do now is to hoard paper US dollars if you are particularly in Europe