More indications of the growing financial exit to avoid the predictable response from totalitarian moves by Beijing. [Backstory – Backstory] Now we see reports growing of mass financial moves out of Hong Kong, as billionaires see the looming shadow of Red Dragon closing in…

HONG KONG (Reuters) – Some Hong Kong tycoons have started moving personal wealth offshore as concern deepens over a local government plan to allow extraditions of suspects to face trial in China for the first time, according to financial advisers, bankers and lawyers familiar with such transactions.

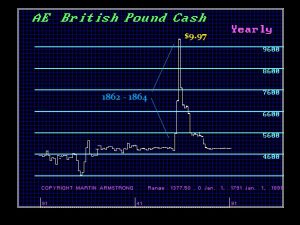

One tycoon, who considers himself potentially politically exposed, has started shifting more than $100 million from a local Citibank account to a Citibank account in Singapore, according to an adviser involved in the transactions.

“It’s started. We’re hearing others are doing it, too, but no-one is going to go on parade that they are leaving,” the adviser said. “The fear is that the bar is coming right down on Beijing’s ability to get your assets in Hong Kong. Singapore is the favoured destination.”

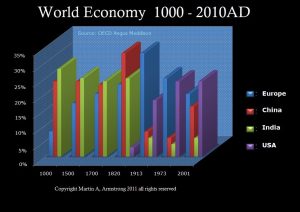

Hong Kong and Singapore compete fiercely to be considered Asia’s premier financial centre. The riches held by Hong Kong’s tycoons have until now made the city the larger base for private wealth, boasting 853 individuals worth more than $100 million – just over double the number in Singapore – according to a 2018 report from Credit Suisse.

The extradition bill, which will cover Hong Kong residents and foreign and Chinese nationals living or travelling through the city, has sparked unusually broad concern it may threaten the rule of law that underpins Hong Kong’s international financial status.

Hong Kong’s Beijing-backed leader, Carrie Lam, has stood by the bill, saying it is necessary to plug loopholes that allow criminals wanted on the mainland to use the city as a haven. She has said the courts would safeguard human rights. (read more)

As predicted Singapore and Tokyo will be the primary benefactors of large scale shifts in financial wealth. The investing class always leads the way. You don’t have to be a geopolitical expert to see what is coming over the horizon. The trick is to make the exit quietly and re-position assets ahead of the rush for the exits.

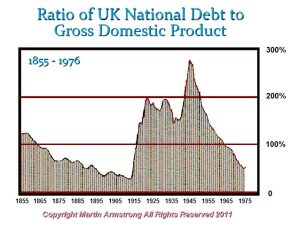

The best days of Hong Kong are in the rear view mirror. The combination of President Trump’s geopolitical trade pressure upon Beijing, and the natural tendency of China to respond with over-the-top totalitarian tactics (subtlety cast asunder), will mean a crushing and oppressive Red Dragon will soon step in to block the escape doors.

The Red Dragon is going to do what the Red Dragon does.

Thus begins the phase when corporate interests, particularly multinationals, recognize at its core China is a communist state-run, controlled-market, system.

The reaction from China is immensely predictable; and creates a downward spiral. If any corporation is perceived as working against the interests of the state; the state will take control of the corporate interest. What western business interest would want to do business within China when that reality is the landscape of every economic decision?

The willingness of China to self-immolate is the golden arrow in President Trump’s economic quiver. The inability of China to modify itself based on downstream economic outcomes is the inherent weakness… Overlay that weakness with the zero-sum outlook and you get this quote from Chinese State-Run broadcast:

…“If the US wants to negotiate, our door is open. If you want to fight, we will fight to the end.”…

Think about the logical reality of this statement as expressed. Put another way: ‘if you agree to our terms we will work with you; however, if you don’t agree to our terms, we will self destruct.’ That’s the economic reality of the zero-sum dragon mindset. This inevitable position is what CTH has been outlining for several years.

China has no cultural or political space between peace and war; they are a historic nation based on two points of polarity. They see peace and war as coexisting with each other.

Chinese engagement stems from a belief that opposite or contrary forces may actually be complementary, interconnected, and interdependent in the natural world, and they may give rise to each other as they interrelate to one another. However, it must benefit China.

Trump is applying Chairman Xi’s own “us -vs them approach” toward confronting China. The supply chain investment Beijing needs to sustain itself is now being controlled by elements outside China. Beijing responds by attacking those in the international community who control the investment.

This will not end well for China.

Keep watching,… as time goes along and more companies, and nations, slowly walk toward the exits with China. There is just too much inherent financial risk. The first loss is the best loss.