Armstrong Economics Blog/Gold

Re-Posted Mar 3, 2020 by Martin Armstrong

QUESTION: This is what infuriates those that like gold. All of the shorting. Why? No other sector looks like this. So how is it that gold miners are restricted but no other sector sees shorting to the extent that restrictions are in place??? Gold is $1600 and these stocks traded double this price in 2008 with gold at $800. You ask why “goldbugs” are so angry, this is your answer.

S

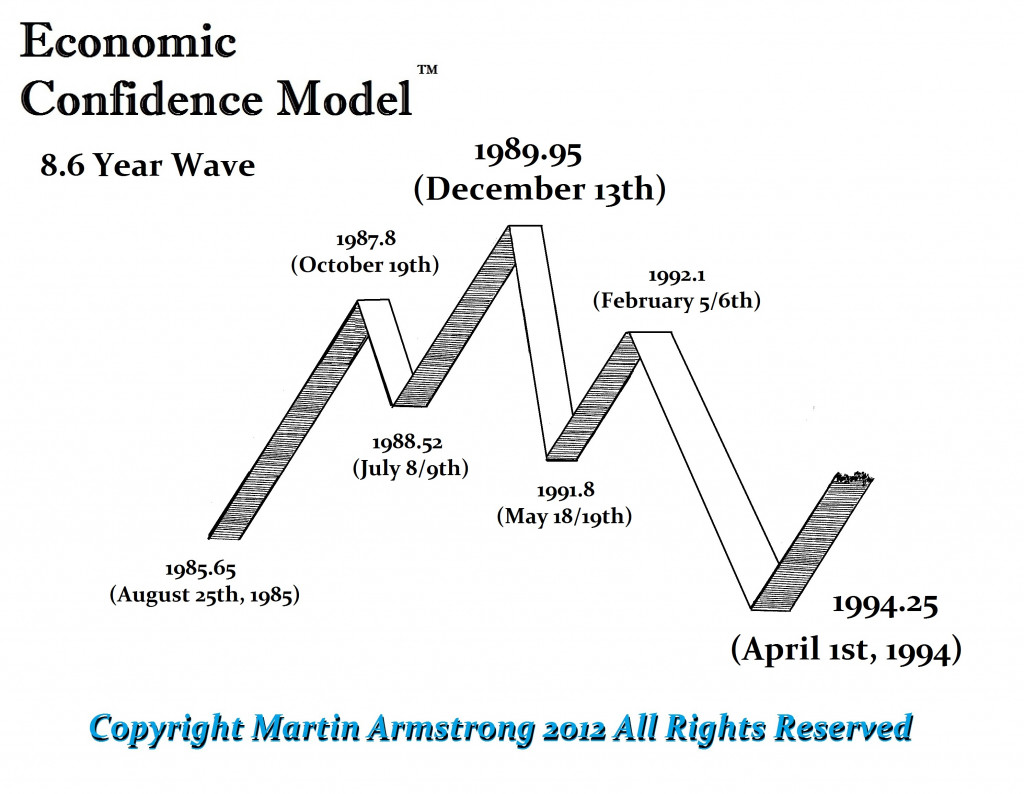

ANSWER: For decades, I have watched “The Club” rally the metals and then crash them because the goldbugs treat it as a religion rather than a market. Every rally is touted as, here we go, the world will crash and only gold will survive. The Club uses that sentiment against them all the time for they know it is easy money. When they step back and look at the metals as markets, then they will win. Many other markets have made long-term profits but they are always demonized by the goldbugs. Why? I believe that some of the people promoting gold are the very ones involved in selling it to them. Everything has a cycle. It goes up and goes down. These chants from the goldbugs are not realistic and they cost countless people their life savings as they get sucked in by people who act like used car salesmen.

Short sale restriction is a rule that came out in 2010 and it’s also referred to as the alternate uptick rule, which means that you can only short a stock on an uptick. You will note that there is no such thing as a long buy restriction where you can’t buy a stock as it’s going up.

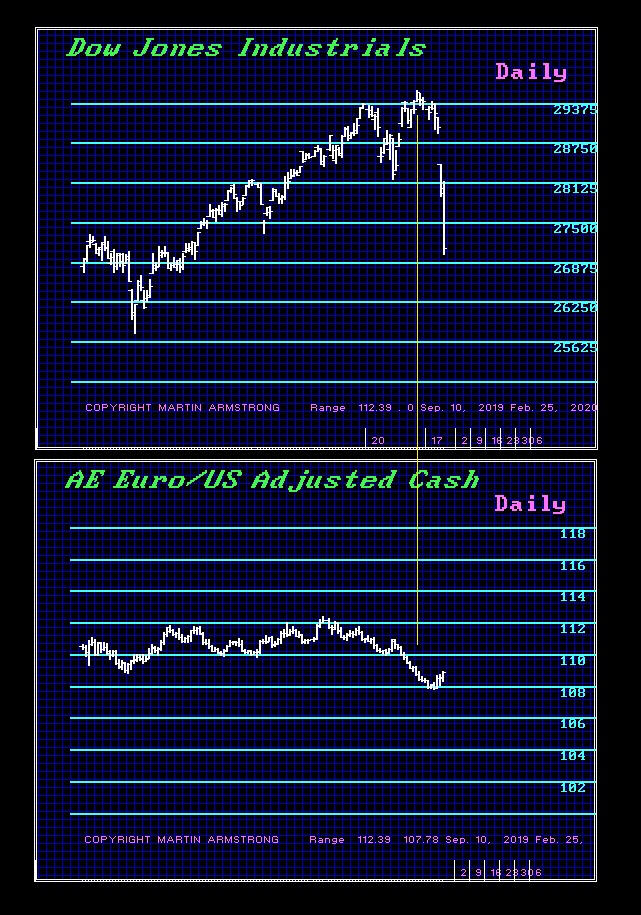

Inevitably, the goldbugs blame shorts. That is NEVER the case in any crash. The real cause is that you have exhausted the buying. When you run out of buyers, that is when markets become vulnerable. The smart do not short, they sell to take profits. That starts the decline and the hated short-player is blamed but never found.

The short selling rule came in only because of shorting Lehman Brothers. When the shorts turned on Goldman Sachs, they pulled the strings. But those were shorts looking at reality, not speculative. There has NEVER been a discovered mythical short position that causes the entire market to collapse.

I have stated countless times that gold will rally ONLY when the general public perceives there is a crisis with the government. Forget deficits, quantitative easing, and fiat currency. They will never convince the average person to take gold seriously. When you begin to look at the market without emotions and trade them up and down, then you will see the light.