COMMENT: Marty; the Greta worshipers are really brain-dead. We just set a 77-year record low on Valentine’s Day and they say that proves its climate change caused by man. When you try to have an intelligent conversation, they simply say every scientist agrees with them. They are brainwashed beyond belief. The entire theory of CO2 and greenhouse is that it makes it warmer, not colder. They really are stupid people!

JB

REPLY: I know. Perhaps they are playing the role that the cycle demands. Civilization is collapsing and they are insisting climate is moving in the opposite direction when all the great deaths in human society come during cold periods, not warm. That is when the diseases rise like even the Black Death. The flu season comes during the cold period, not summer. There is no other explanation. They have convinced even politicians who mouth this out like Michael Bloomberg simply because he thinks that will get him the votes to overthrow Trump and destroy our economy all under the theory that we need to get to CO2 zero or the climate will burn everything up.

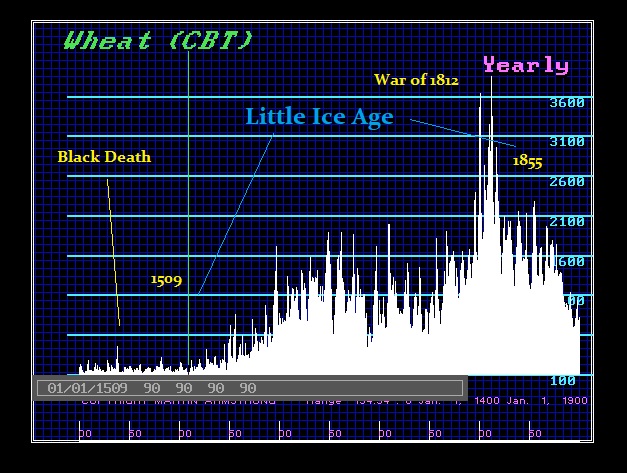

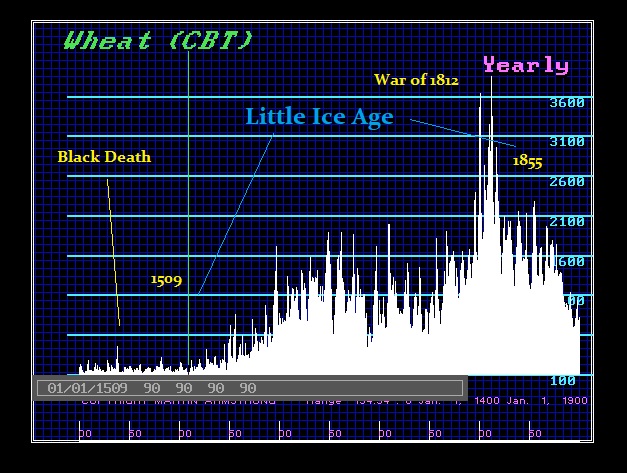

To me, it is just like the Biblical story of Joseph and the Pharoah. If you understand the cycle, prepare for its downturn, you survive. The climate change people are claiming there is no cycle and that climate change is all linear caused by human activity while they ignore the great cyclical swings in climate long before the Industrial Revolution. Wheat prices soared during the Little Ice Age simply because crops fail in winter.

Already, the winter wheat crop in Australia is at a 7-year low. The trend is clear, but the Global Warming crowd is determined to push their agenda regardless of the truth. We are is a serious political crisis. Today’s brand of the left-leaning politicians is all about pandering to Greenpeace and Al Gore substituting what sounds good for what actually works. We were all supposed to be dead by 2000, Then they moved it to 2010, then 2020, and now they realize that the claims we only have 5 years left sound questionable so they have switched it to the dire consequences will come in 50 years from now. A new study by the University of Arizona claims one-third of all plant and animal life will become extinct from climate change by 2070.

They concede that historically, mass extinctions have been caused by catastrophic events like asteroid collisions. This time, human activities are claimed to have set in motion the 6th extinction because of deforestation, mining, and carbon dioxide emissions. Of course, this is their opinion since there is no historical evidence that such a combination would result in a mass extinction. CO2 emissions have taken place far worse than the present. In ancient times they burned wood for heat not oil.

They also do not account for the fact that things such as producing olive oil reduce CO2 levels. For every litre of olive oil produced, 10.65kg of CO2 is extracted from the atmosphere. In ancient times, aside from burning wood for heat, the ancients burned olive oil for light. Lighting the average house for 5 hours at night regardless of the time of year produced 2.89 kg of CO2 being emitted per night. That was nearly 1,055 kg of CO2 per night and taking just the city of Rome with a population of 1 million, which was far more CO2 generated for light alone than we produce today. Half of the carbon emissions created are generated from the production of electricity. Lighting alone creates 17% of carbon emissions. Every 1KW of electricity generates 830 grams of carbon equivalents. Assuming the same 5 lights per house, today we generate 4.1 kg of CO2. The Roman Emperor Justinian I (527-565AD) enacted the first known Clean Air Act in 565AD.