QUESTION: Do you agree with Bridgewater’s Bob Prince that the Boom-Bust Cycle is over? Have they made an offer to buy you out yet?

SH

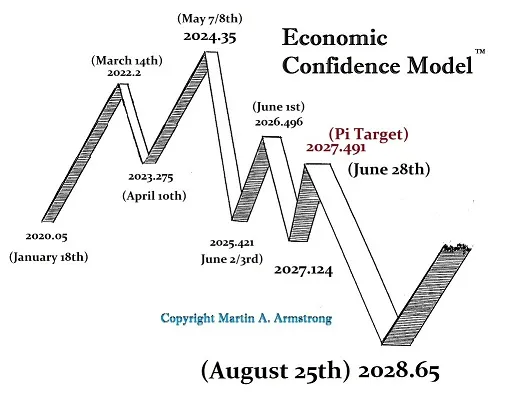

ANSWER: Absolutely no way. His theory is that the tightening of central banks all around the world “wasn’t intended to cause the downturn, wasn’t intended to cause what it did.” Prince explained, “I think lessons were learned from that and I think it was really a marker that we’ve probably seen the end of the boom-bust cycle.”

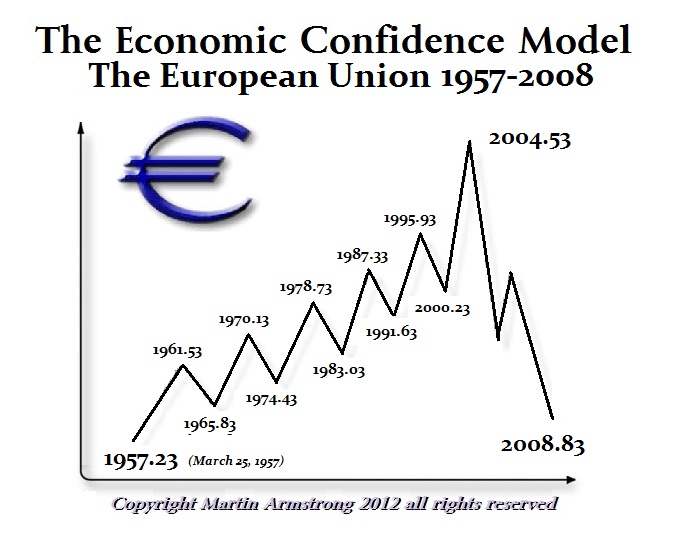

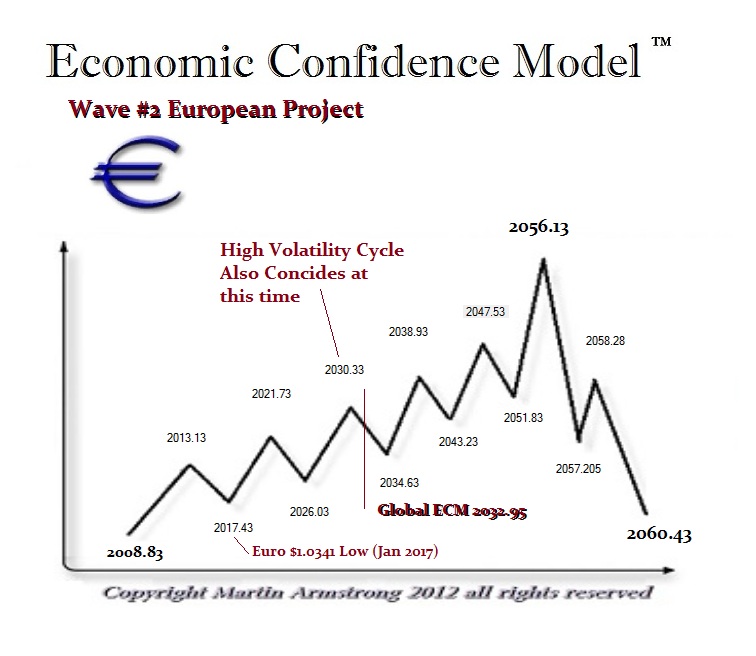

That is an interesting take, but it reflects the typical investment manager focus. They tend not to pay attention to history and always assume that the financial world started as far back as maybe 1971 if not 1990. The boom-bust cycle that he refers to has been the classical economic expansion and contraction in economic activity. However, the very book I just published, “Manipulating the World Economy,” deals with this issue of central bank intervention. He seems to think that since the financial crisis and monetary easing has disrupted that cycle, that it has fueled the longest-running bull market in stocks.

This is why Bridgewater has had a terrible year in 2019. They have completely misunderstood the market and do not grasp the capital flows and how they drive markets. Indeed, Bridgewater Associates, the world’s largest hedge fund firm, had a very difficult 2019 because of this view. The firm’s flagship Pure Alpha strategy was essentially flat in 2019, with Pure Alpha 18%, the more leveraged version, falling 0.5% for the year, according to an investor in the funds. It has been this fundamental focus which is why they missed the bull market.

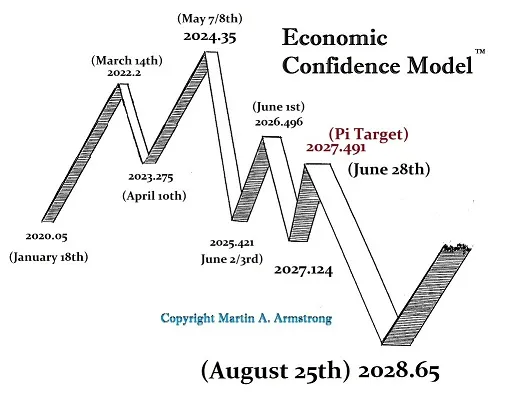

The repo market is already proving the idea that the boom-bust cycle is dead. Interest rates are pushing higher and the Fed is desperate to try to prevent that rise. You cannot defeat the business cycle. Even Paul Volcker admitted that much (Rediscovery of the Business Cycle). Many people have thought that governments have killed the business cycle. They have ALL BEEN PROVEN to be wrong!

No, I have never met Ray Dalio that I remember. If I did, it was just in passing perhaps at some cocktail party. Bridgewater is not a client so the idea of some offer is not even plausible. It is one thing to take in a partner, it’s something entirely different to sell everything to some private firm which would then have exclusive use. That is not my goal and I would not live long enough to spend some mythical billion-dollar sell-out. Sorry, that is not my agenda. I would like to see Socrates help to better manage the world economy, not make money for a bank or hedge fund exclusively.