Posted originally on Sep 9, 2024 By Martin Armstrong |

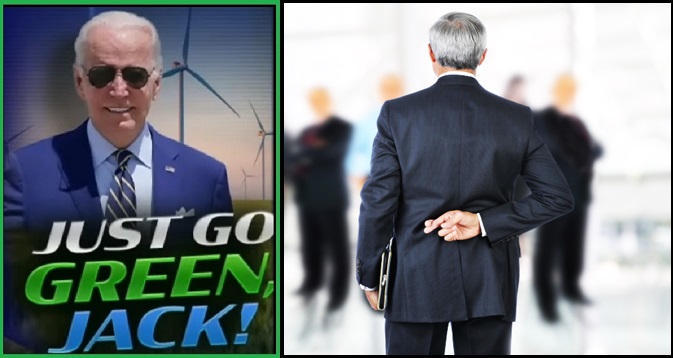

PSA: Joe Biden is still the president of the United States. Biden has been hiding on a beach in Delaware ever since his disastrous debate with Donald Trump that hard-launched Kamala Harris as the Democrat nominee. Biden is speaking off the prompter once again and revealing hard truths that have been concealed from the public. The Inflation Reduction Act, the largest spending measure in American history, was never intended to reduce inflation.

“We should have named it what it was!” Biden said at an event in Westby, Wisconsin, where he unsuccessfully attempted to tout the success of Bidenomics. The president referred to the Inflation Reduction Act as “the most significant CLIMATE CHANGE LAW ever,” adding, “by the way, it is a $369 billion bill, it’s called the–we we we should’ve named it what it was.”

We now know without a shadow of a doubt that the Inflation Reduction Act increased inflation, similar to how the Affordable Care Act under Obama increased the costs of healthcare.

Treasury Secretary Janet Yellen admitted the truth behind the Inflation Reduction Act last year, but the general public does not know of Yellen and her confession did not make headlines. “The Inflation Reduction Act is, at its core, about turning the climate crisis into an economic opportunity,” Yellen clearly stated. It provided the government with an opportunity to eliminate our energy independence. We did not have an energy crisis before Joe Biden took office. He killed the Keystone deal on his very first day in office and has been promoting the larger WEF Build Back Better plan at the expense of the nation. Biden implemented policies that worsened inflation and then convinced mindless politicians, who never read the large bills put forward, to vote for a $369 billion act under the premise of fixing a problem he created.

The Biden Administration is still seeking TRILLIONS in funding for the largest hoax of the century. Climate change has become the untouchable charitable cause that no one can question. COVID-19 was merely a stepping stone for the lucrative tax opportunity that is climate change and the green agenda. As it is a global issue, it gives rise to the need for globalized institutions and coalitions. The G20 meeting stressed the importance of developed nations collaborating to prevent climate change by taking the people.

Janet Yellen declared that it will take $3 TRILLION ANNUALLY into 2050 for nations to meet their climate objectives. They deem climate change “the single-greatest economic opportunity of the 21st century,” but logical minds will see it as the biggest economic obligation. “Neglecting to address climate change and the loss of nature and biodiversity is not just bad environmental policy. It is bad economic policy,” Yellen told the G20. Not one member objected or questioned her proposal.

This is why they are coming after capital gains and expanding the Treasury to shake down the American public for their asinine spending packages that focus of funneling money to green initiatives. Climate change has become a global hoax created by the globalists to usurp power. Now, the global population must collectively defeat through taxation. Even third world nations must look at how they’re releasing emissions and make changes. They are willing to limit the food supply, strangle entire sectors, and completely alter our way of life to reduce carbon emissions.

Every nation must comply. We saw Italy’s Meloni shunned by the European Union for even questioning the climate change agenda and calling it “ideological madness.” Additionally, the globalists plan to implement these extreme measures in record time with no actual plan on how to execute it. All they know is that they need more of our money to save the world by 2035. It would be easier for them to spend and collect trillions from the population at large under a centrally backed currency, digital for good measure. They are testing the waters now to see how and who can hold the power to become the world tax authority. The POTUS has admitted what those who are paying attention already knew and it will take a complete