Armstrong Economics Blog/Economics

Re-Posted Sep 20, 2019 by Martin Armstrong

QUESTION: Hi AE, et al. Your blogs not only inform, but are actually entertaining as they give most of us a point of view we’ve never before contemplated.

My question….you have stated numerous times that one of the reasons the Roman government survived for 100’s of years is because they simply created currency, as needed, instead of borrowing (gov’t bonds) as they do today. But their currency was mainly silver, which possessed at least some intrinsic value, as opposed to today’s digital, key-stroke variety.

The only public figure I can think of, with whom I would entrust such easy access, might be Thomas Jefferson. Human nature being what it is, corruption would be as inevitable as it is today.

To many of us, currency without some intrinsic value, just doesn’t make sense. Too much temptation. Would love to hear a more fulsome reply, with your thoughts on this subject. All of us here deeply respect what you are doing.

Thanks.

HS

ANSWER: All currencies today are still backed and are not intangible. Now, that statement may provoke thousands of emails. But the value of any currency has NEVER been its intrinsic value even throughout history. Proof of that statement is the fact that the surrounding economies to the Roman Empire imitated the gold and silver coinage of Rome for a single reason — the coins were accepted and regarded as more valuable than their intrinsic value simply in metal content.

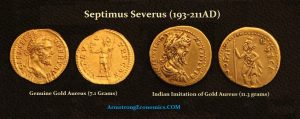

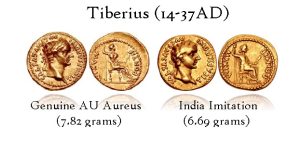

Here is an imitation of a gold aureus of Rome struck in India. The weight of the gold was even greater than that minted in Rome. India routinely imitated Roman coinage from the reign of Tiberius (14-37 AD) to Gordian III (238-244 AD). Obviously, India had gold but the coinage of Rome carried a premium. There would have been no other reason to imitate Roman coinage if the monetary system was purely intrinsic.

Here is an imitation of a gold aureus of Rome struck in India. The weight of the gold was even greater than that minted in Rome. India routinely imitated Roman coinage from the reign of Tiberius (14-37 AD) to Gordian III (238-244 AD). Obviously, India had gold but the coinage of Rome carried a premium. There would have been no other reason to imitate Roman coinage if the monetary system was purely intrinsic.

So, why do I say that ALL currency is backed to this very day and it is not simply fiat with no intrinsic value? All currency is backed by the total productive capacity of its people. For further proof of that statement, just look at China, Japan, and Germany and you will see that each economy rose to the top 10 list in the world when they had NO gold reserves after World War II. It was the total capacity of its people that created the wealth of those nations.

Italy has more gold reserves than France. Yet, Italy is considered to be the third-largest economy in Europe behind France. Algeria has the largest gold reserves in Africa followed by South Africa. At the end of 2017, Algeria had a GDP of about US$170 billion. But South Africa’s GDP is about US$350 billion. The size of an economy does not correlate to its gold reserves.

A currency does not move into hyperinflation because it increases its money supply with no backing. It moves into hyperinflation BECAUSE of the collapse in the confidence of the government both domestically among its citizens and internationally.

With 300,878 million barrels of proven oil reserves, Venezuela has the largest amount of proven oil reserves in the world. The VEF/USD has collapsed to 0.09 from a high of 0.46 back in 2010. Despite having intrinsic assets, the collapse in the currency reflects the total collapse in the confidence of the government.

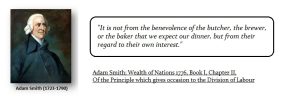

Therefore, step back a moment and abandon this old world mercantilist idea of what is behind the wealth of a nation, which was more Phyisocrat than Adam Smith. Your labor is not worthless. Each of us constitutes the wealth of a nation. America has the greatest economy, NOT because of gold, but because we have the biggest consumer market on the planet to which everyone tries to sell goods in order to take home money.

This idea that money MUST be tangible is not realistic. It is the product of people frustrated by the business cycle, no different than Karl Marx. Marx sought to confiscate all wealth to kill the business cycle and others keep preaching a gold standard to fix the currency to also defeat the business cycle. If money were truly fixed and could not rise or fall, that would mean your house could never rise or fall in value and you should not expect a raise at work.

Money is the perception of the wealth of a nation, which is its total productive capacity of its people, and not its gold reserves or tangible resources. Russia has tremendous natural resources, but its economy is dominated by oligarchs who have prevented Russia from expanding as China has shown the opposite. The fluctuations in currencies are how capital votes on the confidence of the political state behind each currency.