Posted originally on the CTH on March 16, 2023

Before getting to the details of the Credit Suisse issue, it is worth taking a bigger geopolitical context to the dynamic. The initial backstop sought by Credit Suisse was from the Saudi National Bank; however, SNB Chairman Ammar Abdul Wahed Al Khudairy refused more lending {LINK}.

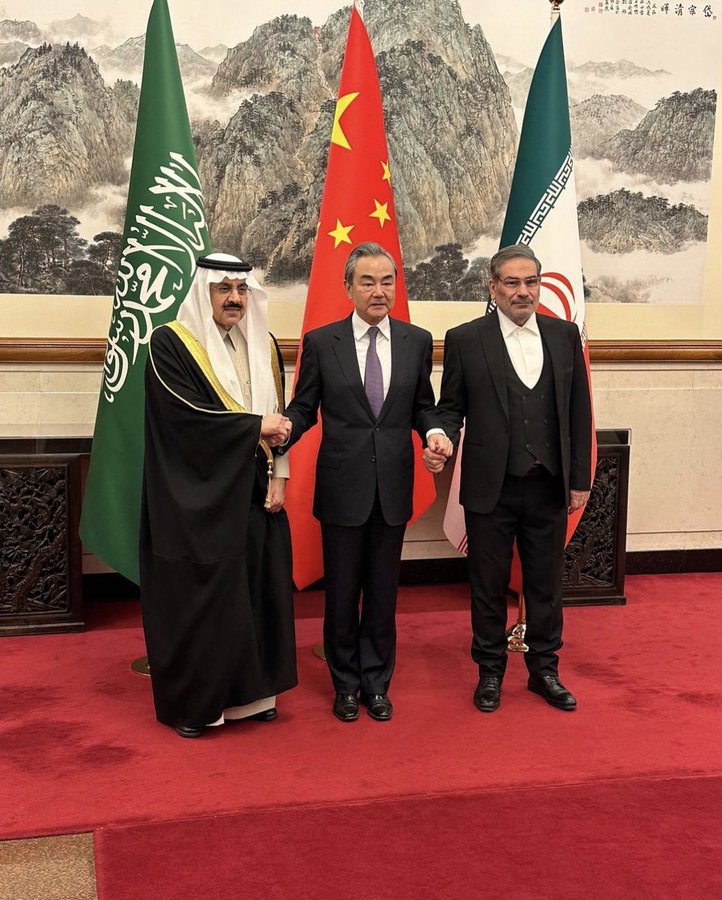

This is where we need to keep the BRICS -vs- WEF dynamic in mind and consider that ideologically there is a conflict between the current agenda of the ‘western financial system’ (climate change) and the traditional energy developers. This conflict has been playing out not only in the energy sector, but also the dynamic of support for Russia (an OPEC+ member) against the western sanction regime. Ultimately supporting Russia’s battle against NATO encroachments.

Russia, Saudi Arabia and China are geopolitically aligned in interest against the western financial system. As a consequence, when western banks find themselves in need of capital and cash, there is a layered geopolitical dynamic in the background to Saudi refusal that must be considered.

With multiple western banks now in trouble, Credit Suisse is also exposed, and, like U.S. Treasury/Fed intervention in America, the Swiss central bank has stepped in to backstop the looming collapse.

In the big picture we are seeing the ramifications of the ‘Build Back Better‘ agenda impacting the banking and finance sector which spearheaded it. I am not seeing this discussed anywhere, as the western governments of the collapsing banks are being forced to intervene.

(Reuters) – Credit Suisse on Thursday said it was taking “decisive action” to strengthen its liquidity by borrowing up to $54 billion from the Swiss central bank after a slump in its shares intensified fears about a broader bank deposit crisis.

The Swiss bank’s problems have shifted the focus for investors and regulators from the United States to Europe, where Credit Suisse led a selloff in bank shares after its largest investor said it could not provide more financial assistance because of regulatory constraints.

Regulators in the private banking hub on Wednesday had sought to ease investor fears around Credit Suisse, which added to broader worries sparked by last week’s collapse of Silicon Valley Bank and Signature Bank, two U.S. mid-size firms.

Asian stocks had extended Wall Street’s tumble on Thursday and investors bought gold, bonds and the dollar, leaving markets on edge ahead of a European Central Bank meeting later in the day. The bank’s announcement in the early European morning helped trim some of those losses though trade was volatile. (read more)

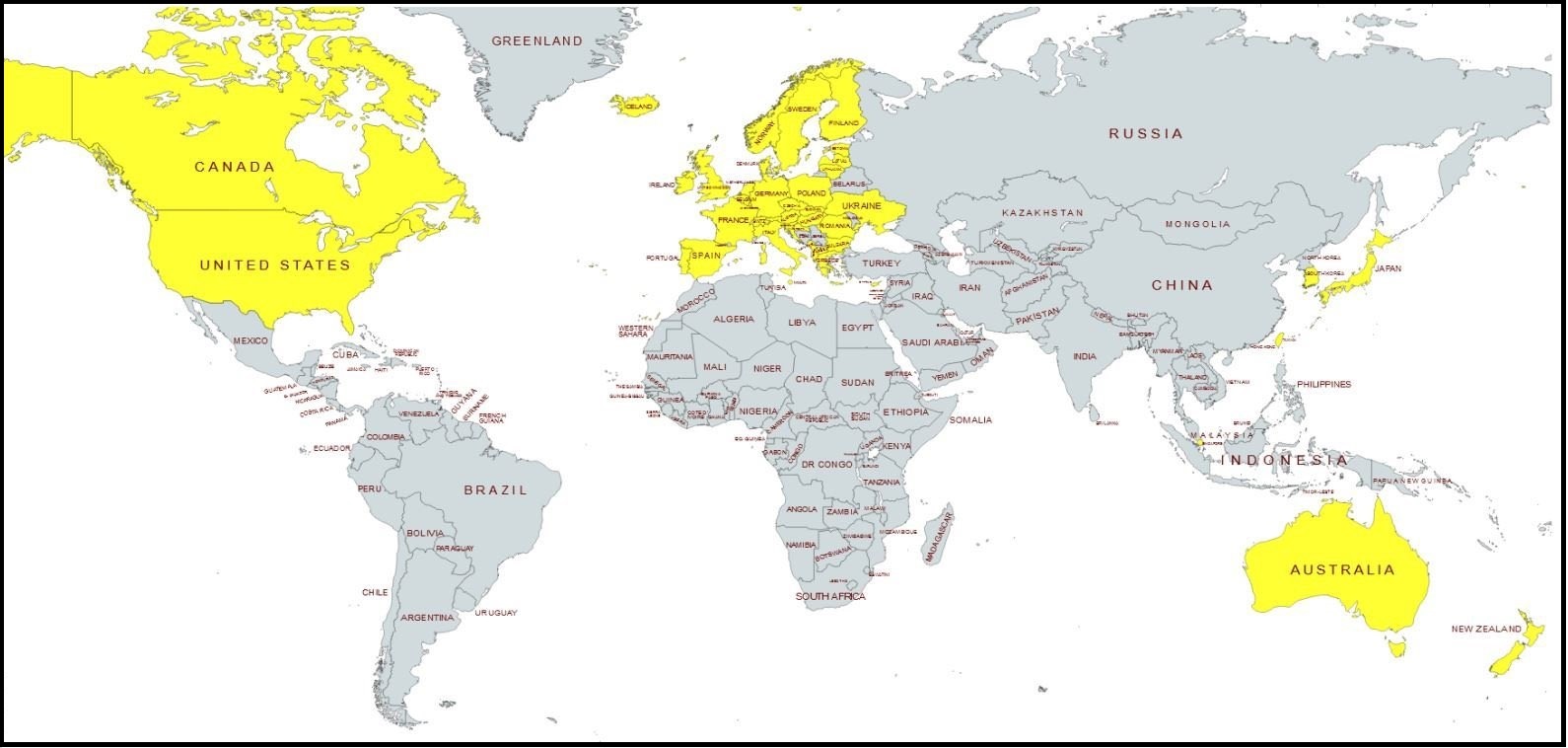

Again, I go back to the geopolitical map. The yellow nations with sanctions against Russia are also the yellow nations driving the ‘Build Back Better’ climate change energy policy. The grey nations are not in alignment with either dynamic. It is not a coincidence the banking issues are all within the yellow nations.

(Via Daily Mail) Wall Street’s main stock indexes opened lower on Wednesday, as turmoil at Credit Suisse renewed fears of a banking crisis and sent shares of major US banks lower.

At the opening bell, the Dow Jones Industrial Average fell 396 points, or 1.23 percent, while the S&P 500 opened 1.09 percent lower and the Nasdaq Composite dropped 1.20 percent.

Shares of First Republic, one of the regional banks swept up in contagion fears after the collapse of Silicon Valley Bank, dropped up to 11 percent after the bank’s bond rating was downgraded to junk status by S&P.

In Europe, shares of Credit Suisse plunged more than 25 percent, hitting a new record low for the second day in a row, after the Swiss bank’s largest investor said it could not provide more financial assistance to the lender.

The Big Four trillion-dollar US banks suffered in early trading after yesterday’s rally. Wells Fargo slid 3.9 percent, Citigroup dropped 4.3 percent, Bank of America was down 2.2 percent and JP Morgan saw a 3.5 percent dip.

After the collapse of SVB Financial and Signature Bank, emergency measures by US authorities had soothed some worries about the health of the other banks, helping regional lenders stage a rebound in Tuesday’s session.

However, regional banks were giving back their gains in early trading Wednesday, with shares of First Republic, PacWest and Western Alliance all down between 2.7 percent and 11 percent.

[…] Driving investor sentiment was turmoil at Credit Suisse, after its biggest shareholder – the Saudi National Bank – said that it would not inject more money into the ailing Swiss bank.

Saudi National Bank chairman Ammar Al Khudairy told Reuters: ‘We cannot [buy more shares] because we would go above 10 percent. It’s a regulatory issue.’

The Saudi bank holds a 9.88 percent stake in Credit Suisse, according to Refinitiv data. (read more)

Yellow Team -vs- Gray Team: Remember, China just brokered a deal to lessen hostilities between Iran and Saudi Arabia. The fulcrum of that agreement was economics.

Meanwhile in North America, Mexican President Andres Manuel Lopez-Obrador has said he was not willing to join the energy suicide pact pushed by Joe Biden and Justin Trudeau…. A policy break in the trilateral relationship which suddenly, and not coincidentally, aligns with the timing to make Mexico a pariah to the U.S. vis-a-vis a renewed media push on the drug cartel narrative.

BIG PICTURE NOT BEING DISCUSSED – The western politicians followed the climate change instructions of the WEF multinational corporations and banks (Build Back Better) and post-pandemic immediately started reducing energy development. The central bankers then began raising interest rates to shrink the economies of the same western nations to the scale of the now diminished energy production.

The raising of interest rates is now hitting the national and multinational banks impacted by government policy that was following WEF orders. Now the western politicians are stepping in with the government controlled central banks to backstop the national banks and multinationals. Can you see the dynamic?

Team yellow is suffering the consequences of their own ideological policy as enacted. Team grey is not going to help team yellow get out of a crisis team yellow created, which was intended to hurt team grey.

…. And we continue watching.