Armstrong Economics Blog/Sovereign Debt Crisis Re-Posted Feb 14, 2023 by Martin Armstrong

QUESTION: Marty, Ever since the debacle in London with the long-term debt, there have been whispers in NYC about how the demand for long-term is drying up. When this becomes critical, is that when the whole thing comes crashing down?

KW

ANSWER: That was the real gist of Yellen’s speech back in October of 2022. Of course, the US press will never elaborate on this problem until it smacks them in the face. Yellen publicly admitted that the Treasury asked the primary dealers of US government debt for their views on the merits and limitations of a buyback program. The Treasury Borrowing Advisory Committee, made up of market participants, highly recommended considering the move because the demand for long-term was declining.

Yellen herself publicly acknowledged the decline in trading volume in 20-year bonds, which they reintroduced in 2020 thanks to COVID. Quoting from her direct comments:

“The 20-year Treasury is an area, an issue where there’s been less liquidity — but we haven”t made any decisions about it.”

Even the Securities Industry and Financial Markets Association came out and publicly also stated last October that there had been episodes of illiquidity. This was the same problem that created the Crisis in the Long-term British gilt market.

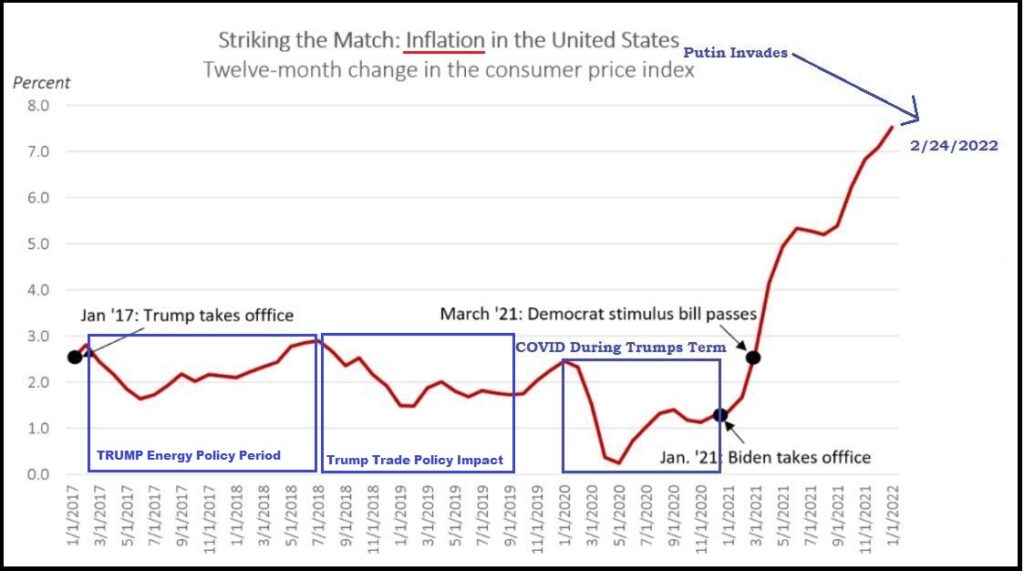

Institutions do not want to buy the long-term in the face of (1) rising interest rates to fight inflation, and (2) unlimited handing of money to Ukraine that will NEVER come back for Ukraine is a black hole and reliable sources are deeply concerned that Ukraine will lose and exist no more.

The escalation in debt on the horizon with World War III is beyond the capacity of the Primary Dealers to buy. They are strained now with the debt expansion for socialism, then Ukraine, and add War, this system is cracking NOW! The Primary Dealers cannot buy more debt than their balance sheets allow. The “whispers” running around have been on the street. The press has not articulated this for (1) it’s above their pay grade to comprehend, and (2) they cannot dare report the truth.