What does the Trudeau brand really stand for? Privilege, Arrogance, Disdain, Self-Promotion, Indifference, and Failure. Image over substance

Re-posted from the Canada Free Press By Ken Grafton —— Bio and Archives—July 24, 2020

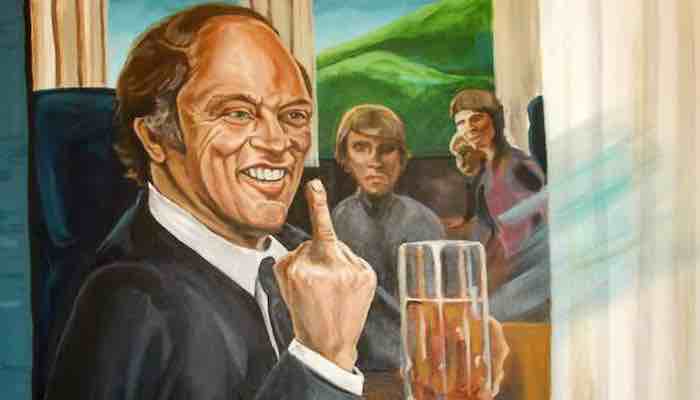

The Salmon Arm Salute – Jenn Kovachik

With the Prime Minister facing yet another investigation by Ethics Commissioner Mario Dion, his third since taking office in 2015, Canadians need to take a hard look at the Trudeau brand.

How does brand promise contrast with operational reality?

What does the Trudeau brand really stand for?

The Trudeau brand values were Young, Hip, Smart and Liberal. Image over substance

In order to understand the Trudeau brand, it is necessary to travel back through the mists of time to a different age; the turbulent 1960s. Hippies, Pot, Acid, the Counterculture, Carnaby Street, Andy Warhol, the Grateful Dead, Timothy Leary, the Vietnam War, Civil Rights, rioting in the streets, Martin Luther King…Bobby Kennedy was running for President…the Beatles were still together…it was an exciting time to be young and alive.

In this atmosphere of social revolution, a little-known lawyer from Montreal named Pierre Elliott Trudeau was appointed Minister of Justice and Attorney General by then Prime Minister Lester Pearson. In April of 1968 Trudeau won the Liberal Party leadership and became Prime Minster in the June election. The first celebrity politician in Canada, his campaign ran on personality and generated an intense emotional energy amongst supporters that was dubbed “Trudeaumania”, due to the hoards of screaming female fans that drew a parallel to the hysteria of Beatles fans.

Against Conservative Robert Stanfield, the stodgy scion of a prominent New Brunswick family; the witty, charismatic, socially-liberal 48-year-old bachelor Trudeau cleaned up easily with 154 seats.

Despite being a middle-aged lawyer, Trudeau dated attractive movie stars, drove a Mercedes 300 SL, and sometimes wore denim. Somehow, he could pull it off. His initials were PET. Overnight, Canada was suddenly cool.

This was the genesis of the Trudeau brand. Forged in the psychedelic, drug-fueled, rock and roll, colour TV, FM radio atmosphere of the late 60s.

You had to be there.

The Trudeau brand values were Young, Hip, Smart and Liberal. Image over substance.

He was friendly with Cuban Dictator Fidel Castro—Bragged He Was A Communist

While Trudeau had charmed Canadians in 1968, the love affair didn’t last. Winning only a minority in 1972, he was defeated on a vote of non-confidence in 1974, which led to another majority win in the resulting election. He was defeated by Conservative Joe Clark in 1979, who was also brought down by a vote of non-confidence, and then defeated by Trudeau in the 1980 election. Facing dismal poll numbers, which had dropped to 25% by 1982, Trudeau resigned in 1984 and handed over to Finance Minister John Turner (making 70 unpopular backroom patronage appointments as part of the deal).

His time in office was fraught with controversy.

Feb 16th, 1971 Trudeau was accused of having told opposition MP’s in the House to go forth and multiply. This became known as the “fuddle duddle” incident. In a CBC interview (CBC Digital Archives, 1971) Tory MP, Lincoln Alexander “He mouthed two words. The first started with the letter F, the second word the letter O.”

During a vacation trip in 1982, the PM extended a middle finger to local BC protestors from the borrowed Governor General’s railcar, in an incident famously recorded in history as the “Salmon Arm Salute”. Visitors can view the preserved railcar (National Post, 22 Aug 16) and pose with a cardboard Trudeau at a resort near Craigellachie, BC.

He was friendly with Cuban Dictator Fidel Castro and praised the Soviet Union (Maclean’s, 28 Feb 18) during the Stalin years, bragging that he was a communist.

The Reality Behind the Image

In 1970 he deployed the military on Canadian streets under the War Measures Act.

In 1971, the 51-year-old Prime Minister married Margaret Sinclair, the 22-year-old flower-child daughter of Liberal MP and Cabinet Member James Sinclair of Vancouver.

The March 21st, 1977 cover story in Maclean’s featured a photo of Margaret Trudeau and Mick Jagger, with the banner “Margaret and the Rolling Stones” which detailed her exploits with the bad-boy rockers.

At a state dinner in Venezuela, she honored the country’s first lady with an impromptu song instead of a planned toast, and later admitted that she had taken peyote (Bazaar, 17 Mar 16) beforehand. The press had a field day.

In 1978 Margaret Trudeau, then separated from her husband, appeared in a High Society Magazine cover story entitled “Margaret Trudeau – Caught With No Panties!”. The photo, which showed Canada’s first lady seated on the floor of notorious New York disco Studio 54 sans lingerie, was auctioned in 2017.

She hung with Andy Warhol.

Not unlike say Paris Hilton officially representing Canada abroad. Viral quality clickbait potential definitely, but embarrassing for most Canadians.

Three decades later, in a new age of post-truth and social media, all that remained in the minds of a majority of Canadian voters was brand recognition. Succeeding generations and a large immigrant population were unaware that the Trudeau brand had tarnished since it’s introduction in 1968. Celebrity had become the key value in political contests, and almost seven-million Canadians looked no further than the Trudeau name and tinsel-town allure at the polls in 2015.

Since then, Prime Minister Justin Trudeau has continued in the family tradition, with scandal after scandal keeping Liberal spin-doctors in a state of perpetual angst.

Justin Trudeau’s List of Scandals

Without limiting the generality of the foregoing, these include:

- Lavalin-gate

- Aga Khan Gate

- Embarrassing Indian Costumes and Bhangra dance

- Indian Terrorist Invited to Trudeau Reception in Delhi

- Elbow-gate

- Black Face x 3

- Vice Admiral Mark Norman Trial

- Various Cash for access scandals

- Praise for Cuban Dictator Fidel Castro

- Castro serves as pallbearer with Justin Trudeau at Pierre Trudeau’s funeral

- 20,000 Missing Public Works Projects

- WE Charity Scandal.

Pierre Trudeau tripled Federal spending between 1969-79 (MacDonald Laurier Info Wars Debate, 27 Sep 11) and plunged the country into recession in 1982, almost bankrupting it. His National Energy Program (NEP) nationalized foreign oil interests and repelled investors. Wage and Price controls contributed to the economic nightmare. It took thirty years to repair the damage done. He gutted the military, polarized parties through evoking the War Measures Act in 1970, and alienated English Canadians through his blatant favouritism of Quebec. As author Bob Plamondon wrote in his book “The Truth About Trudeau”, “No prime minister did more damage to national unity.”

Justin Trudeau has also virtually destroyed Canada’s economy, gutted the energy sector

The apple doesn’t fall far from the tree.

Since 2015, Justin Trudeau has also virtually destroyed Canada’s economy, gutted the energy sector, failed to win a UN Security Council seat, ditched his promise to create a proportional electoral system (which would have meant a Liberal loss in 2019), flooded the country with controversial refugees, inspired Quebec voters to elect a separatist party to Parliament, inspired a Western separatist party, and alienated just about everyone in the country without a special-interest lobby (and some who do). Disunity now threatens Canada’s future.

What does the Trudeau brand really stand for?

Privilege, Arrogance, Disdain, Self-Promotion, Indifference, and Failure. Image over substance.

Edmonton artist Jenn Kovachik captured it all in “The Salmon Arm Salute”. It would make a great logo.