QUESTION: Do you think that Cambridge Analytica actually had any influence in creating BREXIT given the controversy that they were hired but then not? Can such influence actually change elections?

DK

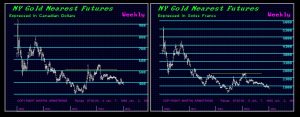

ANSWER: As Nigel Farage noted at our Rome WEC in early 2019, our computer forecast BREXIT when nobody else did. Our computer does not even look at polls nor does it have any way of influencing the masses. Its sole input is economic trends globally which includes all the various trading free markets. That said, the real question is are we deluding ourselves that the media or firms such as Cambridge Analytica can even influence people to start with?

I have told the story how at the very day of the top in interest rates back in 1981, my mother and her sister went to the bank and bought 10 year CDs paying 20%. They never asked me. There was never a discussion between me and them regarding interest rates. All on their own they went to the bank and locked in money for 10 years. I then asked them why they made that decision? They said at 20%, they didn’t think they would see that high of a rate again.

The average person is driven more by what they see and feel on the street than in the news. All the stats show that less than 60% of adults even bother to watch the news. It has been declining with about 50% of U.S. adults now get news regularly from television, which is down from 57% a year prior in early 2016.

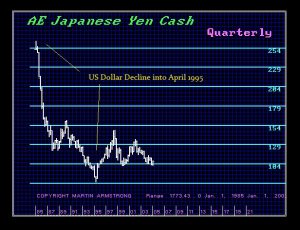

Our computer forecasts the start of what we called Big Bang that began 2015.75. That was more than just the beginning of crazy negative interest rates and the start of the Sovereign Debt Crisis, which is becoming painfully obvious at the state and local levels. The crisis will expand into the federal levels probably around 2021-2022 in Europe and then Japan. Back in 1985, we also warned that the 2016 election would be the first time a third party could possibly win the presidency. Well, that was clearly the Trump Revolution. How was this forecast even possible? The start of this Economic Confidence Model wave was 1985.65. Add Pi, 31.4 years, and we come to 2017.o5 to the day that Trump was sworn in.

Our computer forecasts the start of what we called Big Bang that began 2015.75. That was more than just the beginning of crazy negative interest rates and the start of the Sovereign Debt Crisis, which is becoming painfully obvious at the state and local levels. The crisis will expand into the federal levels probably around 2021-2022 in Europe and then Japan. Back in 1985, we also warned that the 2016 election would be the first time a third party could possibly win the presidency. Well, that was clearly the Trump Revolution. How was this forecast even possible? The start of this Economic Confidence Model wave was 1985.65. Add Pi, 31.4 years, and we come to 2017.o5 to the day that Trump was sworn in.

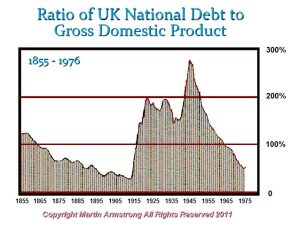

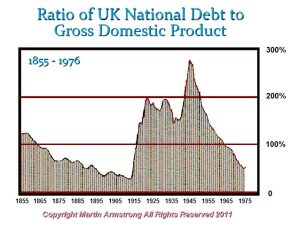

This pi interval is where political change often takes place. In the wave which peaked in 1929, the start was 1882.45; add pi and we arrive on November 6, 1913. That was the precise day that Mohandas Karamchand Gandhi (1869-1948) began the decline of the British Empire.

This pi interval is where political change often takes place. In the wave which peaked in 1929, the start was 1882.45; add pi and we arrive on November 6, 1913. That was the precise day that Mohandas Karamchand Gandhi (1869-1948) began the decline of the British Empire.

By the end of World War I which began the next year, the United States had displaced Britain as the financial capital of the Western world.

The next wave began 1934.05 (January 17/18). It was precisely the 17th when the German salute of raising the right hand was introduced by the Prussian Economic and Labour Ministry. Then on the 24th of January, Alfred Rosenberg became the ideological supervisor of the Nazi Party. It was Rosenberg who pushed the anti-Semitic and racial ideologies using what Hitler had written in ‘Mein Kampf’ as the basis for his ideas.

While Hitler expounded his own ideas, there is little doubt that he was influenced by some of Rosenberg’s beliefs. Hitler would not achieve full dictatorial power until after the death of Hindenburg in August 1934. It took just 17 days thereafter when Hitler combined the office of President and Chancellor while the army swore a pledge to Hitler personally rather than to the nation.

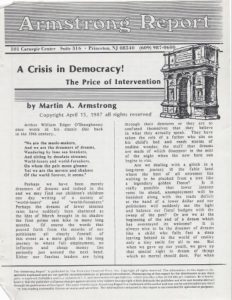

These Pi intervals mark the beginning of a political change. Manipulating the people does not create these changes. It is the economics behind the events. The harsh reparation payments on Germany and punishing the people for their leaders in World War I only set the stage for Hitler. It is ALWAYSeconomics which create political change. It was 1933 which not only brought Hitler up in Germany but FDR in the USA and the New Deal as well as Mao in China.

The computer in its forecasts would never be able to accomplish these results if it relied upon opinion polls which are often wrong. The way to influence people is economics. CNN and its fake news are preaching to those who would never vote for any Republican. The pools were all manipulated for both BREXIT and the 2016 election. Our computer is the ONLY forecast that got both correct without human opinion – just economics. Why do you think the press will NEVER report our forecasts? They want opinions not a computer.

What I have learned is straight forward. Given a specific time interval, humans will simply respond in the same manner consistently. Government abuses their power and over-tax and over-regulate in a quest to maintain control. In that process, they inevitably seal their own fate and thus governments die by their own hand. There is simply no exception. Undermine the economy and everything else will change accordingly.