Armstrong Economics Blog/Climate Re-Posted Apr 14, 2023 by Martin Armstrong

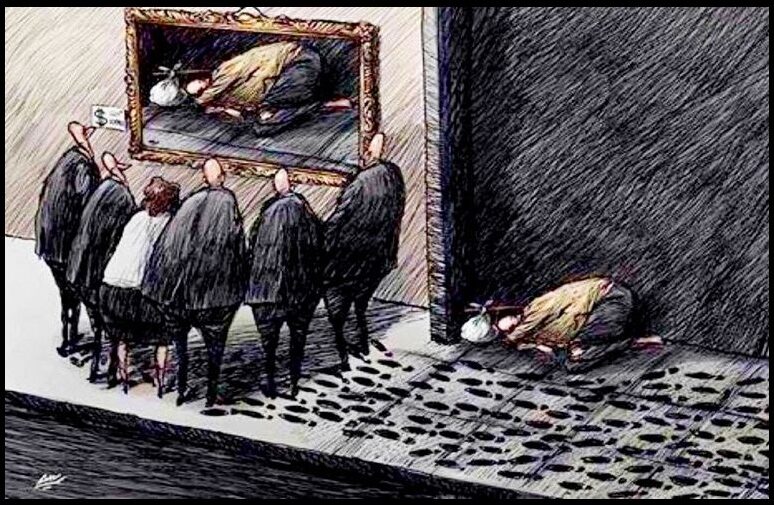

The Environmental Protection Agency (EPA) is targeting gas vehicles in an attempt to reduce emissions. Their goal is to reduce carbon emissions by 10 billion tons before 2055 to “protect public health.” In turn, 67% of new personal vehicles will be electric by 2032. The average price of an electric vehicle (EV) is $64,338 and completely out of reach for the average American consumer. The war on the working class rages on.

The measure will also cut oil imports by 20 billion barrels. Half of all buses and garbage trucks, 35% of short-haul freight tractors, and 25% of long-haul freight tractors will also be EV. This is guaranteed to propel inflation and cause supply chain issues. What will truckers do when the weather is poor or they need to stop for hours to charge their truck? Extreme weather can cause the range of an EV to decline by 20%. One of my vehicles is electric, but that’s not the car I am depending on for long drives.

America’s infrastructure cannot handle such a steep increase in EVs. We saw California urge residents not to charge their cars during the Labor Day heat wave. Some areas in Florida lost power during Hurricane Ian, and people could not drive. Texas experienced a similar problem when its power grid was experiencing issues. How will school buses operate during bad weather?

The bill focuses solely on tailpipe emissions and fails to consider the resources needed to create these vehicles. The batteries in these vehicles use 10X more energy than the average household uses in one day. The cobalt within these vehicles is mostly mined through modern-day slavery in the Congo. This also requires mining for things like lithium and cobalt. Lithium mining is extremely harmful to the environment. South America has experienced water supply contamination near lithium mining regions, and Tibet reported marine life dying in mass near some of their facilities.

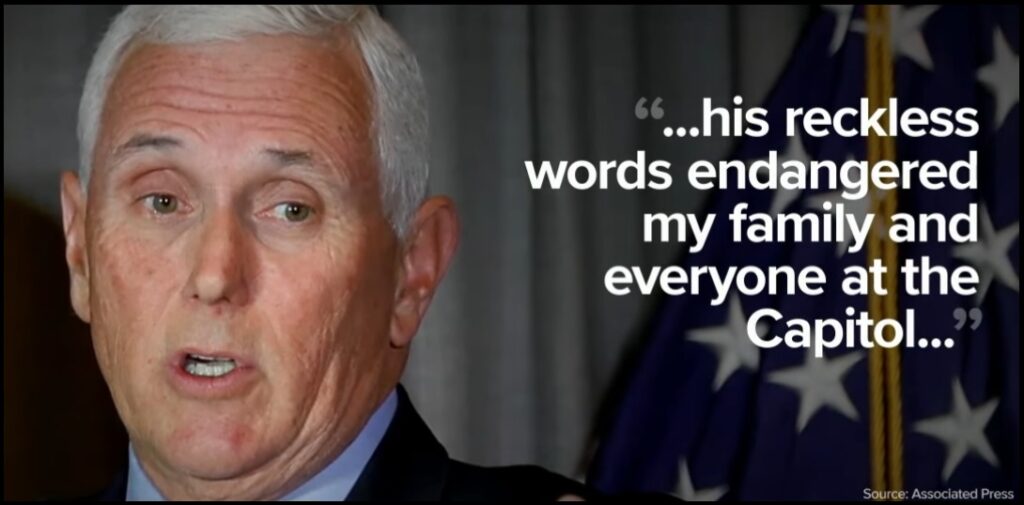

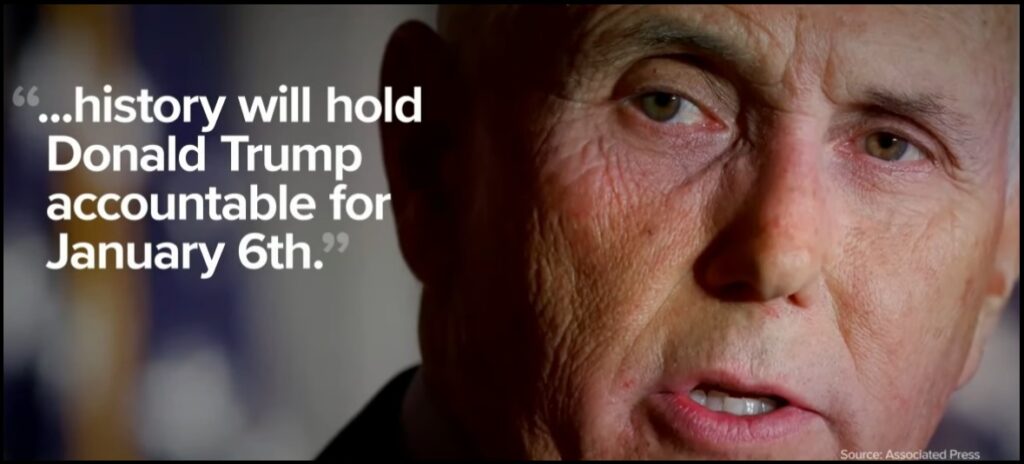

The goal is to limit fossil fuel usage, not to help the environment. “Yet another draconian rule from the Biden Admin,” Rep. Dan Newhouse, R-Wash., said. “From gas stoves to vehicles, their anti-American energy policies put our nation on a dangerous path. It’s time for the government to stop over-regulating our lives and protect our energy independence.” Some have pointed out that insurance alone for an EV is 26% higher than combustion-engine vehicles, and maintenance costs are also much higher. Car ownership may soon be unattainable to a portion of the population.