The attached paper is a continuing and reasonable analysis of the events from September 3, 2022 to September 18, 2022 which is an event that will change the Republic forever. In this mad rush to save the planet from total destruction from green house gas emissions from carbon base fuels the worlds politicians are dismantling Western Civilization. Former President Trump is a major obstacle to Klaus Schwab, and his fellow radicals in the World Economic Form (WEF) e.g. George Soros, Bill Gates and Anthony Fauci have decided to take him out any way they can since he is the only one that can stop them.

Category New Monetary Theory

Tucker Carlson Notices the Missing Jubilation in Martha’s Vineyard as Dozens of Illegal Aliens Arrive

Posted originally on the conservative tree house on September 15, 2022 | Sundance

A strange thing happened. After lecturing the nation on the virtues of mass migration, the white liberal democrats on Martha’s Vineyard did not celebrate the arrival of the non-white immigrants they have been demanding for years.

Fox News host Tucker Carlson noted in his monologue that Martha’s Vineyard famous nimby residents, including former President Barack Obama, did not welcome the people of color as one would expect. Instead of celebrating the new diversity, oddly the residents quickly moved to find alternate off island locations to accept the arriving immigrants. WATCH:

.

Switzerland to Imprison People for Heating Homes

Armstrong Economics Blog/Climate Re-Posted Sep 15, 2022 by Martin Armstrong

Imagine going to jail for three long years for heating your home or business. That now may become a reality in Switzerland, where heating your home above 19 C (66.2 F) is considered excessive and a punishable offense. Water may not be heated above 60C (140F), and saunas and hot tubs powered by radiant heaters are prohibited. Indoor swimming pools also must remain cold.

Markus Sporndli, a spokesman for the Federal Department of Finance, said that people could be charged a daily fine of 30 francs for disobeying, but the fee could spike to 3,000 francs. The government is warning that there could be “spot checks” and said they would send authorities if someone reports a resident or business for breaking the law. Switzerland imposed fines and expected neighbors to turn on one another for COVID, and this is yet another power grab.

The law is still being finalized, but this is yet another way for the government to turn the common person into a criminal. The government, not the people, created this energy crisis and now demands that the people suffer for their mismanagement. Some are calling these measures “Green fascism” or “ecofascism.”

Historian Michael E. Zimmerman defined ecofascism as follows: “a totalitarian government that requires individuals to sacrifice their interests to the well-being of the ‘land,’ understood as the splendid web of life, or the organic whole of nature, including peoples and their states.” Expect to see this trend rise as temperatures decline.

Food Stamps for US Soldiers

Armstrong Economics Blog/USA Current Events Re-Posted Sep 15, 2022 by Martin Armstrong

Washington acts perplexed as to why recruitment is nearing a record low. Food inflation is on the rise across the world, increasing 10.9% in the US over the last year. This marks the largest 12-month spike in food prices since 1979. The food at home index spiked 15.8%, cereals and bakery goods rose 15%, and dairy products rose 14.9% in the past year alone. Service members who rely on government pay, not adjusted for inflation, are struggling.

This may come as a surprise – the Pentagon believes 24% of enlisted personnel are food insecure. How on Earth could the US expect to maintain a strong military when nearly a quarter of members cannot provide their families with food? The military budget is certainly not hurting for funds.

The US Army is now recommending that service members apply for food stamps. So, instead of using the funds from the military budget, the government wants to take those funds from a program designed for low-income individuals.

“With inflation affecting everything from gas prices to groceries to rent, some Soldiers and their families are finding it harder to get by on the budgets they’ve set and used before,” the guidance written by Sergeant Major of the Army Michael A. Grinston reads. “Soldiers of all ranks can seek guidance, assistance, and advice through the Army’s Financial Readiness Program.”

Grinston goes on to recommend resources for managing debt, spending, and taxes. Soldiers can request to receive a 6% interest rate cap on debts incurred prior to serving. This includes credit cards, loans, and mortgages. Take advantage of this service and any military benefits if you have the opportunity.

It is a shame that the men and women fighting for our country are surviving on food stamps. Maybe instead of paying off military contractors, sending endless funds to foreign nations, and “10% to the big guy,” the US government can help those who risk their lives to serve and protect our diminishing freedoms.

Gun Purchases to be Tracked by Global Organization

Armstrong Economics Blog/Regulation Re-Posted Sep 14, 2022 by Martin Armstrong

The far left is eager to repeal 2A. We are not as free as we think. The International Organization for Standardization (ISO), an organization headquartered all the way in Geneva, will be tracking all gun purchases made on credit. The ISO develops standard documentation that is globally recognized. Gun sales were previously listed as “general merchandise,” but the ISO is changing the code.

If you purchase a gun through a credit card, an international agency will document the purchase. Cash is still an option for now, but I expect it will become increasingly difficult to gain access to firearms – at least for those who plan to purchase them legally.

Visa is eager to participate. “Following ISO’s decision to establish a new merchant category code, Visa will proceed with next steps, while ensuring we protect all legal commerce on the Visa network in accordance with our long-standing rules,” they said in a statement. American Express said that they would work with a third-party processor (more people with access to your data) and will implement the code once the details are finalized. Mastercard said they will “turn our focus to how it will be implemented by merchants and their banks as we continue to support lawful purchases on our network while protecting the privacy and decisions of individual cardholders.”

Every credit company will comply. The National Rifle Association is pushing back, but the change is already underway. “The [industry’s] decision to create a firearm-specific code is nothing more than a capitulation to anti-gun politicians and activists bent on eroding the rights of law-abiding Americans one transaction at a time,” National Rifle Association spokesman Lars Dalseide stated to Fox Business.

As a reminder, criminals have access to guns. Joe Biden continually calls on Congress to ban assault weapons, but that is the beginning. Not so coincidentally, Joe Biden’s own family members illegally discarded a gun in a trash can outside a school, but that’s (D)ifferent. The Second Amendment is under fire, and the people must vote accordingly.

When a Clown Moves into a Palace

Armstrong Economics Blog/Uncategorized Re-Posted Sep 10, 2022 by Martin Armstrong

-Record-high inflation

-Proxy war with Russia

-Open borders

-Loss of energy independence

-Looming recession

-Reckless spending

-Woke agenda

-Increase in violent crimes

-Polarized nation

-Compromised elections

-America now seen as vulnerable to enemies

The list goes on and on…

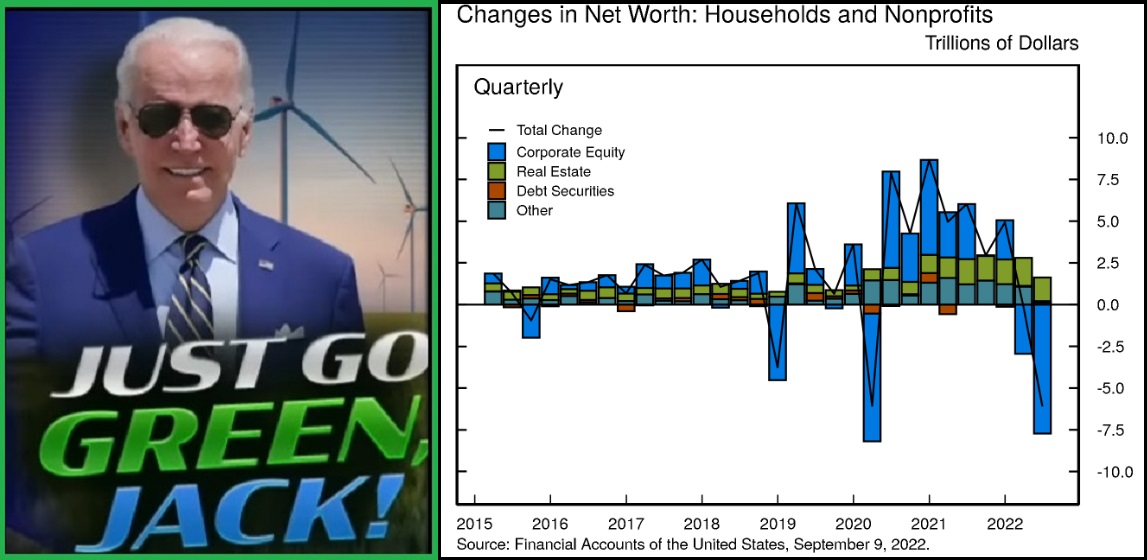

U.S. Household Net Worth Drops $6.1 Trillion in Second Quarter, Despite Home Values Increasing $1.5 Trillion

Posted originally on the conservative tree house on September 9, 2022 | Sundance

The U.S. Federal Reserve has published the second quarter 2022 balance sheet of U.S. total household wealth [DATA HERE].

In the second quarter (April, May, June) 2022, the total U.S. household wealth dropped $6.1 trillion, despite a calculated increase in home value of $1.5 trillion. The majority of the loss is connected to a drop in Corporate Equity (stock market) and household investment in the stock market.

FED “The net worth of households and nonprofit organizations declined $6.1 trillion to $143.8 trillion in the second quarter. The value of stocks on the household balance sheet declined by $7.7 trillion, while the value of real estate increased by $1.5 trillion.” Keep in mind this is backward looking data, and after a period of decelerating rates of growth, the overall real estate market is now in a period of decline as calculated for the most recent month of July [DATA].

The equity position of homeowners is now considerably less than the equity position when the feds calculated the second quarter household wealth (two months ago). Part of the issue goes back to what we have been discussing with inflation and specifically energy driven increases in fuel and electricity.

Inflation sucks money out of the economy, making people less wealthy. Energy inflation sucks money exponentially faster out of each household, potentially making the already working-class poor, much poorer.

The higher prices paid for housing, food, fuel and energy do not contribute to anything, the increased costs are just sucked out of the consumers’ pockets without generating any additional value. It just costs more to live, and that reduces wealth. Consider this the cost of going green.

Joe Biden and his economic team are introducing phrases like “a growth recession,” to explain a dynamic where earned wages are replaced by government subsidy. You can no longer afford food, energy, housing etc, so the government steps in as the provider of subsidy based on income level to supplement the gap between wages and the new costs of products and services within the Biden created “green” economy.

However, in the bigger of big pictures, the government does not create wealth. Wealth is created outside government by private activity. Government income via taxation is lowered when the economic activity of the private sector drops.

There is currently a massive lag in recording dropped economic activity that is going to surface very soon. The rate of energy price increase has been so large, so fast, the ability of producers to transfer the cost creates an economic lag.

Total product costs (except imports) are rising faster than finished good prices to consumers. At the same time, consumer demand for goods has dropped dramatically due to the speed and rate of increased energy costs. As a combined result, the equity market will likely continue to decline as each earnings report comes in lower than prior expectation.

Now, looking at wealth over time, what happens to the economic model of Biden when current housing value ($41.2 trillion) simply drops back to 2020 levels ($33.0 trillion a conservative real estate market correction)?

Continued higher prices to consumers, less money to government, less economic activity and lower household equity. That’s trouble, big trouble.

Wave #3 of food inflation starts hitting hard next month as the increased costs at the field start to transfer through the supply chain from harvest to the fork.

WASHINGTON DC – […] The sour mood appears to stem from record food, energy and housing prices. Positive views of the grocery industry dropped 14 percentage points from last year, the biggest drop in the survey. The real estate industry dipped 9 points, the second-largest decline.

Just 22 percent of respondents reported having a positive view of the oil and gas industry, down from 28 percent last year. Twenty-nine percent reported having a positive view of electric and gas utilities, down from 36 percent last year.

Grocery prices rose a stunning 13.1 percent over the last 12 months ending in July, the largest annual increase in more than four decades, according to Labor Department data.

Housing affordability has fallen to its lowest level since the Great Recession, according to the National Association of Home Builders, with rents and home prices at record levels.

Gas prices reached an all-time high in June before falling slightly in recent months, while energy bills are also soaring amid huge demand for natural gas. (read more)

Meanwhile Biden’s economic team is bragging that Main Street is in better shape?

“The President’s first two years in office have been two of the most productive in American history, and as the Blueprint explains, these accomplishments are all part of one economic vision.” (more)

Ukrainian Parliament Lines Pockets with Western Aid

Armstrong Economics Blog/Corruption Re-Posted Sep 7, 2022 by Martin Armstrong

The pro-war People’s Deputies of Ukraine Party are using Western funding to line their pockets. It has been reported that the average paycheck went from 28,800 to 49,600 hryvnia, and taxpayers in other countries will pay for their raises.

This news came out shortly after CBS attempted to release a documentary that claimed weapon shipments from the US were frequently missing. CBS was forced to redact parts of the documentary, “Arming Ukraine,” after Ukraine’s government threatened them. The first report stated that 70% of the weapon purchases had gone missing, while another piece said only 30% of aid had arrived. “Since that time, Ohman says delivery has improved,” CBS backtracked. “We are updating our documentary to reflect this new information and air at a later date.”

“The weapons are stolen, the humanitarian aid is stolen, and we have no idea where the billions sent to this country have gone,” an anonymous veteran originally told reporters. He went on to claim that soldiers are receiving less pay while those at the top are lining their pockets. Zelensky continually claims that his country needs endless funds for the endless war. Where is this money going? Since WE are paying for the war, we deserve to know the truth.

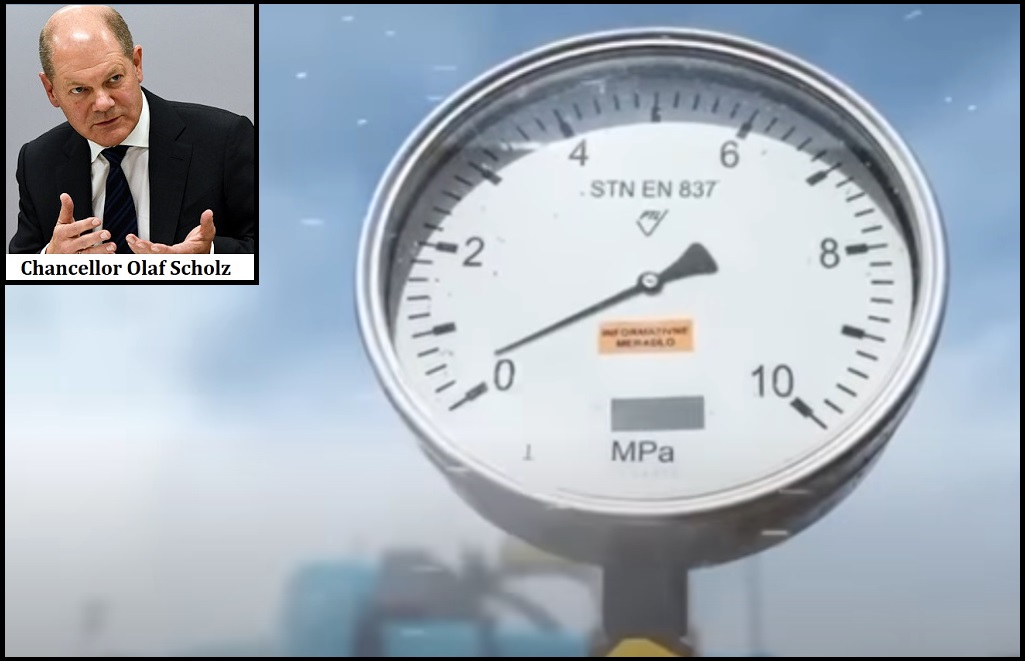

Russia Shuts Down Nord Stream 1 Gas Pipeline, Gasprom Sends out Eerie Video ‘Winter is Coming’

Posted originally on the conservative tree house on September 6, 2022 | Sundance

Well, it looks like it’s official now. After several days of sporadic reporting on Russia’s decision to shut down the Nord Stream 1 natural gas pipeline into western Europe, it looks like the valves have been shut down until EU sanctions against Russia are removed.

Strategically the Nord Stream 1 pipeline is the major gas supply route into Germany, Europe’s largest economy. As noted by Reuters, “European gas prices, as measured by the benchmark Dutch TTF October gas contract, rose by as much as 30% on Sept. 5, amid growing fears of a total shutdown of Russian pipeline imports ahead of the European winter.”

Europe was already going into a deep economic recession due to inflation created by pre-existing green energy policy. The Nord Stream shutdown will make things exponentially worse as energy prices skyrocket. The Russian owned energy company Gasprom sent out a video that can be best described as psychological warfare. WATCH:

.

Wow, Europe Household Electric Bills Estimated to Jump by $2 Trillion Next Year, That’s 12% of Their GDP

Posted originally on the conservative tree house on September 6, 2022 | Sundance

What is predicted to happen in Europe is just stunning, literally stunning.

♦Context – According to official data from the World Bank, the combined Gross Domestic Product (GDP) of the European Union was just over $17 trillion US dollars in 2021. That is the last calculated measure. The combined GDP value of European Union represents roughly 12.78 percent of the world economy.

According to analysts for Goldman Sachs, the current energy crisis in Europe has increased electricity prices at a rate that is increasing almost daily. Within the data it is now estimated that households within the EU will pay an additional $2 trillion for electricity in the next year.

Put that $2 trillion into context with their GDP, and that scale of energy cost would be wiping out 12% of the purchasing strength within the total EU economy. Forget about buying anything else, if this analysis is correct Europeans will be buying food and energy, nothing else.

If you consider what that means, it is bordering on full economic collapse of western Europe.

What is being described above is what we posited when we outlined the impact of the “Energy Economy” {Go Deep}. When you suck 12% of the purchasing power out of an economic engine simply to maintain the status of current energy use, everything else starts to collapse.

Also keep in mind we are only talking about the direct impact of $2 trillion in electricity cost. The downstream consequence is far greater because everything created, produced, or manufactured, including food, is dependent on electricity – which will drive the final cost to produce of all those products even higher.

The damage is almost unimaginable in scale.

[Fortune] – European households should brace for an expensive winter owing to the continent’s deepening energy crisis that will likely send electricity and heating bills soaring.

Energy affordability in Europe is reaching a “tipping point” that could peak next year, with total spending on bills across the continent growing by 2 trillion euros ($2 trillion), a Goldman Sachs research team, led by Alberto Gandolfi and Mafalda Pombeiro, said in a note published Sunday.

Many European households are already feeling the bite of a steadily worsening energy crisis, brought on by Russian natural gas producers intermittently pausing flows along the critical Nord Stream pipeline following Western sanctions this year.

Energy bills at some restaurants and coffee shops have already more than tripled this year, but with threats looming that natural gas supply from Russia could become even tighter as the Ukraine War rages on, analysts warn that Europe’s coming struggles are set to rival some of the worst energy crises on record.

“The market continues to underestimate the depth, the breadth, and the structural repercussions of the crisis,” the Goldman Sachs analysts wrote. “We believe these will be even deeper than the 1970s oil crisis.” (read more)

The economic contagion will not be isolated to Europe.

The impacts to the social fabric are also almost unquantifiable in scale.

Example: What happens to migration patterns when economic migrants are now considered a threat to scarce resources?

While the US is not quite in the same level of energy desperation, what we were discussing last week is an example of the problem we too may face.

Let’s say you are an average USA Main Street household with an income around $100,000/yr, and you now face an increase in electricity rates from $300 to $500 due to Joe Biden’s new national energy policy known as the Green New Deal. That’s $200 more per month for this initial economic/energy “transition” moment.

That extra $200/month equates to $2,400 per year.

That $2,400 per year is static economic activity. Meaning nothing additional was created, and nothing additional was generated. The captured $2,400 is simply an increase in the price of a preexisting expense.

Take that expense and expand it to your community of 100 friends and family households. The $2,400 now becomes $240,000 in cost that doesn’t generate anything. $240,000 is removed from the community economy. $240,000 is no longer available for purchasing other goods or services within this community of 100 households.

The economic purchasing power of the 100-household community is reduced by $240,000 per year.

Take that expense and expand it to your county of 10,000 households. Now you are reducing the county economic activity by $24 million. In this county of 10,000 households, $24 million in economic transactions have been wiped out. Meals at restaurants, purchases of goods and services, or any other spending of the $24 million within the county of 10,000 households (approximately 25,000 residents) has been lost.

Now expand that expense to a larger county, quantified as a mid-size county, of 50,000 households. The mid-sized county has lost $120 million in household economic activity, simply to sustain the status quo on electricity rates. Nothing extra has been generated. $120 million is lost. The activity within the county of 50,000 households shrinks by $120 million.

Expand that expense to a large county of 100,000 households, and the lost economic activity is $240 million.

Expand that expense to a small state of 1 million households (2.5 million residents), and the lost economic activity is $2.4 billion.

Expand that expense to a state with 5 million households (approximately 12 million residents) and the economic cost is $12 billion in lost economic activity unrelated to the expense of maintaining the status-quo on electricity use. This state loses $12 billion in purchases of goods and services, just to retain current energy use.

These examples only touch on household expenses. The community, county and state business expenses for offices, supermarkets, stores, etc. are in addition to the households quoted.

Meanwhile the Gross Domestic Product (GDP) of the community, county and state, remains static because the GDP is calculated on the total value of goods and services generated in dollar terms. The appearance of a static GDP is artificial. In real Main Street terms, $12 billion in economic activity is lost, but the price or increased value of electricity hides the drop created by the absence of goods and services purchased.

Fewer goods and services are purchased and consumed. However, statistically the inflated price of electricity gives the illusion of a status quo economy.

Now expand that perspective to a national level and you can see our current economic condition.

All of this is being done under the justification of “climate change.”

Previously I would have said this level of economic impact in Europe would lead to a total revolt against the government. However, with the backdrop of the recent COVID lockdowns and government control mechanisms in mind, and looking at the citizen compliance that took place in response to those government mandates, it is now more likely the citizens in Europe will simply bow to the energy control mechanisms of the governing authority.

It’s almost as if the COVID compliance effort was the test…