Posted originally on the conservative tree house on April 13, 2022 | Sundance

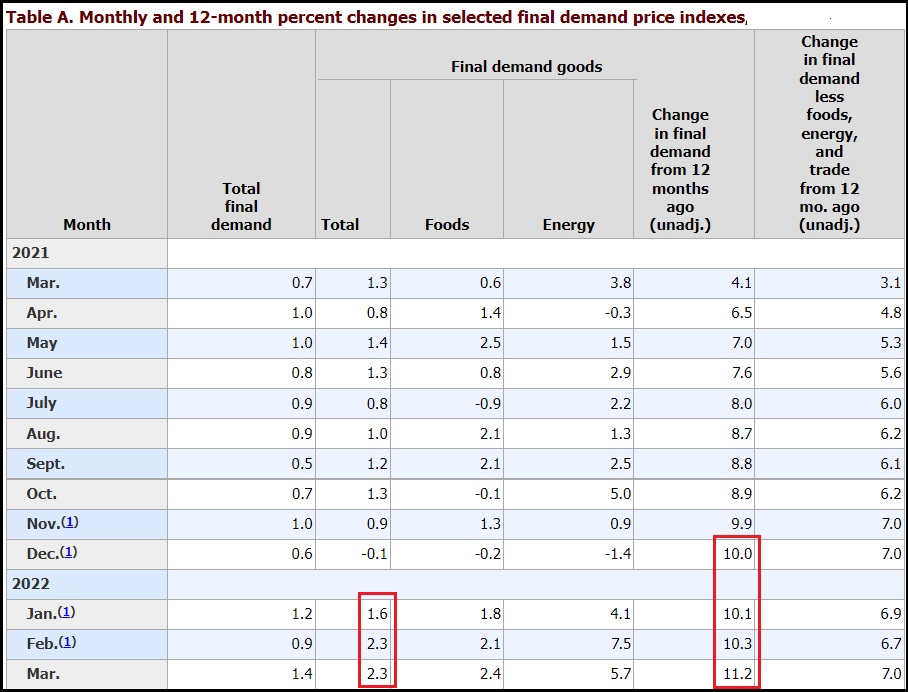

he “Producer Price Index” (PPI) is essentially the tracking of wholesale prices at three stages: Origination (commodity), Intermediate (processing), and then Final (to wholesale). Today, the Bureau of Labor and Statistics (BLS) released March price data [Available Here] showing a dramatic 11.2% increase year-over-year in Final Demand products at the wholesale level. This is the fifth consecutive month with the highest rate of inflation the PPI ever recorded.

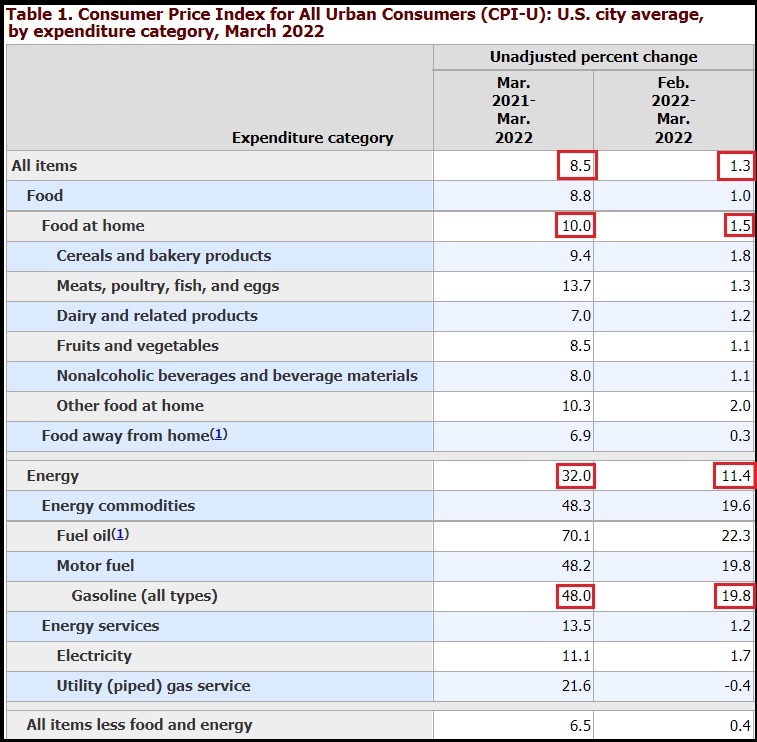

The single month increase in wholesale prices of 2.3% was driven by inflation built into the supply chain at every level that shows up in the final wholesale price. Those price increases then get passed along to consumers along with the additional costs for warehousing, transportation and delivery. I modified Table-A (FINAL DEMAND) to take out some of the noise.

Wholesale prices of goods jumped 2.3 percent in March, and the wholesale price of food products jumped 2.4 percent. The total demand inflation compared to last year is 11.2 percent, the highest rate ever recorded since the PPI tracking was first started.

The total final demand monthly calculation (1.4%) is lower than the final demand goods (2.3%), because final demand services are offsetting. You may remember the discussion/analysis about prices beginning to stabilize after this month due to a contraction in demand for goods and services. I see support for that thesis within this data.

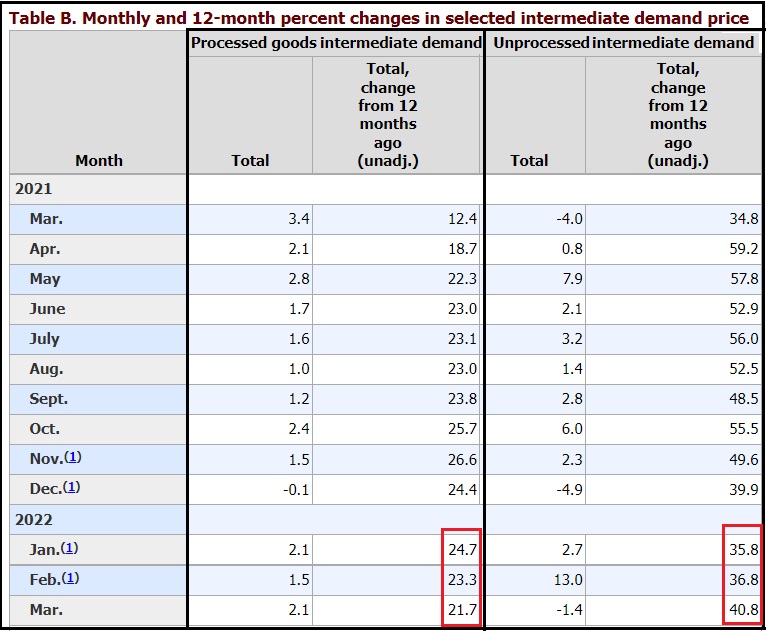

The three phases of wholesale product creation: (1) origination, (2) intermediate, and (3) final, cycle through the economic analysis in reverse chronological order. Roughly speaking, the flow of goods quantified is done in 30-day sequences. Final demand this month is comparing to final demand in March 2021. The intermediate demand goods this month will become final demand goods next month (April).

The rate of inflation behind this set of final demand goods is beginning to soften. See Table B, Intermediate goods. Again, modified to take out the noise:

While the yearly comparison for both processed and unprocessed intermedia goods is eye dropping, in the unprocessed intermediate demand goods, we are starting to see a lessening of monthly price increases.

In essence, prices have been rising so fast and for such an extended period of time, that we are now cycling through the rate of increase and starting to compare it to last year when the rate of increase was originally going high. As a consequence, the rate of price increase will likely lessen, even though the actual price may still keep climbing within the manufacturing process.

The price of raw materials, and the wholesale energy costs to process those materials into finished goods, are still rising. In addition to the consumer prices reported yesterday, this wholesale price data is showing the most recent increases (March) in fuel and transportation costs. For the next report these figures should now plateau.

♦ BOTTOM LINE – We have not yet reached PEAK INFLATION – However, the price increases from wholesalers to retailers are now at parity. The increased price of things coming into the supply chain are now at similar rates of increase when compared to the stuff on the shelves.

Inflation from field to fork is now fully matriculated and embedded in the total economy as a result of two massive price waves (July to October 2021 and November to March 2022). Those prices will never fall.

Highly consumable goods like food, fuel and energy will remain at approximately the price today for a period of around five months, then we will see the third wave kick in as the new higher harvest prices hit the processors in late summer.

The prices for non-essential durable goods, like cars, electronics, appliances etc. from this moment forth will now be determined by demand. Highly sought after goods will increase in price as more customers chase fewer products. However, ordinary or widely available durable goods will likely start to come down in price very soon as inventories climb because consumer spending has prioritized and dropped non essential goods from their shopping lists.

To put it more succinctly: The stuff we need will cost more. The stuff we don’t need will cost less.

Let’s Go Brandon