Newsmax TV Published originally on Rumble on September 13, 2022

Arizona gubernatorial candidate Kari Lake joins us to discuss the Justice Department’s expanding its investigation into the Capitol breach.

Newsmax TV Published originally on Rumble on September 13, 2022

Arizona gubernatorial candidate Kari Lake joins us to discuss the Justice Department’s expanding its investigation into the Capitol breach.

The far left is eager to repeal 2A. We are not as free as we think. The International Organization for Standardization (ISO), an organization headquartered all the way in Geneva, will be tracking all gun purchases made on credit. The ISO develops standard documentation that is globally recognized. Gun sales were previously listed as “general merchandise,” but the ISO is changing the code.

If you purchase a gun through a credit card, an international agency will document the purchase. Cash is still an option for now, but I expect it will become increasingly difficult to gain access to firearms – at least for those who plan to purchase them legally.

Visa is eager to participate. “Following ISO’s decision to establish a new merchant category code, Visa will proceed with next steps, while ensuring we protect all legal commerce on the Visa network in accordance with our long-standing rules,” they said in a statement. American Express said that they would work with a third-party processor (more people with access to your data) and will implement the code once the details are finalized. Mastercard said they will “turn our focus to how it will be implemented by merchants and their banks as we continue to support lawful purchases on our network while protecting the privacy and decisions of individual cardholders.”

Every credit company will comply. The National Rifle Association is pushing back, but the change is already underway. “The [industry’s] decision to create a firearm-specific code is nothing more than a capitulation to anti-gun politicians and activists bent on eroding the rights of law-abiding Americans one transaction at a time,” National Rifle Association spokesman Lars Dalseide stated to Fox Business.

As a reminder, criminals have access to guns. Joe Biden continually calls on Congress to ban assault weapons, but that is the beginning. Not so coincidentally, Joe Biden’s own family members illegally discarded a gun in a trash can outside a school, but that’s (D)ifferent. The Second Amendment is under fire, and the people must vote accordingly.

MyPillow CEO Mike Lindell told the story earlier today on his podcast. {Direct Rumble Link} Apparently, after returning from a hunting trip, while going through a Hardee’s drive-thru, three cars from Joe Biden’s jackboot FBI operation surrounded him and demanded he turn over his cell phone. WATCH:

.

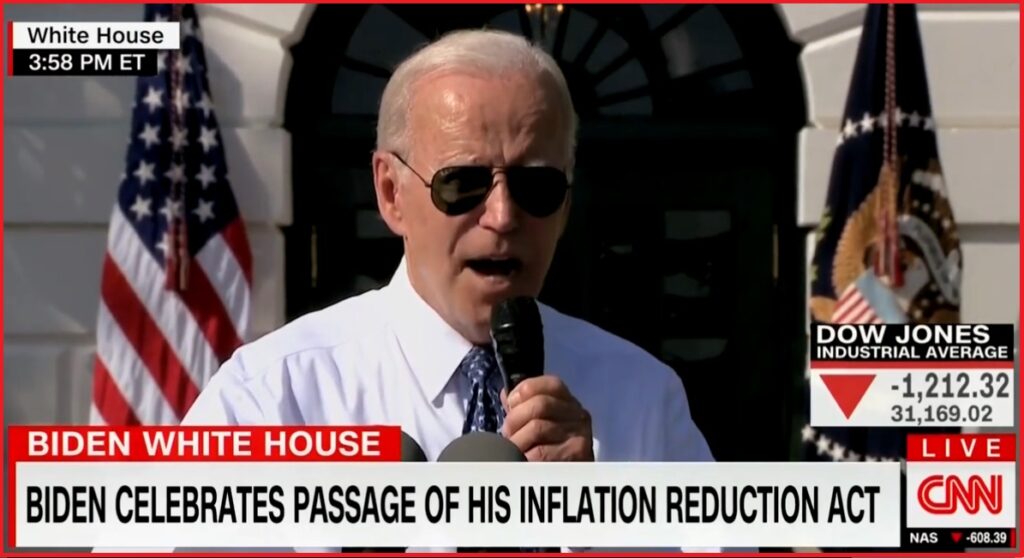

If there was ever an audio-visual of the disconnect between Joe Biden policy and the horrific consequences they create, today would be the case study.

As the stock market is plummeting after a horrific inflation report from the Bureau of Labor and Statistics, Joe Biden is simultaneously celebrating the passage of the “Inflation Reduction Act,” most commonly known as the Green New Deal. WATCH:

.

The same thing happened on Fox News.

.

As the European Central Bank (ECB) finally begins to raise rates, Greece is rushing to repay its outstanding debt. The failure to consolidate eurozone debt hurt the southern nation, whose debt spiked due to simple currency conversion. Greece remains the most indebted country in the EU. The country received its third bailout in 2018 and has been struggling to pay off its debt, relying mostly on bonds.

Greece is making its next payout ahead of schedule, as it knows that the amount owed will only rise. Greece is set to repay 2.7 billion euros, according to the finance ministry. However, this is a small piece of what they owe as debts have more than tripled since the start of the year.

As the eurozone is facing an inevitable recession, Brussels is sure to hunt down its debts. Greece has been put in a lose-lose situation as its initial debt spiked after the drachma was converted to the euro. Greece’s debt to GDP has soared since joining the euro. The ratio is expected to reach 186.1% by the end of the year, which is slightly better than 2020 (206.3%) and 2021 (193.3%).

The entire EU Crisis began precisely on schedule on the political pi turning point from the major high in 2007. Precisely on the day of the ECM turning point, April 16, 2010 (2010.29), Greece notified the International Monetary Fund (IMF) that it was on the verge of bankruptcy. The eurozone and IMF provided Greece with a 260 billion euro loan – a small price to pay to prevent the European economy from crashing. Greece repaid the IMF 28 billion between 2010 and 2014. More money was requested a few years later. Fast forward to 2022, and Greece needed an additional 7 billion euros through bond sales. They are simply trying to stay afloat.

California sent out an emergency public notification to warn residents that the power grid was under a strain. Since people are likely unwilling to turn off their power during the summer heat, California is concocting “de-energization” plans. Simply put, California plans to temporarily turn off the power grid in the name of public safety.

This is the same state that plans to eliminate gas-powered cars yet does not have the capability to maintain the current electrical grid. Companies are already creating advice for residents to “get ready for a PSPS” (Public Safety Power Shutoff). PG&E warned that some residents may be without power for “several days.” Their advice seems quite dystopian. Those who will DIE without power due to medical conditions may receive an exemption to power their medical devices.

Several days without electricity will cripple small businesses, and large businesses will also suffer. Those who may need but do not qualify for an exemption could die. They are recommending that people use camping stoves and outdoor charcoal grills to cook, but that is not an option for many. The elderly are especially vulnerable without power. Those without power banks will be unable to charge their phones and will be isolated from the world. Kids will be unable to attend school. They are asking people to power their EVs, but you can only go so far on one charge. It will come as no surprise if they shut off electricity for the poorest areas first.

Perhaps we could have funded this project instead of sending over $120 billion to Ukraine. California is still pushing to end the use of fossil fuels but look at the situation they are in currently.

Well, the Goldbugs are out in force claiming that Putin is creating a Moscow World Standard for gold. These people will never learn that their dream of some fixed gold standard has always collapsed throughout history. They have never played in the big leagues and consequently, they do not even understand the rules of the game. It’s like standing on the street corner and seeing a guy drive by in a black limo and lament life is not fair for they should be like him without ever knowing what he is really all about.

Yes, gold coins existed since the 8th century BC. However, it was NEVER a gold standard for if that was even attempted, it would have collapsed as did Bretton Woods, the 19997 Asian Currency Crisis, the Swiss-Euro Peg, or the collapse of the British pound in the ERM Crisis that made Soros a fortune. NEVER throughout all the recorded financial history of the world was there EVER a “gold standard” as they keep telling people. Gold floating up and down with the economy the same as the dollar does today – it was always a floating exchange rate monetary system.

There were periods when the gold coinage of Byzantium was debased especially during the Great Monetary Crisis of 1092. The coins that were once gold, we debased to the point they became silver.

Even the ratio of silver to gold was never constant. There were times when new discoveries of silver poured from the mines leading to the decline in purchasing power of the silver. Likewise, there were times when gold became more common than silver. Even during the California Gold Rush of 1849, the purchasing power of gold declined sharply because there was too much of it coming around.

So why do their relentless theories of a return to a gold standard fail and only end up with people losing their shirts, pants, their home, and sometimes their wives? The answer is SIMPLE, yet they cannot escape their own beliefs that have turned gold into a religion. There can NEVER be any FIX EXCHANGE RATE regardless of whether it is gold, silver, bronze, paper dollars, or sea shells – yes they too were money along with cattle and slave girls.

For you see, there is such a thing as a BUSINESS CYCLE. They simply refuse to understand the basic monetary theory or the history of money, which had been many things for over 6,000 years. It does not matter what the money might be at any point in time, it will decline in value as assets rise which we call inflation, and as people need cash and assets decline, we call that a recession. That has ALWAYS taken place regardless of the century, what was money at the time, or the culture. This is WHY there can NEVER be a “gold standard” that will ever survive for that is COMMUNISM where you prevent a recession by eliminating freedom. For you see, Marx tried to stop this business cycle so he confiscated all private assets and even that failed to prevent the business cycle from winning.

Even Fed Chairman during the collapse of Bretton Woods explained its epitaph. The business cycle ALWAYS wins! That simply means gold will rise and fall in value BECAUSE of the business cycle. It is not some scheme to manipulate it. That is part of the natural cycle.

Gold has been around for a long time. In Egypt, they had the first paper money. There were warehouse receipts for the grain you would deposit. Gold was seen as the tears of the god Ra, the sun god. The only person who was worthy to touch it was the Pharaoh. The Celts used gold in ring form, not coins. But throughout the entire history of gold, it rose and fell and had no such FIXED value.

So, as the goldbugs are pushing the latest that Russia is now establishing a gold standard, they do not understand what is really going on. Russia has been turning from Europe and America toward Asia expanding its markets and its economic power even to include India and Iran. Putin has persuaded Middle Eastern oil and gas producers to turn to Asia. Some have accused me of advising Putin in his latest speech everything he said and what he is doing is coming from our models. I do not advise Putin personally. Of course, we have many readers in Russia as well. I was even called by RT about how our model predicted Ukraine would be the hot spot one year in advance.

Biden has destroyed the world economy. I believe that even Bill Browder may be just a front for the CIA pushing this agenda that is actually undermining the West – not Russia. The world economy has been divided in two and it will NEVER return to normal. Putin is very smart. Probably far smarter than any other world leader at this time. Both Russia and China see the world in cycles. In Europe and America, we see the world as linear and that is our downfall.

Lady Margaret Thacher spoke at our World Economic Conference in 1996. She understood about cycles. As she told me that Tony Blair would win well before there were any polls, she said it was “just time.” The downfall of the West is that we do not see the world in cycles. It is Just Time, for the rein of the United States to come to an end.

Even Bill Clinton told Yeltsin after meeting Putin, “He’s a very smart man.” Putin sees the rising power of Asia in what is their Industrial Revolution. Biden’s insane sanctions against Russia have strengthened the bond with China, opposite of what Nixon did. Thanks to Biden’s sanctions, Russia is forging an alternative world order to that of the World Economic Form and its directive to Western leaders. Putin’s move to create a Moscow gold exchange is simply because he cannot sell gold anymore in the West. Putin, hopefully, will not be that stupid and try to fix a value of gold that would only ensure the collapse of Asia and Russia. Gold must be free to rise and fall as it has done for thousands of years.

It is good to see at least one energy finance analyst at the Institute for Energy Economics and Financial Analysis, speaking commonsense. In an article by Clark Williams-Derry for Barron Magazine [SEE HERE], the author accurately outlines how significant U.S. Liquified Natural Gas (LNG) exports are driving up prices for American consumers.

The author accurately refutes the notion that exports do not drive-up domestic prices, by walking through the example of how natural gas prices dropped for U.S. consumers when the liquefied natural gas plant in Quintana, Texas [Freeport LNG] was temporarily shut down, blocking a portion of the export capacity. However, that facility is about to come back on-line and with increased exports from other facilities domestic U.S. prices have already doubled.

According to the U.S. Energy Information Association (IEA), U.S. storage of Liquified Natural Gas (LNG) is 12% below the five-year average (LINK). Additionally, the IEA is expecting the U.S. to export 11.7 billion cubic feet of LNG per day during the fourth quarter of 2022 — up 17% from the third quarter. The destination of that export is Europe.

Consider that 43% of U.S. households use LNG for home heating, and power suppliers use LNG to create electricity. With the massive 2022 exports of LNG to Europe (+17% in fourth quarter alone), that means lower domestic supplies and increased prices here in the United States for electricity and home heating. We are seeing and feeling these massive price increases right now.

Barrons – […] If you need more evidence of the impact of natural gas exports on prices, just compare supply and demand fundamentals for the year leading up to February 2020 (the last pre-pandemic month) versus the year leading up to this May (the most recent month with full federal data). Annualized production rose over the period, while domestic consumption remained roughly flat. Yet LNG exports almost doubled—a surge that tightened U.S. gas markets and doubled the price that U.S. consumers pay for the fuel.

The growth of global demand for U.S. LNG can be tied to many market forces, including the shortfalls in Europe due to Russia’s manipulation of European Union gas markets. Sustained high demand in wealthy Asian nations has contributed to export growth as well. And so has the U.S. gas industry’s dogged determination to ship its wares to the highest bidder, foreign or domestic.

Russia’s role has been particularly critical in the rise of global LNG demand. As Russia choked off gas shipments to Europe, EU buyers have turned to global LNG markets to make up the shortfall. Global LNG prices rose in response, and U.S. LNG companies ramped up output, shipping more cargoes to Europe. But Russia responded by further clamping down on gas supplies to the EU—a vicious circle that has hurt Europe’s economy even more severely than it has harmed America’s.

There’s little sign that U.S. gas prices will ease in the coming years. Freeport’s demand will be back online soon enough, and there are three other massive LNG export projects under construction, with more than a dozen of others waiting for financing.

[…] Curiously, federal regulators have consistently found that the gas export projects are in the public interest—meaning they were in the economic interest of LNG companies and gas drillers. But now, exports are creating sky-high costs for U.S. consumers, and drillers are reluctant to boost gas output lest prices fall back to earth. So, it’s high time to consider whether soaring U.S. LNG exports are actually in America’s interest—or if, instead, runaway LNG exports are fueling energy inflation and undermining the nation’s economic competitiveness. (read more)

Not only are U.S. taxpayers directly paying for the majority of costs in Ukraine, but we are also subsidizing the European Union by exporting LNG and driving up the price for energy here at home.

We the taxpayers are directly paying Ukraine, and indirectly paying Europe to maintain gas sanctions against Russia. As a result, we the taxpayers are also paying higher prices here at home. This is the reality of the current exfiltration of wealth as created by the Biden administration.

FUBAR

-Record-high inflation

-Proxy war with Russia

-Open borders

-Loss of energy independence

-Looming recession

-Reckless spending

-Woke agenda

-Increase in violent crimes

-Polarized nation

-Compromised elections

-America now seen as vulnerable to enemies

The list goes on and on…

I have created this site to help people have fun in the kitchen. I write about enjoying life both in and out of my kitchen. Life is short! Make the most of it and enjoy!

De Oppresso Liber

A group of Americans united by our commitment to Freedom, Constitutional Governance, and Civic Duty.

Share the truth at whatever cost.

De Oppresso Liber

Uncensored updates on world events, economics, the environment and medicine

De Oppresso Liber

This is a library of News Events not reported by the Main Stream Media documenting & connecting the dots on How the Obama Marxist Liberal agenda is destroying America

Australia's Front Line | Since 2011

See what War is like and how it affects our Warriors

Nwo News, End Time, Deep State, World News, No Fake News

De Oppresso Liber

Politics | Talk | Opinion - Contact Info: stellasplace@wowway.com

Exposition and Encouragement

The Physician Wellness Movement and Illegitimate Authority: The Need for Revolt and Reconstruction

Real Estate Lending