Armstrong Economics Blog/Forecasts

Re-Posted Aug 6, 2019 by Martin Armstrong

QUESTION: Hello,

about your recent post ‘The Sum of All our Economic Fears’… i understand you will give some advices to investors how to trade difficult times that lie ahead in 2020 and beyond. What i wonder is what we, non investors but just ordinary people who does have only house or the apartment they live in and day job, what we should do and what we can expect regarding crisis that’s coming our way. (many non investors are reading your blog, just for the love of knowledge, i’m sure you are aware of that)

Thank you for your time.

MR

ANSWER: The basic level of Socrates is designed for the non-investor who needs a broader outlook rather than short-term buy and sell strategies. I fully intend to make sure that information is available for the general public. The NY bankers have always wanted to shut down our forecasting, for they want people to only listen to their forecasts which are always self-serving. I will make every effort to ensure that this forecasts of Socrates will be available to the general public because we need not opinion and hype, but objectivity.

The Reality of Trade Between USA & China

Armstrong Economic Blog/China

Posted Aug 6, 2019 by Martin Armstrong

We are clearly cascading toward the Monetary Crisis Cycle as the USA wrong accuses China of manipulating its currency for trade advantages. All one needs do is look at the trend of the dollar against other major world currencies and you will quickly see that the trend of the dollar against the yuan is in line with the global trend. This is the problem we face when politicians simply follow the academic view of currencies when they are still teaching Keynesianism based upon fixed exchange rates. About 80% of China’s trade is with the rest of the world other than the United States. One does not lower its currency to impact 20% of its trade at the expense of the rest of the world.

I have written before that I was asked if I would teach at one of the top 10 universities in the world. I was surprised, to say the least. When I asked why would they even ask me the response was even more shocking. They actually said to me over lunch that they “knew” what they were teaching was wrong!. They also said the problem they face is those who have real-world experience are NOT INTERESTED in teaching classes in school. I said I would be glad to do a guest lecture, but I too had no interest in teaching a class every day.

Cina has been doing the exact opposite of what the US is accusing it. They have been supporting their currency and if they stopped and allowed it to float freely, then the US would witness probable new record highs in the dollar which will bring about the crisis we see coming by 2021.

I do not know what it is going to take to get governments to stop this nonsense over currencies. If the dollar was declining against all major currencies and China devalued the yuan counter-global-trend, then there would be an argument. But that is just not the case.

The yuan has been under pressure also because the yuan is too expensive within Asia and manufacture has been migrating to South East Asia. China has become the world’s second-largest economy by GDP (Nominal) and largest by GDP (PPP). When we look at the trade between the USA and China, we must look at goods v services.

- The U.S. goods trade deficit with China was $419.2 billion in 2018, an 11.6% increase ($43.6 billion) over 2017.

- The United States has a services trade surplus of an estimated $41 billion with China in 2018, up 0.8% from 2017.

Yes, we are one of the few rare services who publish our forecasting in China. We fall into the Services Catagory. About 80% of China’s trade is with the rest of the world other than the United States.

- United States: US$479.7 billion (19.2% of total Chinese exports)

- Hong Kong: $303 billion (12.1%)

- Japan: $147.2 billion (5.9%)

- South Korea: $109 billion (4.4%)

- Vietnam: $84 billion (3.4%)

- Germany: $77.9 billion (3.1%)

- India: $76.9 billion (3.1%)

- Netherlands: $73.1 billion (2.9%)

Will Europe See More Deflation, Stagflation, or Inflation?

Armstrong Economics Blog/European Union

Re-Posted Aug 5, 2019 by Martin Armstrong

QUESTION: Dear Martin, am a loyal reader of your blog and many thanks to you for the education. Please, one brief but important question, which keeps me thinking hard these days. I remember your words, inflation should pick up in the next cycle. But, isn’t it the other way round? Isn’t deflation the next thing.

We see inflation everywhere, in all asset classes, home prices, and durable goods. But if the economy declines and the people have no longer so many funds to pay their debt interest rates hey go defensive. And if the stock market declines too, sentiment turns and people become even more defensive. Isn’t this the classic scenario of a deflation period?

Thanks from Europe

RS

ANSWER: I realize that on one hand, it may appear to be asset inflation in Europe, but you must look at the real numbers and then plot them in FOREX. We can see that when we look at the DAX in price, the bounce in US dollars has been less than in euros. In real terms, Europe has been in DEFLATIONbut capital has been shifting into the property market to escape the banking sector. It appears that the low in real terms for Europe may come in 2023. However, the type of inflation we see is cost-push, not demand. So you might call this STAGFLATION, as was the case during the 1970s following the OPEC crisis.

Real-World v Fake Central Bank Interest Rates

Armstrong Economics Blog/Interest Rates

Re-Posted Aug 5, 2019 by Martin Armstrong

QUESTION: Socrates has been forecast that the free market rates are rising but the official central bank rates are still bearish overseas and neutral domestically. Is this the divergence you are forecast with respect to interest rates rising in the real world against the fake central bank rates?

Thank you

See you in Orlando

BF

ANSWER: Yes. I have also warned that the Fed is entertaining the prospect to PEGGING long-term government rates rather than engaging in Quantitative Easing. I have gone into this in detail in the new book about to be released soon. The Fed realizes that Quantitative Easing has failed. They are lobbying behind the curtain to try to get Congress on the side with sharing the burden to support the economy. However, that effort is not being received very well.

You must understand that there is a HUGE gap between real rates and fake rates unfolding. Call your bank and ask them what they will give you for a CD for say even 1 year. You will be lucky to get 2.5%. A car loan will be 4.71% to 5.26% on average. Banks are nearly doubling their money and this is the real-world compared to the fake rates offered by central banks. This is the HUGE gap between real-world and central banks which is expanding. So a forecast of lower rates ONLY applies to the fake rate – not the real-world rates.

Our forecast shows that real-world rates will rise, but the fake central bank rates will remain the same to lower ONLY because the central banks are becoming nearly exclusive buyers of government debt with the exception of pension funds which MUST buy government debt by law.

The Next Lehman Moment – Threat to the Global Economy the Fed Responded to

Armstrong Economics Blog/Reports and DVDs

Re-Posted Aug 4, 2019 by Martin Armstrong

I am seeing an overseas crisis is brewing which many might rename the “Lehman Moment” to something more up to date. Clearly, the stakes are far higher to the world economy than anyone may truly appreciate. We are cascading toward a perfect financial storm. However, this particular storm is exacerbated by the politics of Europe stemming from the structural design of the Euro. There is a major risk to both the European and world economy. All the Quantitative Easing by Draghi at the European Central Bank (ECB) has completely failed and in the process created a systemic risk to the entire world economy – not just the EU. This is why the Federal Reserve (Fed) has lowered interest rates when there was no true justification for the interest rate reduction domestically. The Fed has confirmed that it is indeed the central bank to the world even if it does not like that role. It can no longer place domestic policy objectives over international.

I am rushing to put out a special report on the next “Lehman Moment” for this is going to be extremely critical.

When Muslims Do Not Assimilate

Even in PC Europe the leftists have noticed that Muslim immigrants self-ghettoize and do not attempt to become Europeans. The answer as to why this happens is simple–Mohammed and the Koran. Islam is a complete civilization that is superior to the European/American civilization. Islamic doctrine addresses the barrier between the Kafirs and Muslims.

Macron’s French Police Openly Attacking the People Seriously Injuring if not Trying to Kill Them

Armstrong Economics Blog/France

Re-Posted Jul 30, 2019 by Martin Armstrong

Unfortunately, as governments begin to collapse moving into 2021/2022 due to the complete failure of Socialism, they will not simply yield to the people and admit that their fiscal mismanagement is the cause of destroying everyone’s future. They will not go quietly into the light. Here we see French police acting no different than the police in Venezuela terrorizing and suppressing the people there as well.

Did the Fed Begin Secret Bailouts in 2007 Before Anyone Knew of the Pending Crisis?

Armstrong Economics Blog/Central Banks

Re-Posted Jul 30, 2019 by Martin Armstrong

When the GAO report came out on the Quantitative Easing by the Federal Reserve, it uncovered a secret $16 trillion feeding tube from the Fed structured as revolving, low-cost loans to any bank (foreign or domestic) teetering on the edge. Amazingly, the audit showed the Fed started the loans in December 2007 – long before the public knew there was a dangerous financial crisis – and it lasted until at least July 2010.

When the GAO report came out on the Quantitative Easing by the Federal Reserve, it uncovered a secret $16 trillion feeding tube from the Fed structured as revolving, low-cost loans to any bank (foreign or domestic) teetering on the edge. Amazingly, the audit showed the Fed started the loans in December 2007 – long before the public knew there was a dangerous financial crisis – and it lasted until at least July 2010.

In addition to the publicly known support to Bear Stearns from the New York Fed, the GAO audit revealed that the Federal Reserve provided another $853 billion in secret loans to Bear Stearns; $851 billion from its Primary Dealer Credit Facility and $2 billion from its Term Securities Lending Facility. It wasn’t until May 31, 2008, when JPMorgan Chase closed its deal with Bear Stearns. However, the GAO reported that Bear Stearns “was consistently the largest PDCF borrower until June 2008.” The Fed shows that Bear Stearns continued to receive funds until June 23, 2008.

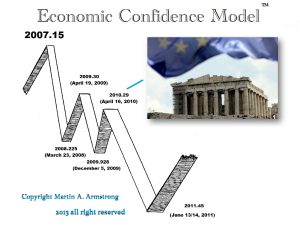

Then by April 2010, that is when Greece had to ask the IMF for a bailout. What is amazing is how no banker was ever charged for the toxic financial waste they created while trading against their own clients.

Brussels to Build a Berlin Wall in Ireland in the event of a Hard BREXIT

Armstrong Economics Blog/BRITAIN

Re-Posted Jul 30, 2019 by Martin Armstrong

COMMENT: You are quite correct Mr. Armstrong. Prime minister Boris Johnson spoke that “no deal” Brexit looks like a surety and the FTSE 100 skyrocketed and the pound took a beating against ALL mostly traded pairs. Indices (excepting for a few) are going to the moon!!

COMMENT: You are quite correct Mr. Armstrong. Prime minister Boris Johnson spoke that “no deal” Brexit looks like a surety and the FTSE 100 skyrocketed and the pound took a beating against ALL mostly traded pairs. Indices (excepting for a few) are going to the moon!!

J.F

REPLY: There are actually suggestions in Brussels I have received a few calls from reliable sources that a hard BREXIT means that Brussels wants to build their version of the Berlin Wall to separate Ireland all for taxes to prevent the free flow of commerce between the Irish people. All of this because of the insanity of their demands on trade. Britain will be so much better off with a hard BREXIT.

In 2018, UK exports to the EU were £289 billion (46% of all UK exports). UK imports from the EU were £345 billion (54% of all UK imports). The share of UK exports accounted for by the EU has generally fallen over time from 55% in 2006 to 43% in 2016, though this increased slightly to 44% in 2017 and 46% in 2018. The numbers are very clear. The UK buys more from the EU than the EU buys from the UK.

A hard BREXIT will allow Britain to enter free trade deals with Asia and the USA which are the more than 50% of its trade balance sheet. The decline in the pound will make British exports even more salable overseas.

Yikes – Two Somali Refugees Arrested for Conspiring to Provide Material Support to ISIS…

July 29, 2019

This is disturbing. Two Somali refugees in the U.S. have been arrested for conspiring to provide material support to ISIS.

(VIA DOJ) John Demers, Assistant Attorney General for National Security, Michael Bailey, the United States Attorney for the District of Arizona, Michael McGarrity, Assistant Director of the FBI’s Counterterrorism Division, and Sean Kaul, Special Agent in Charge of the FBI Phoenix Field Office, announced that on July 26, Ahmed Mahad Mohamed and Abdi Yemani Hussein, were arrested for conspiring to provide material support and resources to ISIS, a designated foreign terrorist organization.

According to the criminal complaint, the defendants had been in communication with an FBI undercover employee whom they believed was a supporter of ISIS ideology.

These communications revealed the defendants’ desire to travel overseas in order to fight on behalf of ISIS or to conduct an attack within the United States if they were unable to travel.

Ultimately, the defendants purchased airline tickets to travel to Egypt, with the intention to travel on to Sinai and join ISIS. FBI agents arrested Mohamed and Hussein after they checked in for their flight at the Tucson International Airport in Arizona.

According to court documents, both defendants came to the United States as refugees from Somalia. At the time of their arrest, Mohamed had obtained lawful permanent resident status and Hussein remained a refugee. (read more)