Posted originally on the conservative tree house on August 24, 2022 | Sundance

Long-term CTH readers might remember in 2014 when President Obama claimed U.S. families had been paying too little for electricity for too long. As soon as Joe Biden took office, he began implementing the Green New Deal energy policy that, (a) directly forces higher costs for energy; and (b) is now creating massive problems.

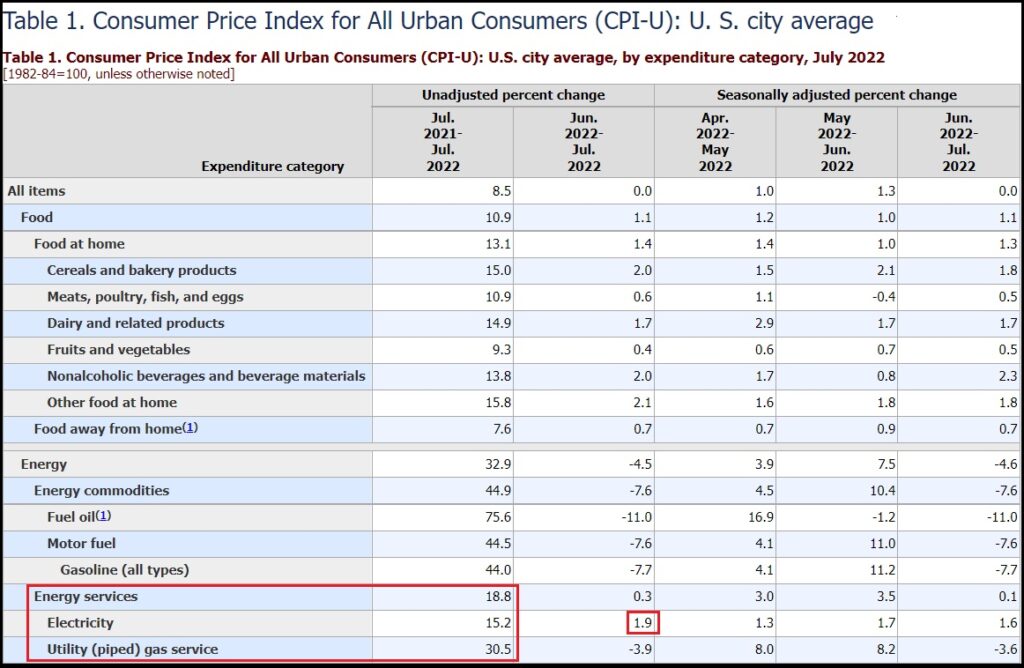

In July I noted my own electricity bill had jumped 28% in a single month. That bill was followed by another almost identical increase this month. A review of the Consumer Price Index (CPI) for July [Data Here] shows that nationally the same thing is happening. The year-over-year electricity price has increased 15.2%. However, worse still, the July increase alone was 1.9%, which figures to an annualized rate of 22.8%.

When the growth rate of monthly increase is exceeding the year-over-year result, that means future higher prices are coming. This is a serious problem that cannot be overstated. Already struggling with a doubling of gas prices, massive food price increases at the grocery store and the pain of all costs for goods far outpacing any rate of wage increase, this type of uncontrollable increase in price of electricity is going to hit the middle class hard.

Steve Cortes calls this the backside of the Biden created inflation hurricane. The backside of a hurricane is the worst because it hits from the opposite direction upon already weakened infrastructure.

The hurricane metaphor is apt because any increase in energy costs will be accompanied by the simultaneous arrival of another wave of food inflation, as the massive increases in field and crop prices start to feed into the food supply chain headed to our forks next month.

Making matters that much worse, Bloomberg is now reporting that 20 million households are now behind in their utility bills, specifically electricity bills, and the moratorium on shut offs has ended. [Paywall Article] Steve Cortes has written about the issue on his substack [Here].

One in six U.S. households, that is tens-of-millions of Americans, are now facing having their electricity turned off due to lack of payment. It is certainly understandable how this horrific outcome would happen. Joe Biden’s energy policies are destroying working class families with unsustainably higher prices.

20 million households is a catastrophic level of utility default. This is a serious issue with major social implications created by the desperation of those families. Middle- and lower-income families cannot survive this level of financial pressure.

.

Rents are behind. Mortgages are behind. Car payments are behind. And now this report on utility bills.

Steve Cortes appeared with Steve Bannon to discuss {Direct Rumble Link} – WATCH: