Posted originally on the conservative tree house on July 27, 2022 | Sundance

Imports are plummeting… should be a good thing… trade imbalance shrinks…. that lifts GDP calculations…. but the problem is…

…. Consumer Demand Has Collapsed.

The state of the U.S. economy is not as difficult as the ‘experts’ always claim. Simple business and checkbook economics always, always, tell you the future. You just have to be willing to accept things as they are, not as you would wish them to be. Let’s have an honest chat. We need it.

Remember, it was November 2021, and no one was paying attention but retail hiring was negative. The month before the 2021 Christmas holiday, when historically businesses would be adding people to their payrolls to support the increase in shopping, and retail businesses did no hiring. In fact, 20,000 retail jobs were LOST the month before Christmas. Retail sales had plummeted. That was a major flare, no one paid attention. Everyone was distracted with the Supply Chain crisis.

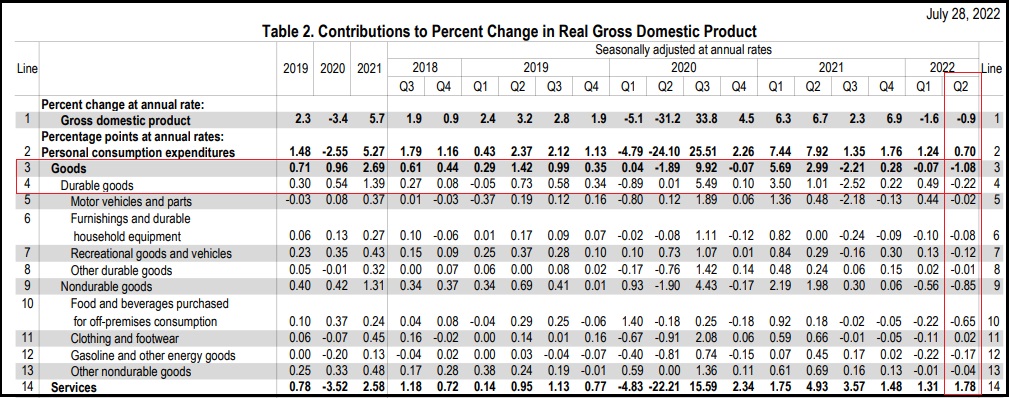

Then the fourth quarter 2021 GDP result came in at 6.9%, massively higher than the visible reality on Main Street. The reasoning was identified as a major increase in the value of inventories. While the Biden administration liked the GDP figure, the existence of the unsold inventory was another major flare. Add unsold inventory units to the massive inflationary value of those units (+8%) and you quickly see the +6.9% was bad news, not good news. Major increases in the value of goods have no value unless people are purchasing them. It wasn’t happening. Again, no one (except us) was paying attention.

Then the first quarter of 2022 GDP result came back with a negative 1.6% result. With high inflation those inventories were stagnant. The eight-percentage point GDP swing from the fourth quarter of 2021 to the first quarter of 2022 was another warning flare. Again, no one was truly paying attention. Retail sales -as measured in units purchased- had been in a contracting position since June of 2021, when the stimulus ran out. However, skyrocketing inflation was hiding lower unit sales.

With inventories stagnant, purchase orders to manufacturers stopped. Orders for non-durable consumer goods dropped.

Due to lengthy supply chains, including trans-pacific shipments, the process to stop deliveries in the electronic goods sector takes around 90-days before the drop in retail sales reaches the manufacturer to stop production. Here is the announcement from Samsung: “Samsung Electronics is temporarily halting new procurement orders and asking multiple suppliers to delay or reduce shipments of components and parts for several weeks due to swelling inventories and global inflation concerns, sources have told Nikkei Asia.”

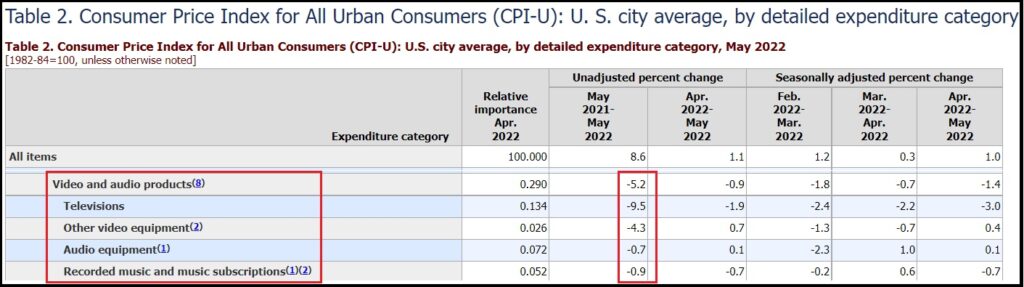

Pay attention to the dates. Prices were dropping because consumers were not spending:

If the USA economy was really in the shape that appeared statistically, you would see it on Main Street. We did see it on Main Street. Consumer purchases of non-essential goods had stalled and contracted. Everyone was paying more for food, energy, housing and fuel. There was/is no room in the household budget to spend on non-essential purchases. People are hunkering down. That was very visible.

When the U.S. consumer stops purchasing goods, the overseas suppliers of those goods need to stop manufacturing and sending them here. As a result, if the economy was in really bad shape, we would expect that imports would drop dramatically. This drop in imports would obviously impact the trade deficit. Well….

WASHINGTON, July 27 (Reuters) – The U.S. trade deficit in goods narrowed sharply in June as exports surged, while business spending on equipment remained strong, reducing the risk that the economy contracted again in the second quarter.

The better-than-expected reports from the Commerce Department on Wednesday left economists scrambling to upgrade their gross domestic product estimates for the last quarter, which had ranged from negative to barely growing. The data were published ahead of the release on Thursday of the advance second-quarter GDP estimate.

[…] The goods trade deficit shrank 5.6% to $98.2 billion, the smallest since last November. Goods exports increased $4.4 billion to $181.5 billion. There were strong gains in exports of food and industrial goods. But fewer capital and consumer goods as well as motor vehicles and parts were exported.

Imports of goods fell $1.5 billion to $279.7 billion. They were pulled down by imports of motor vehicles and food.

[…] The Commerce Department also reported on Wednesday that wholesale inventories increased 1.9% in June, while stocks at retailers rose 2.0%. Retail inventories were boosted by a 3.1% jump in motor vehicle stocks. Excluding motor vehicles, retail inventories increased 1.6%. This component goes into the calculation of GDP.

And here comes the kicker….

[…] According to a Reuters survey of economists, GDP likely increased at a 0.5% annualized rate in the second quarter. The survey was conducted before Wednesday’s data. The economy contracted at a 1.6% pace in the first quarter. Investors have been nervous about another negative quarterly GDP reading, which would mean a technical recession. (read more)

Does that 0.5% look familiar? It should.

From CTH in June: “We can see no political scenario where the Bureau of Economic Analysis (BEA) will report a negative second quarter GDP number, despite the reality of a contracted economy.” … “CTH predicts the BEA is likely to generate a statistical report somewhere in the +0.5% range. Just enough positive GDP to avoid the literal definition of a recession. The BEA report will be issued at the end of July and if they follow recent patterns, they will likely underestimate the inflation rate as well as under-calculate the import data.”

From CTH in July: “CTH has predicted the people within the BEA research group, ie those who make the determinations of GDP, will circle the statistical wagons and generate something akin to a positive 0.5% GDP figure for Q2.“

Three other factors also impact the import data. (1) Operation hide the ships continues (CA regulation issue). (2) There is an ongoing labor dispute with the west coast longshoreman union, and shippers trying to avoid issues are rerouting to Gulf of Mexico and East coast. And (3) There is an ongoing independent truckers strike and protest happening at California ports. All of these provide convenient justifications for lower port data, which, conveniently for the Biden administration, inflates GDP.

The Bureau of Economic Analysis is likely to attribute a 0.5% calculation of GDP (release tomorrow) to the lowering of imports (a deduction to GDP) and then apply a liberal dose of inflation to the value of goods and services created by the economy.

A +0.5% BEA result avoids the pesky technical definition of a recession.