Posted originally on the conservative tree house on June 6, 2022 | Sundance

Within the same 30-day cycle Joe Biden asked Venezuela to produce and deliver more oil in order to help him politically. The Venezuelan government, having been the subject of an attempted coup and sanctions driven by the DC interventionist mindset, refused to assist. Joe Biden then refused to invite Venezuela to his Latin-America summit scheduled for this week.

Latin-America leaders are not stupid. It doesn’t matter whether the self-interested bully comes from the east or the west, they are not blind to the parasitic self-interest contained within the blackmail of any larger nations on the geopolitical stage; especially as the cleaving of the west and east is taking place with increased ferocity.

Today Mexican President Andres Manuel Lopez-Obrador announced he will not attend Joe Biden’s Latin-America summit.

AMLO joins the leaders of Bolivia, Guatemala, Honduras and the tiny Caribbean state of St. Vincent in refusing to attend the summit because Cuba, Venezuela and Nicaragua were blocked from attending by the Biden administration.

(Via Wall Street Journal) – […] After weeks of wrangling over the issue amid threats of country boycotts, the administration excluded the three autocracies due to U.S. concerns over human rights and lack of democratic institutions in those countries, the officials said. The regional summit, scheduled for June 6-10 in Los Angeles, is expected to focus on migration and economic issues.

“I’m not going because not all the countries of America are invited,” said Mexican President Andrés Manuel López Obrador Monday at his daily press conference. The Mexican leader said he had a good relationship with Mr. Biden and that he planned to visit the White House in July.

[…] The political rift between the U.S. and some Latin American leaders may hurt U.S. efforts to agree on a regional plan to fight irregular immigration toward the U.S., which is at record levels. In March, U.S. border authorities apprehended nearly 210,000 migrants attempting to cross the U.S.-Mexico border illegally, the highest monthly tally since 2000.

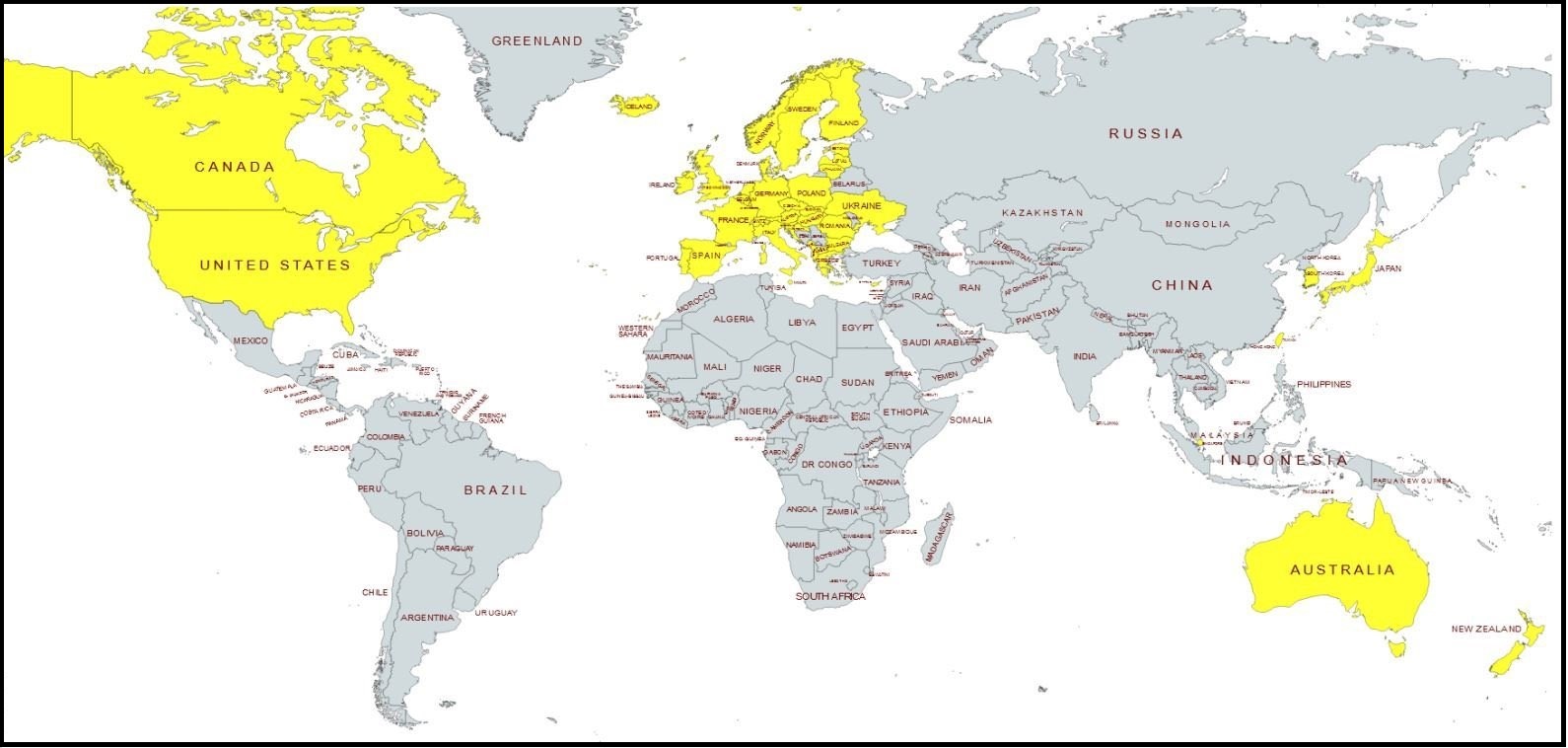

The rift could also benefit China, which has significantly increased its trade and diplomatic presence in the hemisphere in the last two decades, experts say. Beijing quickly supported Mr. López Obrador’s demand that all countries of the Americas be invited to the summit. (read more)

The Biden administration’s foreign policy is advanced under the predicate of threats and bullying. Despite the media effort to gaslight the American audience, the foreign policy of Donald Trump, economic nationalism, was much more respected by leaders who appreciated negotiations on geopolitical dynamics where the interest of both nations was present at the table. For the Biden administration, as generally and historically reflected in the foreign policy of all democrats, the preferred approach is brutal force. A ‘do as we need – or you will pay a heavy price,’ diplomatic approach.

The irony of media narrative construction, reality -vs- media portrayal, is not lost on anyone who follows closely.

A sad, albeit perhaps intended outcome, will be for Latin-America countries being less willing to support any U.S. effort to stop the flow of illegal aliens from Central America through Mexico and into the U.S. via the southern border, already in crisis.

From the 30,000 ft perspective, this lack of Latin-America migration assistance would appear to be an intended feature, not a foreign policy flaw.

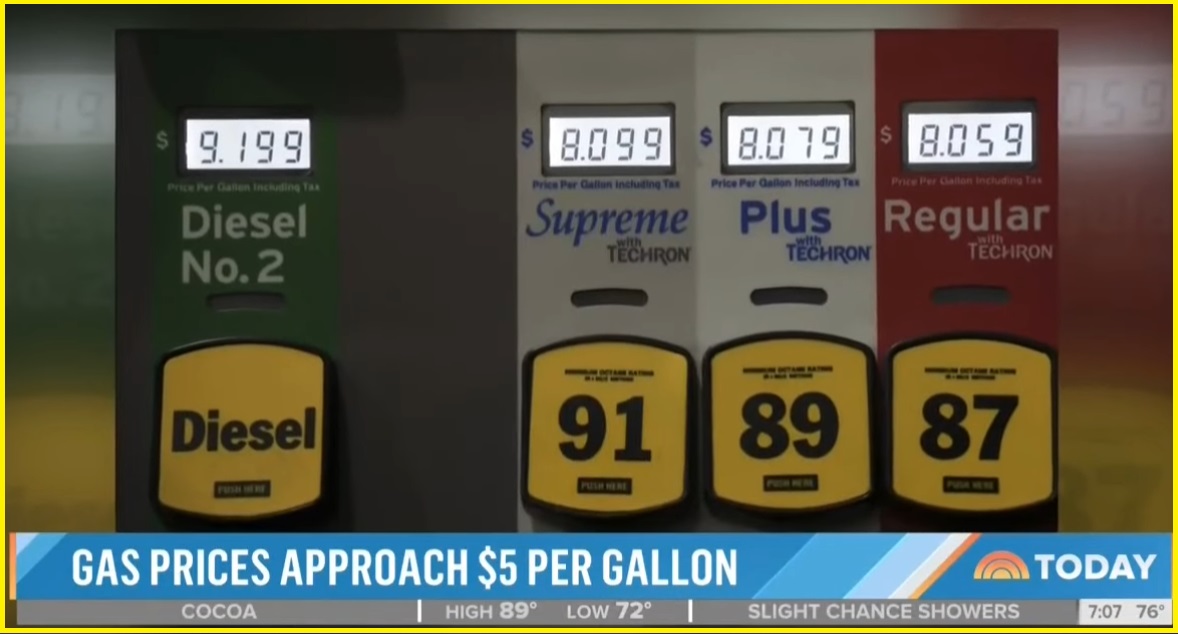

The Biden administration approach follows the familiar Alinsky pattern of planning and executing a purposeful crisis, then throwing up hands to say ‘we are trying, but there is no easy fix.’ Insert a similar reference toward U.S. energy costs, sound familiar?

As noted by the Wall Street Journal, “in recent years, democratic values have eroded across parts of the hemisphere.” There is every reason to believe the people behind the Biden administration are creating the rise of Autocracy while simultaneously decrying the rise of Autocracy. The unilateral fiats used by western leaders during their COVID-19 responses were completely autocratic, yet suddenly they clutch their pearls and decry autocracy.

Factually, the rise of autocratic or nationalistic perspectives helps to cement the global cleaving underway. At the end of this continuum there will be a new geopolitical alignment, a heavily controlled and manipulated set of western societies where citizens are suddenly controlled by centralized government and bureaucracy. This is what many refer to as “The Great Reset.”

In the United States all the interested parties, specifically including the media apparatus, remain committed to pretending the reset is not underway. For those who watch events unfold with eyes-wide-open, the reality of the future is clear.