Armstrong Economics Blog/Disease Re-Posted Jul 13, 2023 by Martin Armstrong

I rank Bill Gates up there with Klaus Schwab and George Soros as one of the greatest threats, combined with others, that will fulfill our computer’s forecast projecting the decline & fall of Western Civilization post-2032 and the sharp decline in world population. That has been his family’s goal since creating Planned Parenthood to promote abortions in minority areas to reduce the population of particular races. That was the clever way to turn eugenics into a woman’s right.

Now, Gates is dangerously altering the environment and there is no understanding of the profound damage he is causing this time all while;e pretending to care about the planet and humanity. In 2022, the Environmental Protection Agency (EPA) approved releasing more than 2 billion genetically altered male mosquitoes in Florida and California following a pilot program in the Florida Keys dating back to 2020. Of course, the so-called fact-checkers only spread their own disinformation and appear to be so hateful and biased that they support anything that undermines whatever is said by their opposition regardless of the truth.

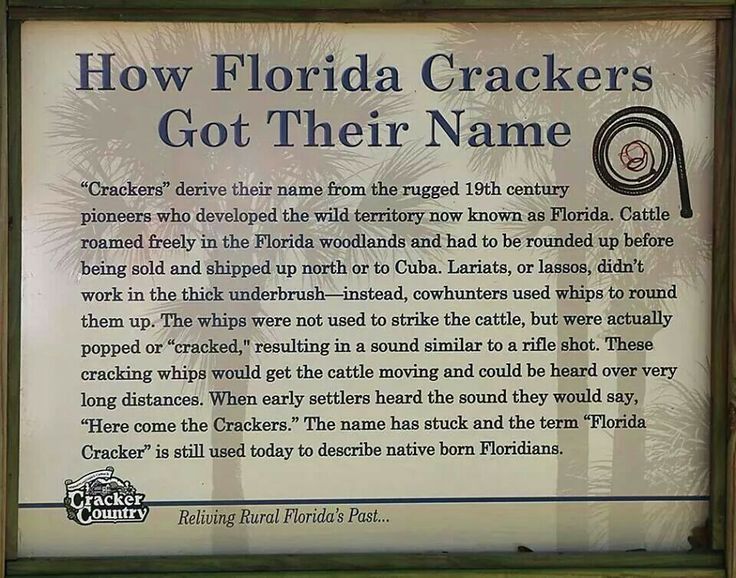

Cases of malaria have emerged in the US for the first time in 20 years. They focus on the statement when this project was released. Oxitec’s work in the US has involved releasing genetically modified, male Aedes Aegypti mosquitoes in the Florida Keys with the purpose of combating insect-borne diseases such as Dengue fever and the Zika virus. The intent is to have the modified mosquitoes mate with female mosquitoes and pass on a genetic change in a protein that would render any female offspring unable to survive — thus reducing the population of the insects that transmit disease.

First of all, they just assume that their press release was telling the truth. They paint the picture that malaria was not among this disease they claimed they were targeting. There was no investigation to see if that was true or not. Or, that Gates would destroy our environment just as Australia did by importing one species to eliminate another and upset their entire ecosystem. Australia learned its lesson and you cannot import any animal whatsoever without the approval of the government.

In 1935, the Bureau of Sugar Experiment Stations tried to eliminate pesticides to kill the native grey-backed cane beetle that was destroying their sugar came crops. In June 1935, they imported 102 cane toads from Hawaii. By 1937, some 62,000 toadlets were bred in captivity and then released in Queensland. Now, the toad number over 200 million and have been known to spread new diseases altering the entire local biodiversity and there is no evidence that they have affected the number of cane beetles which they were introduced to eliminate.

While the fact-checkers claim linking Gates to malaria is a conspiracy theory without any investigation into whether that press release was true or not, even if we assume it was true in this world where it seems they are all liars, if we accept what Gates has done kills one species of mosquito that spread Dengue fever and the Zika virus, both of which were never a serious problem in the United States. Incidence of Dengue fever in the United States is rare, with only 865 cases reported in the US and 38 in the territories according to the CDC in 2019 (903 total), most of which were attributed to travelers that visited dengue endemic regions. That made no sense to launch mosquitoes in Florida and California when the disease was only among travelers who did not contract it in the United States, to begin with. And as for the Zika virus, the CDC reported only 32 cases in 2021. It seems very strange that Gates would spend millions of dollars to alter mosquitoes genetically for a disease that was not very common. This seems to imply that the press release was not true.

These fact-checkers have also totally ignored that the timing could not be better as they are planning to release a new mRNA vaccine to combat malaria. The Bill and Melinda Gates Foundation awarded Oxitec, a biotech company, a large grant to develop genetically modified mosquitos. I for one would NEVER trust Bill Gates with anything. His family has been on a mission to reduce the world population and I find it completely illogical that he cares about preventing disease to allow the population to increase.

It was Gates’ father behind Planned Parenthood which was behind the whole abortion issue that Justice Ginsberg said had nothing to do with women’s rights. The contraceptive chip he funded is to be implanted under a woman’s skin, releasing a small dose of levonorgestrel, a hormone. This will happen every day for 16 years and can be controlled using a wireless remote device. Any review of Bill Gates’ philanthropy reveals that it is not really charity, he expects a profit return and vaccines are one very profitable venture for him.

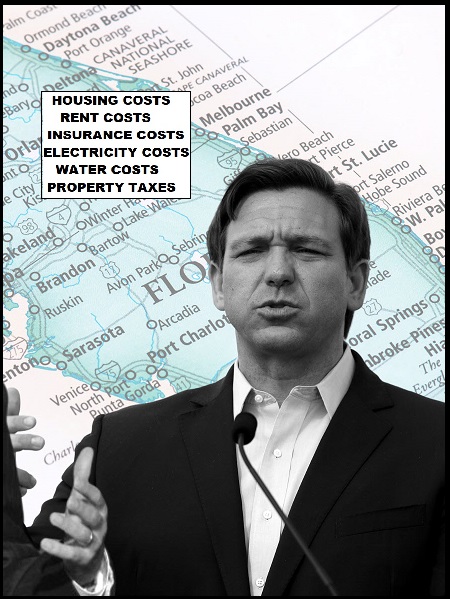

It was April 2021, when the Gates Foundation announced that 150,000 mosquitoes would be released throughout Florida. Aedes aegypti, a mosquito species known to carry infectious diseases, was set to be released in mid-2021 in both Texas and Florida. Gates claimed that these mosquitos, although deadly to humans, cannot reproduce and therefore would eliminate the mosquito population. The number of diseased mosquitos set for release continues to increase. In August of 2020, CNN reported that 750 MILLION diseased mosquitoes were set to be released in the Florida Keys. The Environmental Protection Agency (EPA) is utterly useless and agreed to this mass experiment without analyzing the risks. Governor Ron DeSantis did nothing to prevent these GMO insects from infecting Floridians. We know we cannot trust any government agency anymore. They are taking funding from the very people that they were supposed to regulate.

Oxtitec is calling this experiment “Friendly Mosquito Technology.” The company “anticipates” that it will not pose a risk to animals, people, or the environment. The government, CDC, WHO, FDA, EPA, and every corrupt government agency funded with tax dollars to protect the public are allowing this to take place. Will this prove to be Australia’s cane toad experiment that has destroyed much of its ecosystem?

“During these field tests, Oxitec will release male mosquitoes into the environment that have been genetically modified to carry a protein that will inhibit the survival of their female offspring when they mate with wild female mosquitoes. The male offspring will survive to become fully functional adults with the same genetic modification, providing multi-generational effectiveness that could ultimately lead to a reduction in Aedes aegypti mosquito populations in the release areas. EPA anticipates that this could be an effective tool to combat the spread of certain mosquito-borne diseases like the Zika virus in light of growing resistance to current insecticides.”

Gates funded the largest mosquito-growing facility in the world. A two-story building in Medellín, Colombia, is producing 30 million modified mosquitos per week. They are dropping eggs packed in gelatin capsules into the water to hatch, as well as releasing fully grown adult mosquitos into the air.

How much did Bill Gates make from his COVID-19 Vaccine while immune from lawsuits for even killing some people?

Remember Gates and the lockdowns? The program he funded with Ferguson was a joke. I was given the code and asked to review it from a British source. It was used to create the whole lockdown nonsense that wiped out businesses and he had no problem altering society as a whole. The government is permitting Gates to use the population as his test subject as this Administration seems to allow. Every government agency has approved of this method, swearing up and down it is safe.

Now we have a resurgence of a deadly disease not seen in the US for two decades. Where is the outrage? I have NEVER been bitten by mosquitoes ever here in Florida as I have been this year. I have had to go buy bug lights and place them all around my yard and even put them inside my home. Thank you, Gates. I will reverse my choice of words for your character to myself.

We now have malaria for the first time in 20 years. What nobody seems to have brought up is that if Gates has killed off only one species of mosquito, then if it really is a different species that carries malaria, then they will thrive. He is killing off one species and expanding another. He certainly likes to play god, we really need to stop this insanity for there is no way he cares about eliminating disease and at the same time reducing population. It just makes no sense.

Russia has deep concerns that what Gates is really doing is plotting biological warfare. Even the Nazis were playing this game of releasing mosquitoes to give opposing troops malaria. Russia has brought this issue up that the US has been experimenting with using mosquitoes and ticks to deliver genetically created diseases to wipe out opposition forces. There is a lot more behind what Gates is doing than the press is willing to print.