Armstrong Economics Blog/European Union Re-Posted Apr 13, 2022 by Martin Armstrong

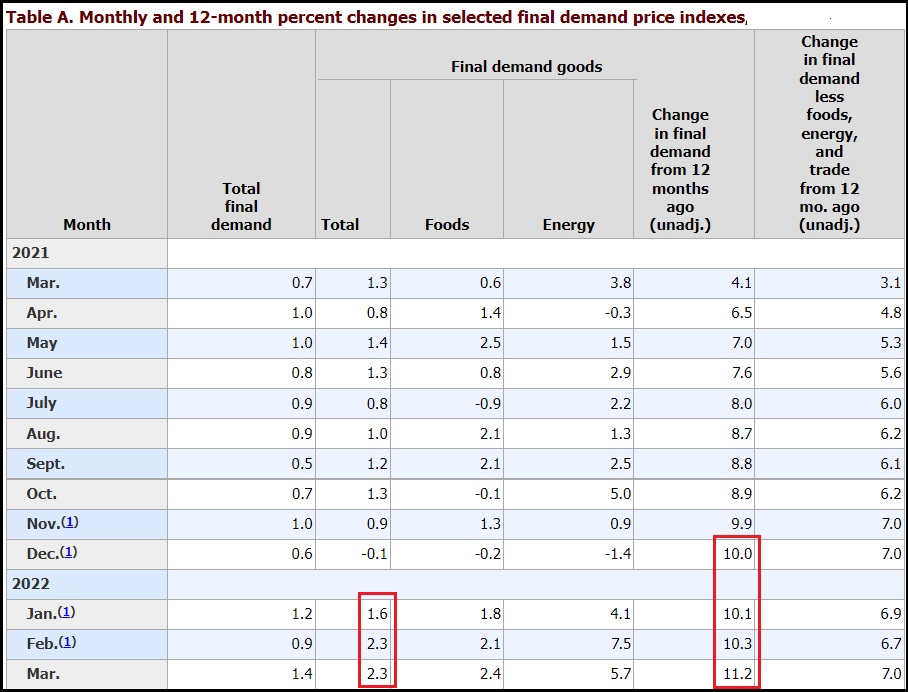

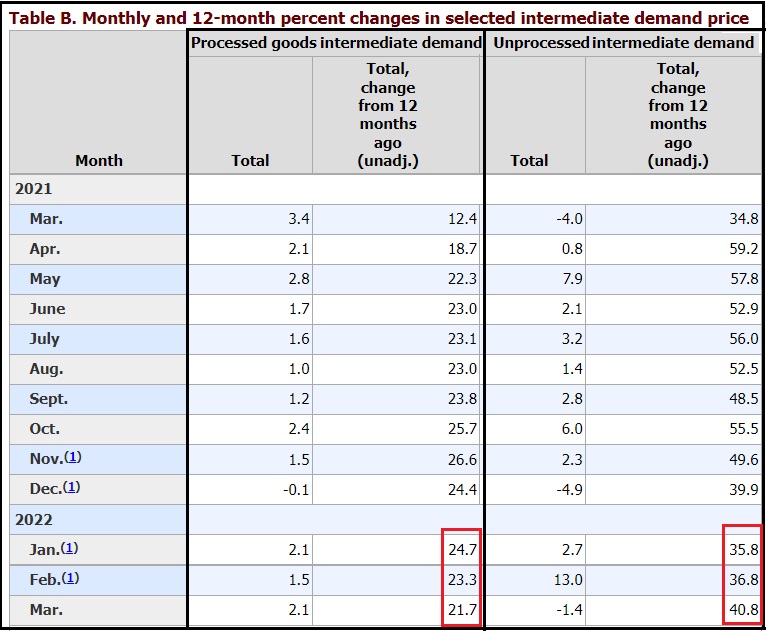

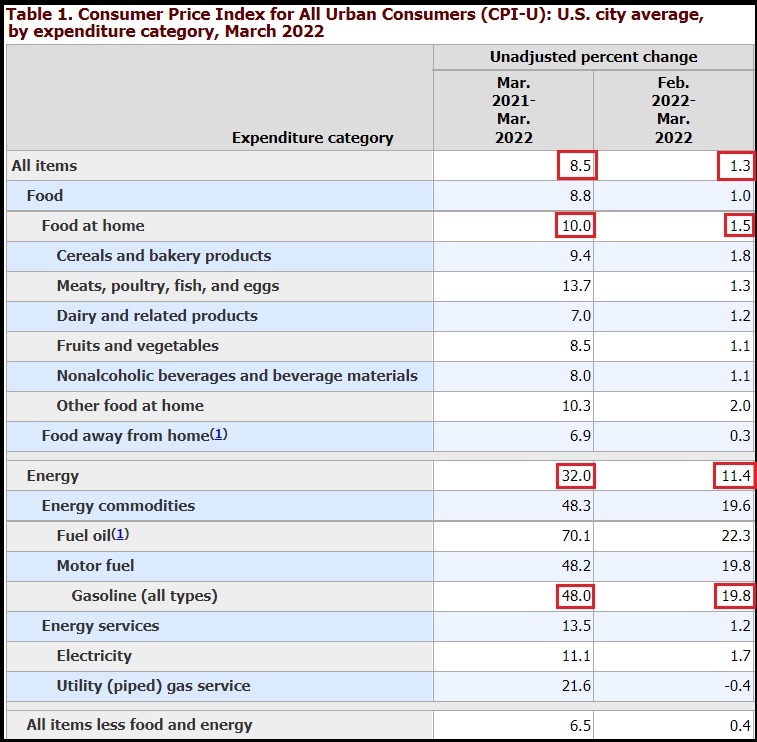

The wholesale prices in Germany rose at a record pace in March. Compared to the same month the previous year, wholesale prices jumped by 22.6%, as the Federal Statistical Office announced on Tuesday in Wiesbaden. This is the highest increase since calculations ever began in 1962. In February, the rate was already high at 16.2%, which has been surpassed here in March. Month-on-month, wholesale prices rose 6.9%, which is yet another record increase.

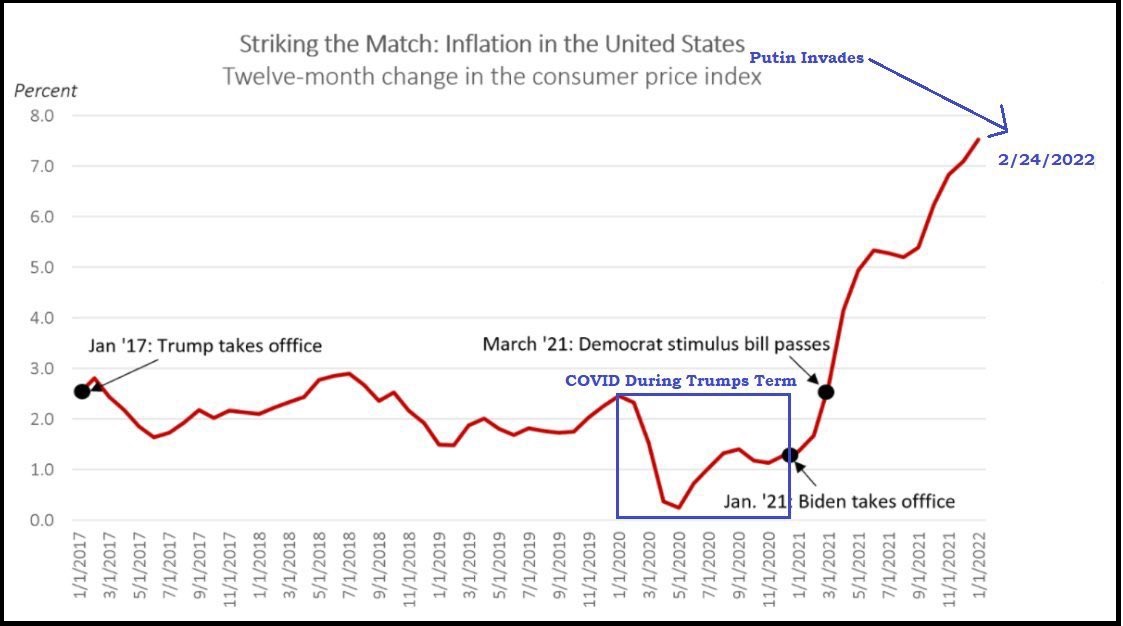

Our models are pointing to serious trouble ahead for Germany and this poking Russia is all intended as a diversion from the collapse of the European economy that is underway. The negative interest rates since 2014 have wiped out the pension funds and proven that the central bank can no longer control the economy. Add to that, the braindead COVID restrictions which have dealt a serious blow through the heart of the supply chain, and we have a recipe for total economic disaster which is being reflected in the inflation rates which then leads to civil unrest.

I have stated many times, we have the WORST possible crop of world leaders I have ever witnessed in my lifetime. There is not a single character that I would be able to sit down and have an intelligent conversation with. Germany appointing Jenifer Morgan in charge of their environmental policies and the intent was to make her their Secretary of State is just astonishing. What is her role? Tell Putin to turn off his tanks because they create CO2?

These climate zealots have managed to destroy the world economy in just two years. Never in the history of humanity has there EVER been such stupidity from those in power. They should admire their heads in the mirror every day, for if history repeats, they will be dragged from their palaces and their heads might be adorning spikes with cheers of vindication.

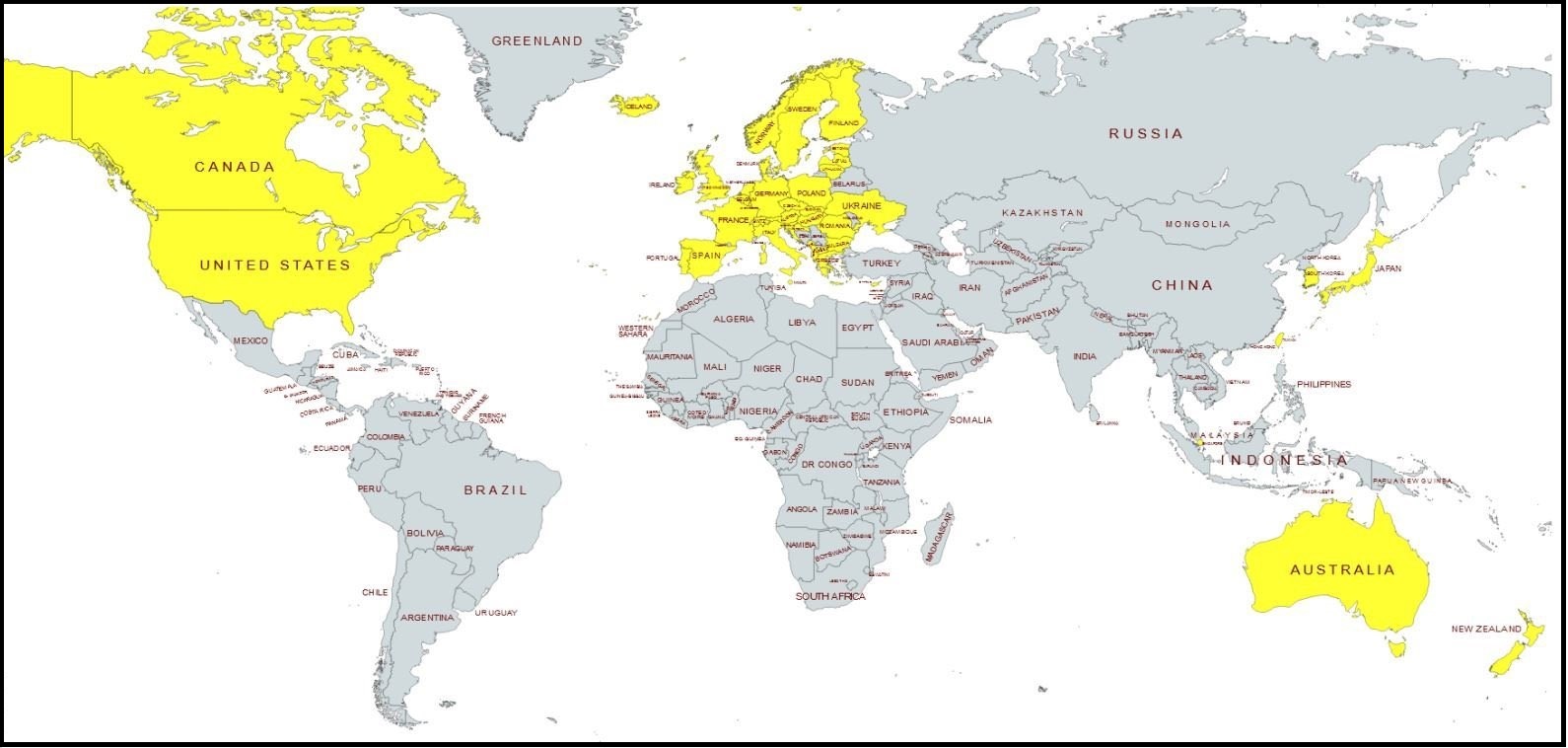

It is well known that the first casualty of war is the truth, and nothing sorts out the lies more than troops crossing political borders. Hence, they also say that history is written by the victors. Ever since COVID, we have witnessed a rising trend of civil unrest politicians have been working hard to deliberately create war with Russia all cloaked in their real objective of controlling the planet. Ever since this intended war to poke the Russian Bear, there’s been an acceleration of every conflicting agenda on the world stage. This has crashed the world economy, ended Globalization, and divided the world into US v THEM with the only resolution being armed conflict. Our World Leaders need a war with Russia and then will turn on China as they think threatening China with sanctions will prevent them from joining Russia against the West. This will fail – China is not that stupid. Blaming the other guy is always the way to war. They need to demonize the enemy to inspire hatred that they use to manipulate war.