Posted originally on the CTH on April 11, 2023 | Sundance

A few days after the terror attack of 9-11-01, someone in media asked George W. Bush what Americans can do to help. Dubya’s response drew instant criticism, because he asked people to go shopping… but in the big picture, President Bush knew what could happen if the economic freeze continued.

When it comes to politics and economic outlooks, trust your instincts. The economics of the ‘thing’ is always the reason the ‘thing’ exists or does not exist.

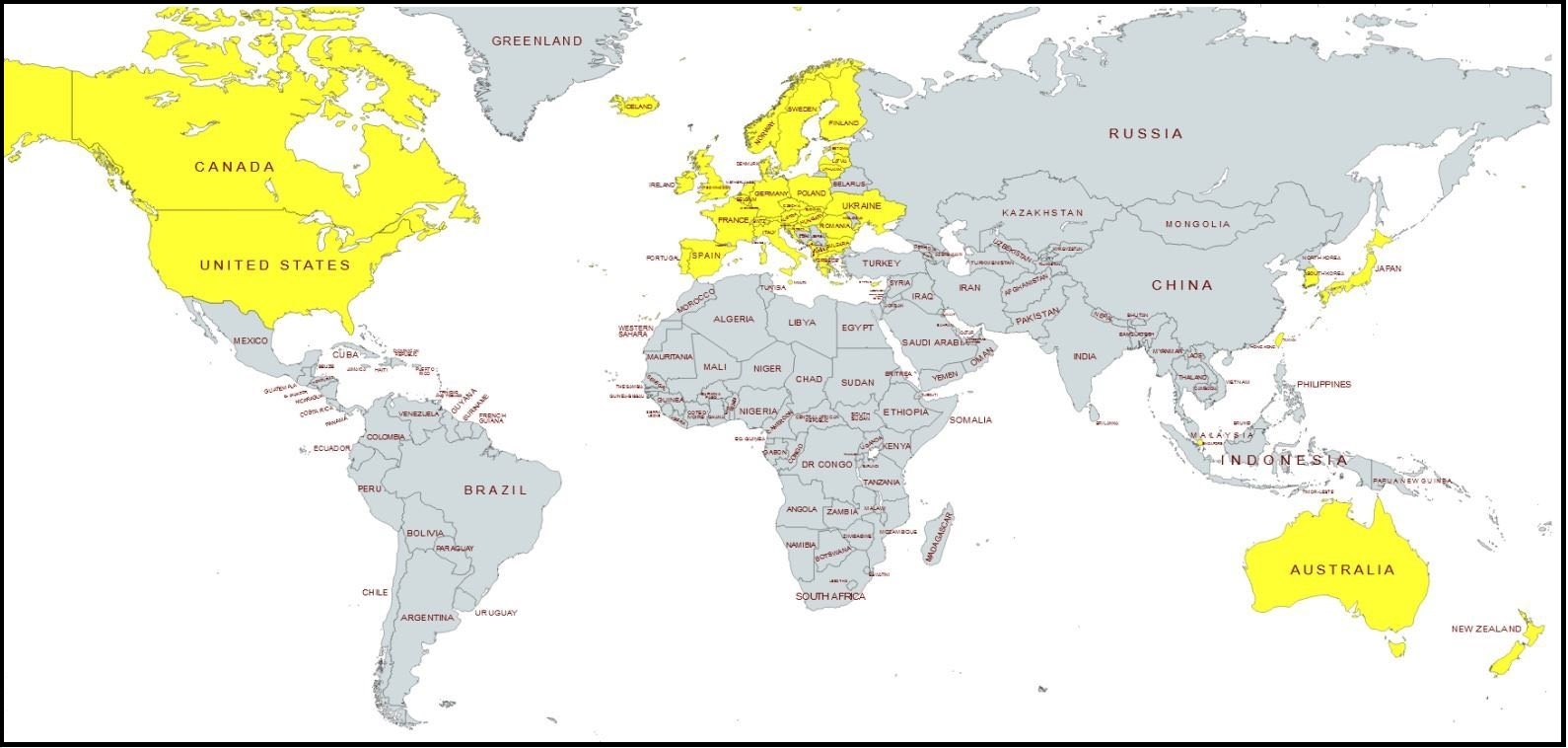

When you are looking at economic news, always remind yourself… the people producing the news have a vested interest in maintaining a very specific outlook. The motive behind what Dubya said in September of 2001, pertains every bit as much today. Economic outcomes can topple entire governments.

Remember, this current ‘supply-side energy policy driven inflation‘, a purposeful effort to shrink the economy and yet tenuously maintain control, has never happened before. The people behind the Build Back Better agenda are, in reality, experimenting with a theory. DATA…

(ISM) – The Institute for Supply Management’s PMI contracted for the fifth straight month in March registering 46.3, the lowest level since May 2020. Any reading below 50.0 indicates contraction. The employment index declined by 2.2 percent to a level of 46.9.

Most of the impediments to manufacturing growth — such as shortages and lockdowns — have subsided, said Tim Fiore, chair of the ISM’s manufacturing survey committee, with the exception of pricing. ISM’s pricing index fell below 50 in March but at 49.2 remains higher than pre-pandemic levels.

“The beginning of the second half may not be the beginning of a recovery,” said Fiore. “Manufactures reduced headcounts because of uncertainty of demand and over-ordering has burned off. Demand isn’t coming back quickly enough to support current headcounts.”

All these trends were prevalent in March, he added, although the PMI has only lost 3 to 4 points since October 2022.

Back in December, ISM panelists anticipated an uptick in demand by the beginning of Q2. “We thought this recovery would be lumpy, but I think this indicates the recovery has been delayed,” Fiore said. “I think we are talking about expansion toward the end of Q3—it’s unlikely we’ll see a lot of activity in the summer.” (read more)

It’s not a recovery now, it will not be a recovery this year.

On a per unit basis, we have been in an economic contraction cycle since mid 2021. However, because economic outcomes are measured in dollars, the shrinking unit output, and the fewer units being sold at wholesale and retail level, is being hidden.

Inflation has hidden serious drops in unit purchases…. and fewer unit purchases mean lowered production output…. and lowered production output means less production is needed.

(CNBC SURVEY) – Inflation, economic instability and a lack of savings have an increasing number of Americans feeling financially stressed.

Some 70% of Americans admit to being stressed about their personal finances these days and a majority — 52% — of U.S. adults said their financial stress has increased since before the Covid-19 pandemic began in March 2020, according to a new CNBC Your Money Financial Confidence Survey conducted in partnership with Momentive.

Anxious and uncertain about whether they can get a better handle on their money, some may be intimidated by the prospect of creating a budget or unsure of where to stash their cash to get the highest returns. Others may be wondering how to begin saving for retirement when they’ve gotten off to a late start.

“People are worried that the money they’ve saved won’t last and are worried they’re going to have to lean more on their credit cards and other sources of debt just to get by,” said Bruce McClary, a senior vice president at the National Foundation for Credit Counseling. (read more)

If you want to know what’s going on in the larger U.S. economy, just look around you.

Don’t turn on the television and read the newspaper to see what is happening in the U.S. economy for your purchasing or life planning. Just look around you.

Look at restaurants and bars. Do you see continued high-volume business or not.

Look at the grocery stores. Do you see continued optimism, or not.

Look at the malls and shopping centers. Do you see foot traffic, or not.

Look at the real estate in your neighborhood – your local view. Do you see prices going up or going down.

That’s the reality of the economy as it impacts you….. and critically, that’s the reality of the economy nationwide.

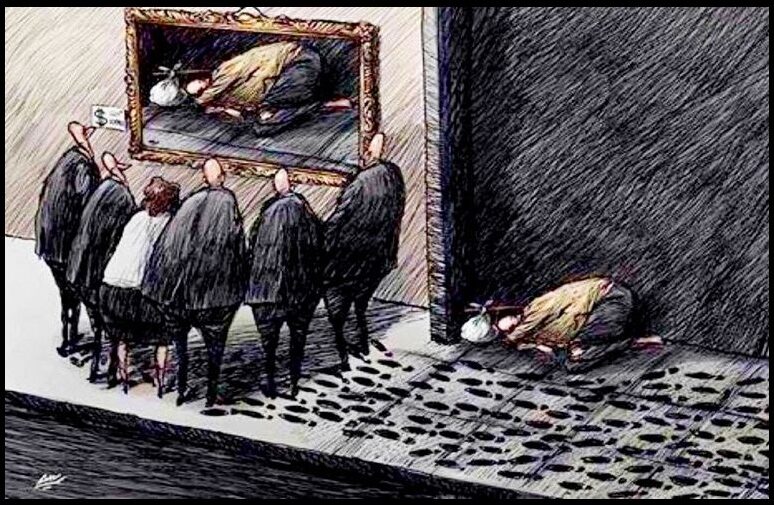

When it comes to data and economics, do not let the media created ‘illusion of the thing‘ cloud your ability to see the reality of the thing.

Trust your instincts.