Armstrong Economics Blog/Armstrong in the Media Re-Posted Oct 23, 2022 by Martin Armstrong

Check out my latest interview with Laura-Lynn Tyler Thompson.

Check out my latest interview with Laura-Lynn Tyler Thompson.

Last week we discussed the announcement of a $24.6 billion merger deal between Kroger and Albertsons supermarkets {Go Deep}. The majority stockholders in both companies are institutional investment groups, Blackrock, Vanguard and Cerberus.

The merger would consolidate the second and third largest food retailers in the U.S. and would certainly dilute the competitive dynamic amid the supermarket industry. Concern over price controls and decreased competition has now arrived on the desks of DC legislators who are reviewing the deal.

(Reuters) – […] U.S. Democratic Senator Amy Klobuchar and Republican Senator Mike Lee were quick to say that they would hold a hearing to discuss the merger. A European interloper could make deal plans even harder.

Frans Muller, Chief Executive of Stop & Shop owner Ahold Delhaize (AD.AS), has made no secret of his desire to consolidate U.S. grocers. The Netherlands-based firm is already the fourth largest grocery chain. If it managed to cobble together a better offer than Kroger’s bid for Albertsons, it would become the second largest supermarket. Plane spotters tracked two Albertsons jets next to Ahold Delhaize’s U.S. base in Massachusetts in early August. Ahold declined to comment.

Ahold can also afford a chunky deal. The Dutch grocer has debt of just 2 times its $6.7 billion of EBITDA estimated for this year, according to Refinitiv. That’s 50% less than the average. If investors reckoned there was merit in a deal, Muller could also use equity to beef up the offer. At more than 12 times, Ahold’s price-to-earnings ratio is a fifth higher than Albertsons’, giving it currency.

Aspects of the deal might make it easier for antitrust authorities to get comfortable, too. Kroger and Albertsons would have a combined market share of 13%, whereas a deal with its Dutch rival gives much less of the pie. Ahold focuses on the East Coast of America whereas Albertsons has a big presence on the West Coast. So regulators wouldn’t have to worry about a larger Kroger shutting down competing Albertsons stores.

[…] U.S. senators who scrutinise antitrust issues expressed “serious concerns” about grocery company Kroger’s plan to buy rival Albertsons, and said they would hold a hearing in November on the $25 billion deal.

The announcement by Democratic Senator Amy Klobuchar, chair of the Senate Judiciary Committee antitrust panel, and Republican Senator Mike Lee confirmed a previous report by Reuters.

A Kroger spokesperson said the company looked forward to the hearing. “We welcome the opportunity to outline how this transaction will benefit America’s consumers by expanding access to fresh, affordable food,” the company said in a statement.

The Federal Trade Commission is expected to review the deal to ensure it complies with antitrust law. (read more)

This might be one of those rare times when a legislative and regulatory review may actually be beneficial to the outcome for the consumer.

December 16, 2020, Dozen Large Eggs $1.79

October 11, 2022, Dozen Large Eggs $7.29

(Source)

(DCBusinessDaily) – […] Scott Rasmussen Number of the Day shows 76% of voters have seen their grocery prices go up in the last month. The poll also found 60% of voters believe prices will continue to rise. Additionally, 54% of voters say gas prices have gone up in the last month and 59% believe gas prices will continue to go up. Ballotpedia’s poll methodology surveyed 1,200 registered voters from Oct. 6-8. According to the Ballotpedia website, the poll was lightly weighted by geography, gender, age, race, education, internet usage and political party to reflect a fair balance of voters across the country. The margin of sampling error is +/- 2.8 percentage points.

The U.S. Bureau of Labor Statistics issued its latest Consumer Price Index (CPI) summary for the nation on Oct. 13, which found that the rate of inflation over the last 12 months stands at 8.2%. It rose 0.4% in September. In the last year, food costs have risen by 11.2%, energy costs have increased by 19.8%, gas prices have risen by 18.2% and the cost to purchase a new vehicle has increased by 9.4%. (more)

The damages from the hurricane are still being evaluated, but preliminary estimates state that Ian caused Florida’s agriculture industry to lose up to $1.56 billion. Around five million acres of farmland were destroyed by the hurricane, 60% of which was grazing land for cattle. An additional 500,000 acres were affected but not destroyed. Florida produces around $8 billion in agricultural goods per year, so this is a significant blow to the industry.

The Sunshine State was already experiencing hardships prior to Hurricane Ian, with some estimates saying the industry would decline by a third this year due to temperatures and disease.

“The impact on Florida’s affected commodities cannot be understated, especially the heartbreaking damage to Florida citrus, an industry already facing significant challenges,” state Agriculture Commissioner Nikki Fried declared. Orange juice alone is expected to cause a $304 million loss. The US Department of Agriculture said that orange production was already 32% down YoY, marking the smallest harvest in eight decades.

Up to $393 million may be lost from destroyed vegetable crops, while horticultural crops may experience a $297 million decline. Cattle is expected to decline by over $220 million.

The true damage cannot be assessed until the fields dry up. None of these figures account for inflation. Natural disasters will only contribute to rising food prices and shortages.

The western alliance is not the only one providing military training. Iran has sent military members to Crimea to train Russian troops. Specifically, they are training them to use Iranian drones. There were reports of Russian troops visiting Iran in August to learn how to operate unmanned aerial vehicles (UAVs). Since then, there have been numerous reports of UAVs failing, but the successfully deployed UAVs are capable of causing serious damage.

Shaheds, also known as kamikaze or suicide drones, explode on impact and are capable of also carrying missiles. This drone is less expensive to develop, but it can travel up to 1,000 miles and leave a range of destruction in its path. Mohajer-6 UAVs can be used for spying purposes and can, of course, also hold a missile. Ukraine claims that they have shot down at least 200 drones and have the capability to jam radars.

Both Russia and Iran have denied trading weapons, but what do they have to lose now that all the cards are on the table? Russia has violated the UN Security Council Resolution 2231 by transferring arms from Iran. The West has already sanctioned Russia in every way possible. Numerous nations are placing sanctions on Iran now, but again, they are not too concerned. Tehran and Moscow, two nuclear powers, are strengthening their relationship and seem prepared to face any Western consequences while resuming trade.

Elevate far enough and you return to that same place where the international finance and banking system is making decisions on politics. The western alliance is ‘all-in‘ on the goal of using climate change as the entry point to the carbon trading system. No one is going to be allowed to challenge this agenda.

British Prime Minister Liz Truss has resigned after only 44 days in office, driven mostly by the financial system reaction to her proposal that taxes should be lowered in order to stimulate the economy. In the big picture, the years of slowly advancing progressive politics in the U.K. has culminated in a political system that is only manageable by a leader who retains a globalist financial outlook and a climate change policy framework.

Prime Minister Truss’s economic agenda, lower taxes – stimulate growth, in combination with an emergency effort to quickly develop oil, coal and natural gas exploitation (fracking etc.) in order to avoid the escalating European energy crisis, was just too much and too radical. The financial markets responded negatively, the World Economic Forum (WEF)was unhappy, and western alliance leaders were critical, including Joe Biden:

Biden called Prime Minster Truss’s proposed tax cuts “a mistake” earlier this week. Biden said he “wasn’t the only one” who thought as much, indicating he had talked to other western alliance leaders who thought the same.

“I wasn’t the only one that thought it was a mistake. I think that the idea of cutting taxes on the super-wealthy at a time when … I disagree with the policy, but it’s up to Britain to make that judgment, not me,” Biden said. With domestic opposition and international pressure, it became clear that Liz Truss was going to collapse. She did.

.

(Daily Mail) – British Prime Minister Liz Truss resigned today after just 44 days in office, sending the country’s parliament into chaos and making it the laughing stock of the world.

Truss only took over from former leader Boris Johnson on September 6 after winning an internal Conservative Party leadership contest. She quickly lost the faith of the party to such an extent that she was deemed unfit to lead last night in a wave of no confidence letters from colleagues.

As a result, she announced her resignation today on the steps of 10 Downing Street.

Her brief time in office is the shortest in modern political history. The British public have been left stunned and red-faced by the upheaval, with many now questioning who the next leader will be.

Boris Johnson, who was himself forced to resign after losing the confidence of the party, is said to be mulling a return. Sources say he plans to throw his hat into the ring again for re-election.

Whoever takes office will become the second unelected Prime Minister in less than two months. Truss assured on Thursday that the process would be completed within a week.

President Biden, who met Truss as Prime Minister once, said: ‘The United States and the United Kingdom are strong Allies and enduring friends — and that fact will never change.

‘I thank Prime Minister Liz Truss for her partnership on a range of issues including holding Russia accountable for its war against Ukraine.

‘We will continue our close cooperation with the U.K. government as we work together to meet the global challenges our nations face.’ (read more)

The establishment of the global trading platform, using climate change and an intentional energy crisis, is of particular importance to the people who run the United Kingdom, Europe and Australia.

Since Liz Truss was put into place as prime minister Queen Elizabeth II died, and King Charles III is now positioned to support the globalists behind the international financial system. This is a critical time for the United Kingdom to join and lead the new climate change energy system known as Build Back Better. With King Charles III, this is a key moment. Having PM Liz Truss in place was not helpful to the bankers and multinationals.

It’s important to remain elevated and not stuck in the granular outcomes of this global inflection point. Western allied leaders and the central banks are focused on the agenda, and anyone who puts up any opposition becomes cannon fodder amid the international unity.

Oil, coal and natural gas must be stopped. Green energy is good. Traditional energy resource development is bad. Ukraine is good. Russia is bad. Banks must raise rates to keep lowering economic activity. Growing economies are bad. Dependence on energy must be lowered. Taxes must remain elevated in order for government to provide the subsides for the lowered economic activity they are creating. Poverty is good. Independence is bad. The collective dependency state is good. The ability to afford holding on to individual luxuries like cars, air conditioning, home heating, housing etc are bad.

At the end of the rainbow is a western created carbon trading platform that will make citizens serfs, forced to ask permission from government for every indulgence.

This system of everything is what the globalists are chasing.

Liz Truss made some claims that were against the interests of the multinational and financial system elites. She’s gone now…

Keep watching to see if Rishi Sunak or Boris Johnson is selected to replace. WATCH (it’s only 1 minute):

.

Remember when Biden publicly chastised the unvaccinated population last year? Do the “right thing,” and you will “get through this.” Those selfish enough to choose medical autonomy, the president stated, were “looking at a winter of severe illness and death for yourselves, your families, and the hospitals you may soon overwhelm.”

We have definitive proof that Pfizer did not test the vaccine against transmission. Governments globally pushed a false narrative, a blatant lie, to force people to take these vaccines. Biden’s memorable speech demonized a portion of the population. You will get sick because of them.

Now that the lie has finally been revealed, the White House is still pushing Americans to receive yet another booster. Headlines are appearing across the liberal news about the “temperatures dropping,” as if that is a factor. Look into it yourself, and you will notice the “temperatures dropping” fear-mongering in the media as if COVID and not the depletion of energy resources should be the catalyst for fear.

The White House expected between 13 and 15 million Americans over the age of 12 to receive another dangerous booster. That means only 5% of the eligible population is willing to play along with the COVID games. Washington and the CDC will unleash a marketing campaign to sell the toxins one way or another, but fewer will comply. Politico reported that they expect less than 30% of the population to receive the next shot.

The next winter will be one of death and destruction, but not because of COVID. The energy crisis will cause death and destruction, as will the war in Ukraine and every nation it “may soon overwhelm.”

I do not know how to describe this with the Through The Looking Glass absurdity it deserves.

The ability of financial media and national economists to suspend accepting current reality, while making claims about the possibilities for next year, is ridiculous. Ask me why this era of great economic pretending is underway, and I have no answer. The intellectual dishonesty is beyond my comprehension.

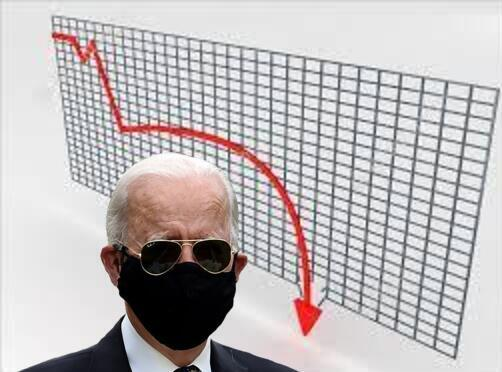

The first and second quarters of the U.S. economy showed negative Gross Domestic Product valuations (GDP). We just finished the third quarter (July, Aug, Sept) and the likelihood of another negative GDP is high. Production is down, demand is down, consumer spending is down, inventories are climbing, and the economy is contracting. We are in a literal, technical and structural recession. Considering the Q1 and Q2 outcomes, we have been in a recession all year.

The Wall Street Journal publishes an article citing several notable economists who are putting the likelihood of a 2023 recession at 63%.

(WSJ) – […] On average, economists put the probability of a recession in the next 12 months at 63%, up from 49% in July’s survey. It is the first time the survey pegged the probability above 50% since July 2020, in the wake of the last short but sharp recession.

Their forecasts for 2023 are increasingly gloomy. Economists now expect gross domestic product to contract in the first two quarters of the year, a downgrade from the last quarterly survey, whereby they penciled in mild growth.

[…] Forecasters have ratcheted up their expectations for a recession because they increasingly doubt the Fed can keep raising rates to cool inflation without inducing higher unemployment and an economic downturn. Some 58.9% of economists said they think the Fed will raise interest rates too much and cause unnecessary economic weakness, up from 45.6% in July. (read more)

They are analyzing a pending recession in 2023 without even admitting we are in a recession right now. AT THIS VERY MOMENT. We have two consecutive negative quarters of economic growth behind us (another Q3 result pending), and these economists are discussing a recession “next year“?

I feel like I’m behind a mirror in a parallel universe looking at financial pundits and economists pretending our reality is something completely different from what it is. This is madness.

♦ “Managing the transition,” is a phrase we have heard often – but what does it mean?

This is the only explanation I can fathom for this era of great pretending.

As you are well aware the various western nation central banks including the U.S. Federal Reserve, have raised interest rates into a global economic contraction, a drop in demand. Raising interest rates into a contracting economy is counterintuitive, it runs against the expressed interest of government to grow economic conditions. However, there is a purposeful design to the contradiction. [A TLDR Version Here]

The central bankers are trying to support western government policy. Unfortunately, the government policy they are under obligation to support is the fundamental shift in energy development, or what the World Economic Forum (Davos Group) has called the “Build Back Better” climate change agenda.

Monetary policy can only impact one side of the inflation challenge. The western bankers (EU central bank, U.S. federal reserve bank, and various banking groups) are raising interest rates in order to “tame inflation” by “taming demand.” However, as you know the global economic demand has been declining for several quarters. There is no excess demand, and there hasn’t been demand side pressure all year.

Raising interest rates into an already contracting economy does one thing, it speeds up the rate of economic contraction.

Economic contraction is the lowering of economic activity. Raise interest rates -in a general sense- and businesses invest less, borrowers borrow less, consumers purchase less, employers expand less, and the economy overall slows down. When the economy turns negative, meaning less products and services are produced, we enter a recession. Some businesses and employers do not survive a recession and subsequently unemployment rises.

During recessionary periods people buy less stuff, people have less income stability, and economic activity drops. When the banks raise interest rates into an economy that is already stalled or contracting, unemployment and general pain on Main Street increases. Workers are laid-off, incomes shrink, consumer spending drops and that leads to less employment. Recessions are bad for middle-class and working-class people. This is what the Wall Street Journal is describing for 2023.

“Employers are expected to respond to lower growth and weaker profits by cutting jobs in the second and third quarters. Economists believe that nonfarm payrolls will decline by 34,000 a month on average in the second quarter and 38,000 in the third quarter. According to the last survey, they expected employers to add about 65,000 jobs a month in those two quarters.” (link)

From the perspective of the western politicians and central banks, there is one benefit from a recession…. Energy use drops.

People travel less; businesses operate shorter work schedules; manufacturing stops; overall fewer goods are produced because less consumer spending is taking place. From the perspective of the groups who want to see overall energy consumption drop, a recession is a good thing.

A recession also brings along a natural drop in energy prices as less overall energy is used inside an economy that is slowing, stalled or contracting.

Oil prices drop as less oil is needed for the manufacturing of goods. Energy use in transportation also drops and generally gasoline prices drop because less transportation fuel is needed, because fewer goods are being transported. When the economy goes into a recession, energy use and prices always drop.

Put these factors together and you start to see how the transition to a new western energy policy, the Build Back Better agenda, benefits from a recession.

This is the essential understanding needed to reconcile why central banks would intentionally create an economic contraction. This is the great pretending. The bankers are supporting the governmental objective of transitioning the western economy into a new energy system away from oil, coal and natural gas.

The banks are supporting the policy makers. However, the central banks cannot openly admit what they are doing to support the politicians and policy makers.

In this weird new era, the banks are being instructed to support the policy makers without actually admitting they have changed their monetary mission. The central bankers will continue to say their job is to manage and/or balance employment and inflation. However, what they will not admit is their unspoken agenda to support the political decisions.

Instead, almost all the central banks are saying their interest rate hikes are intended to cool inflation by lowering demand.

However, it is not excess demand that is driving inflation; it is the policy making behind the energy transition that is driving higher costs on everything. The origin of inflation is on the supply side.

The supply-side of the inflation dynamic is being overwhelmed by massive increases in energy costs which are the results of intentional western policy. Extreme increases in consumer prices are the outcome of these energy price increases. The overwhelming majority of consumer price inflation is being caused by energy policy, not demand.

The various central banks and monetary policymakers know this. In fact, they are lying about their motives. They have to lie, because if they were to tell the truth there would be an uprising, and the success of the energy agenda would be put at risk.

In order to support the energy objectives of the various governments’, the central banks are trying -and succeeding- to lower economic activity.

Less economic activity means lower energy needs. This is what they call “managing the transition” to the new economy based on “sustainable energy.”

The banks and policy makers are ultimately managing the economic decline in order to Build Back Better in the future. This is why the originating charter of the central banks is being ignored, and the banks are raising interest rates into an already contracting economy.

None of this is being done accidentally. All of this is being done with forethought and implicit intention.

Unfortunately, for the average person this means the banks and policy makers have entered a phase where it is in their interests to shrink the global economy. They are trying to control the collapse of the various economies by working together. This is what they mean by “managing the transition.”

Managing the transition means less jobs, less work, a lower standard of living, and a period of extreme financial pressure for the average person.

Eventually, we will reach a point where the government(s) will need to step in and fill the gap from the declined economic activity. Bailouts and subsidies will be needed as they were in the COVID lockdowns. Unemployed workers and the people being impacted by a prolonged economic recession will need subsidies in order to survive.

The government policy makers are planning to do just that, spend more. They practiced during the COVID economic lockdowns, now they seem to be positioning to execute a similar policy path as they manage the energy transition.

We have only just entered the beginning phase of this Build Back Better agenda. No one, including the banks and policy makers, have any idea how long this is going to take.

We could be in this period of severe economic contraction for several years, perhaps decades, until their grand design of a new energy future is complete. This has been the discussion at the World Economic Forum (WEF), as the instructions were passed out.

The entire time the western government architects are doing this, they must keep the demand for traditional energy products like coal, oil and gas at the lowest level possible. That is why the central banks and politicians must keep economic activity at the lowest -yet survivable- rate possible.

Financial analysts and economists are pretending not to know this is our reality. All the pretending in the world will not change the reality on Main Street; pretending will only create a divide between those who admit and those who deny.

The next President will be the political leader who admits the reality and affirms the proper cause.

Don’t bite the hand that feeds you. SpaceX founder Elon Musk came to Ukraine’s rescue when they lost access to the internet. Musk’s sent Ukraine 20,000 Starlink satellite units at the cost of $80 million. After Elon Musk posted a poll regarding allowing the Ukrainian people to vote on the matter of joining Russia and upholding the referendum, Ukrainian diplomat Andri Melnyk publicly tweeted, “Fuck off is my very diplomatic reply to you.”

So now, Elon is considering doing what Melnyk proposed. Musk was concerned about the cost of operations long before Melnyk’s insult. “We are not in a position to further donate terminals to Ukraine, or fund the existing terminals for an indefinite period of time,” SpaceX said in a letter to the White House dated September 8. The company was urging the Pentagon to fund the project, which they estimate will cost $120 million for the remainder of 2022 and $400 million for the next 12 months. Ukrainian General Valeriy Zaluzhnyi, meanwhile, is requesting 8,000 additional Starlink terminals.

Now Musk is considering back peddling and removing his funding to Ukraine. He stated that his company could no longer afford the costs to fund this endless war. When he received negative feedback online, he replied, “We’re just following the recommendation,” and replied directly to Andri Melnyk. This is what happens when you bite the hand that feeds you.

You often hear me talk about how financial pundits and economic analysts are disconnected from Main Street. Today we get a prime example of that from the Wall Street Journal.

The topline of the WSJ article is essentially that people are not spending money on anything except essential goods (housing, energy, fuel, food, etc), which is somewhat of a ‘duh tell us something we don’t know‘ type article. However, the analytical part of the article is where you find the insufferable disconnect. Here’s one example:

[Data Point 1] “Gasoline prices dropped in September for the third month in a row, falling 4.9% from August.” [Data Point 2] Sales at gasoline stations, a proxy for spending by car owners, declined 1.4% last month.”

If gasoline dropped 4.9% in price, but sales only declined 1.4% that would indicate more physical gasoline was purchased at a lower price than the month before. It’s not a hard concept to understand.

This is a retail sales reality even identified in the article itself, “Unlike many government reports, retail sales aren’t adjusted for inflation, so some swings reflect price changes rather than shifts in the amounts purchased.”

However, now look at this: “Spending at restaurants and bars grew 0.5% in September from the prior month. But prices at restaurants grew 0.9% in the same month, according to a separate Labor Department report released Thursday, meaning that consumers are getting less for their spending.”

No, that’s not what this means.

If restaurant prices increase 0.9%, but restaurant sales only increase 0.5% it means you are selling/serving fewer customers. It doesn’t mean consumers getting less food, it means fewer consumers are eating at restaurants…. Which is caused by consumers having to prioritize their spending.

(WSJ) – […] Spending declined in categories linked to big purchases like cars, televisions, beds and golf clubs. Purchases at electronics and appliance stores declined 0.8% in September while spending at furniture stores fell 0.7%.

[…] Scott Brave, the head of economic analytics for Morning Consult, said consumers have started to pull back on optional purchases while still spending on the essentials. “They are having to make tough decisions,” he said. (more)

Socrates has been predicting a downturn for Pfizer’s stock. Could this newly released admission be one of the culprits? A senior Pfizer executive, Janine Small, testified before the European Parliament’s COVID committee. When Dutch MEP Rob Roos asked about the vaccine’s ability to prevent transmission, Small revealed a well-kept secret.

“Did we know about stopping the immunization before it entered the market? No,” Small said with a condescending laugh.

Small claimed that they were under pressure to develop a vaccination as quickly as possible and could not be bothered with its efficiency. They were under pressure to provide Big Pharma and world governments with the greatest power grab in modern history. Hence, governments provided full immunity for the pharmaceutical companies producing these dangerous injectables.

They knew the truth, but Pfizer claimed that the vaccine would prevent transmission. They never tested this claim but stated it as a fact. The vaccine was “safe and effective.” Rob Roos released the above statement shortly after Small revealed the sinister truth. “Millions of people worldwide felt forced to get vaccinated because of the myth that ‘you do it for others.’” Roos said. “That turned out to be a cheap lie.”

The unvaccinated were banished from society and considered selfish psychopaths by the mainstream media and world leaders. If you did not bend and get the vaccine, you were putting the lives of others at risk. Hence, this is why the unvaccinated lost their jobs, were prohibited from the free movement of travel, and were even subjected to COVID passports in some countries. All of these restrictions were completely and utterly useless — and Pfizer knew all along.

I have created this site to help people have fun in the kitchen. I write about enjoying life both in and out of my kitchen. Life is short! Make the most of it and enjoy!

De Oppresso Liber

A group of Americans united by our commitment to Freedom, Constitutional Governance, and Civic Duty.

Share the truth at whatever cost.

De Oppresso Liber

Uncensored updates on world events, economics, the environment and medicine

De Oppresso Liber

This is a library of News Events not reported by the Main Stream Media documenting & connecting the dots on How the Obama Marxist Liberal agenda is destroying America

Australia's Front Line | Since 2011

See what War is like and how it affects our Warriors

Nwo News, End Time, Deep State, World News, No Fake News

De Oppresso Liber

Politics | Talk | Opinion - Contact Info: stellasplace@wowway.com

Exposition and Encouragement

The Physician Wellness Movement and Illegitimate Authority: The Need for Revolt and Reconstruction

Real Estate Lending