Posted originally on the CTH on May 4, 2023 | Sundance

According to those who relish the Cloward-Piven strategy, things are proceeding swimmingly.

…”As long as the decisionmakers continue doing the things that are creating the crisis, the crisis will continue.”

Federal Reserve Chairman Jerome Powell said yesterday the “U.S banking system is sound and resilient,” insert uncomfortable snicker here. However, uncertainty is continuing to pummel the banking industry, despite assurances from the Fed, Treasury, FDIC financial regulators and bankers such as Jamie Dimon who are all saying there is no crisis in the banking industry.

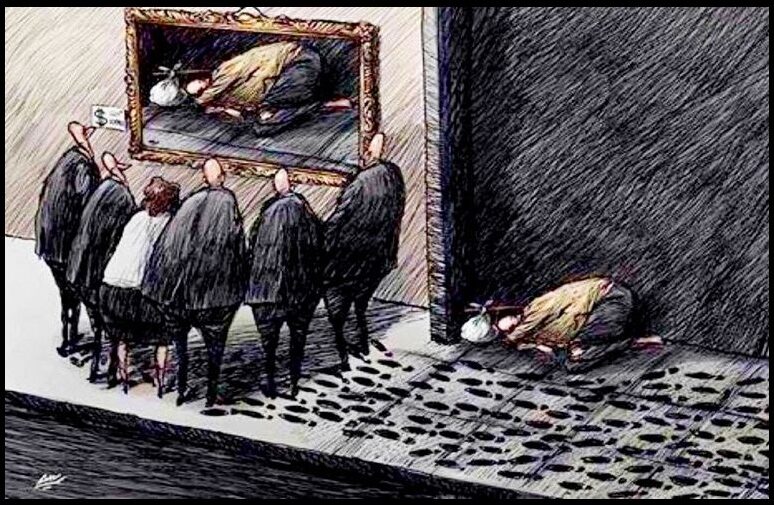

If you want to know the big picture source of the uncertainty, it’s the great pretending. The average person can sense something is wrong, and the person who pays attention has the experience of institutional lying over the past several years. The last ten years of lying and pretending has created the biggest collapse in institutional trust in U.S. history.

Russians interfered with the election – trust us. Stick this needle in your arm, it’s safe – trust us. The FBI are the good guys – trust us. Biden won more votes – trust us. This inflation is merely transitory – trust us.

See the problem?

So, when the same voices shout, “the banking industry is sound, trust us,” well,… yeah, that suspicious cat sense that’s on high alert isn’t buying the chorus.

Reasonably intelligent people who accept things as they are, not as they would have us pretend them to be, can see the core connection to the World Economic Forum, Central Banks, and western globalist policy to change the entire dynamic of economics and finance around the “Climate Change” agenda, or Build Back Better, or Green New Deal.

Overlay that commonsense and pragmatic outlook with the logical consequences of the activity, and this banking collapse issue is a self-fulfilling prophecy. As long as the decision makers continue doing the things that are creating the crisis, the crisis will continue.

(Via Wall Street Journal) – Regional-bank stocks tumbled Thursday despite assurances from the Federal Reserve that the banking system is on solid footing.

PacWest Bancorp PACW -47.04%decrease; red down pointing triangle, which has been hit hard since the collapses of several banks, dropped by about 40%. The stock started falling in after-hours trading Wednesday evening, after a report that it was considering selling itself.

PacWest said in a statement after midnight Eastern Time Thursday that its core customer deposits were up since the end of the first quarter, and that it hadn’t experienced any unusual deposit flows since the collapse of First Republic.

[…] Investors have been wondering how much further the problems in regional-banking could spread, and whether they will spill over to the broader economy. Some analysts said the decline in PacWest and others reflected the market’s tendency to view news as categorically good or bad, rather than worries about PacWest specifically. Western Alliance, another bank whose stock has been hit hard, fell by about 35%.

[…] Regional banks, as major lenders to businesses and families across the U.S., also tend to fall when investors are expecting a recession. The 10-year Treasury yield slipped this week, and Brent crude hit a 52-week low on Wednesday.

[…] On Wednesday afternoon, the Fed said the U.S. banking system “is sound and resilient,” echoing language from its March statement. Fed Chair Jerome Powell added then that deposit flows at banks had eased and that this week’s seizure and sale of First Republic should further stabilize the industry.

[…] PacWest shares were recently trading around $3.70, putting them on track for their lowest close on record. The stock has now lost some 85% of its value since March 8, the day that SVB spooked bank investors by announcing a loss and a planned capital raise.

Many of PacWest’s customers are tied to technology startups—a tightknit clientele that pulled from high-balance accounts en masse at Silicon Valley Bank before it failed. (more)