Posted originally on the conservative tree house on September 14, 2022 | Sundance

From the latest court filing by Special Counsel John Durham, we learn that Robert Mueller’s FBI investigators interviewed Christopher Steele’s primary Source, Igor Danchenko, on June 15, 2017.

In addition to being on the payroll of the FBI since March as a confidential informant, exactly two weeks later, June 29, 2017, the Robert Mueller special counsel renewed the Carter Page FISA application to continue their exploitation of the comprehensive title-1 surveillance warrant against the Trump administration.

Additionally, within the court filing against Igor Danchenko, we find that FBI personnel from Robert Mueller’s team interviewed Christopher Steele:

Now consider this specific line of questioning of Robert Mueller, conducted on July 24, 2019, after the Mueller special counsel published their report. The questioning is from New York Representative Elise Stephanik to Robert Mueller on the specifics of the special counsel questioning Christopher Steele and/or his source, Igor Danchenko.

Keep in mind, ONLY ROBERT MUELLER knew at the time of this questioning that Igor Danchenko remained a paid confidential informant at the time of his answers. WATCH:

.

AFTER originally interviewing Danchenko in January and February 2017, in March the DOJ/FBI then reinterviewed him before refiling the second FISA renewal in April. With Danchenko on their payroll they FBI did not need to worry about him undermining the Trump-Russia narrative or speaking the truth about the dossier. This approach protected the fraudulently obtained title-1 surveillance warrant. The surveillance warrant was renewed in April.

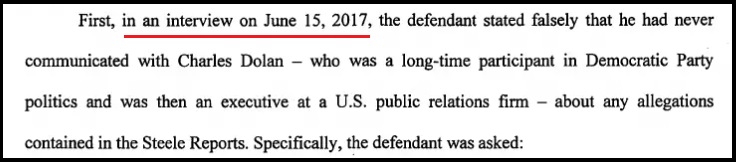

AFTER Robert Mueller is appointed special counsel in May 2017, with Danchenko on the FBI payroll and under control. When Danchenko is interviewed on June 15, 2017, he is being interviewed as part of the Mueller operation. Special Counsel Robert Mueller and Andrew Weissmann now submit the FISA application for another renewal on June 29, 2017. The fraudulently obtained title-1 surveillance warrant was again renewed.

The reason to keep Danchenko on the FBI payroll is to mitigate any risk he might present if he were to speak. A corrupt FBI network in Washington DC put a control mechanism over Danchenko in order to preserve their surveillance warrant, which was built upon fraud by using the Steele Dossier. They renewed the surveillance warrant twice more (April and June) while Danchenko was a paid confidential informant.

As you can see from the Durham filing, a controlled Danchenko was then handed-off to the Mueller probe, who kept Danchenko on the FBI payroll throughout the Robert Mueller investigation (ended in April 2019) until October 2020 when Danchenko was dropped by the FBI and John Durham “officially” took over and was appointed special counsel.

On July 24, 2019, when Robert Mueller is answering the questions about Chris Steele, the dossier and the Steele sources therein, Mueller was able to deflect and dodge answering the questions about it because AG Bill Barr put John Durham into place in May 2019.

AG Bill Barr put John Durham into place in May 2019, immediately following Robert Mueller’s completed investigation, April 2019, for this exact reason.

It is one long continuum.