Armstrong Economics Blog/Regulation Re- Posted Apr 18, 2023 by Martin Armstrong

QUESTION: Marty, You are the only worthwhile analyst. You were alerting us a year ago that the IMF was creating its own digital currency. We have all these people claiming this will kill the dollar just as they proclaimed the euro when that was created. It is also well known that you were called in about revising the world monetary system numerous times. I heard that you were called in on this one and refused to assist them. You warned back in May of 2021 that the IMF was creating a new reserve digital currency.

Is this all part of the rise of the United Nations, World Bank, and IMF all becoming this one world government? I that why you declined to get involved?

LW

ANSWER: I am not at liberty to speak to issues where I am solicited. Suffice it to say, I took no part in creating this currency. This is part of what I have been warning about digital currency. They can restrict its use and anyone who thinks that somehow Bitcoin will be some independent white knight rushing in to save the day, they have drank too much of the cool aid.

Look, try depositing $10,000 in cash. Watch what happens. I have a friend who owns a bar in a college town. He takes in a lot of cash because the customers often do not have credit cards. Some banks did not even want to accept an account from him. Others required inspection and monitoring because cash CAN BE a way to launder money. Europe has been restricting cash to transactions capped at €1,000.

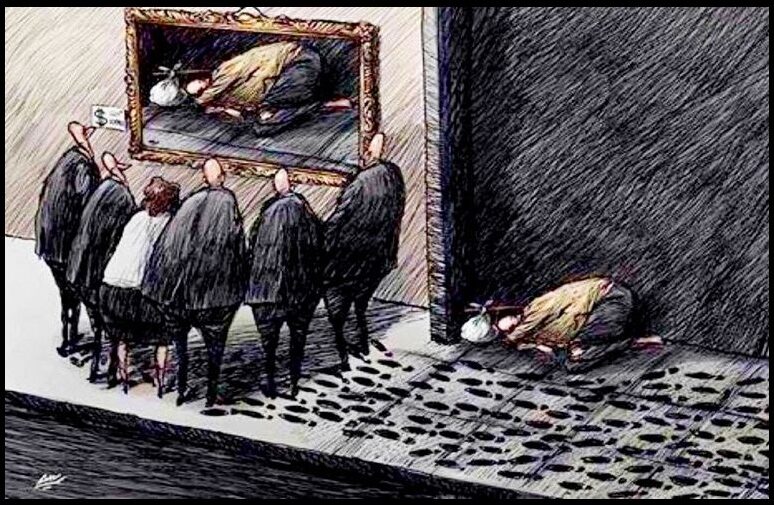

There is serious talk of restricting purchases for cash or CRYPTOCURRENCY and the way they enforce it is precisely restrictions on businesses and noncompliance means you are out of business when no bank will accept your account. That eliminates business in credit cards as well. This is why I say, they will create a black market through their sheer authoritarianism. Human rights will no longer be respected. This is point 8 of Schwab’s Agenda.

Back in 1980, the press was all over my firm. NPR came in with cameras rolling and could not believe we had just paid a woman $6,000 for a heavy silver serving plate. We had lines all day long at all my locations in addition to the fact I was making markets for all the stores nationwide. Whatever they bought that day they sold immediately;y to us and shipments were coming in from everywhere. I had a team just handling that and we would bundle it all up and send it out in Armored trucks to be refined at Engelhard which was 30 minutes away.

Because of all the publicity, the IRS came in and declared me to be a bank under the theory that Nixon only closed the gold window and gold was never demonetized. Sure, it was a novel theory that just because I was one of the 3 largest gold dealers in the country, that made me a bank without applying for a banking license. They claimed I had to report every transaction of $10,000 or more buying for selling. They sent in their stormtroopers and began going through every transaction. They then went out and audited over 3,000 clients. I decided to retire. That was it. I was not about to become a rat on everyone that walked in the door.

The point is this. They can declare everyone mining cryptocurrency to be a bank. Already, the Infrastructure Investment and Jobs Act of 2021 (IIJA) requires any transaction of $10,000 or more to be independently reported to the IRS. The government can declare you to be anything. You can fight them in court and you will lose and it will take years. In the meantime, you will have to comply. They can do ANYTHING they want. It is then your burden to argue that what they are doing is illegal. Good luck. We are no more living in a free country than Russia or China. The government can do anything it desires. It will always be your burden to say they are acting unconstitutionally.

You will NOT be able to travel internationally with even gold coins. You may not even be able to hop on a plane domestically with gold or cash. Over the past several years, a common question for U.S. taxpayers across the globe is whether or not a foreign-based virtual currency such as Bitcoin that is held overseas is reportable for FBAR (Foreign Bank and Financial Account Reporting) or FATCA (Foreign Account Tax Compliance Act) purposes. The Treasury was already pushing since 2021 for any transaction of $10,000 or more in cryptocurrency must be reported to the IRS.

Whether you are a visitor to the United States or a U.S. citizen arriving in the United States, you must complete one or more entry forms.

At the end of the day, they want their pound of flesh and they want absolutely everything to be restricted and monitored. Welcome to the new law of totalitarianism.

Categories: Regulation