Posted originally on the CTH on December 2, 2022 | Sundance

There’s a disconnect in the Main Street data that is perplexing from the standpoint of traditional economic and labor analysis.

There have been significant layoffs in the labor market as the result of diminished consumer spending activity. However, the Bureau of Labor and Statistics (BLS) is reporting a hotter than expected 263,000 new jobs in November [DATA HERE].

There were declines in jobs within the retail sector [-30,000 in Nov, -62,000 since August] and declines in warehousing and transportation [-15, 000 in November, -30,000 since July], which would indicate the outcome of lowered consumer spending on goods, or at least a change in consumer spending priorities.

Simultaneously, there were significant increases in jobs for leisure and hospitality [+88,000 in Nov], with the majority of those gains in food service and drinking. However, that sector is still lower than the pre-pandemic by -980,000 jobs. Also note people are not attending events with high ticket costs, the performing arts and spectator sports segment dropped 7,000 jobs [Table B-1]

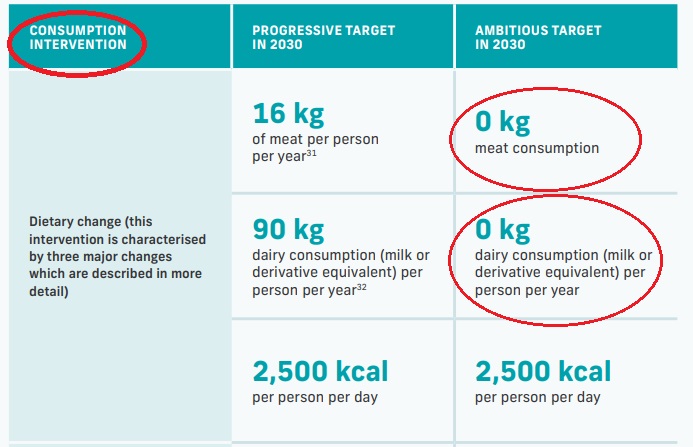

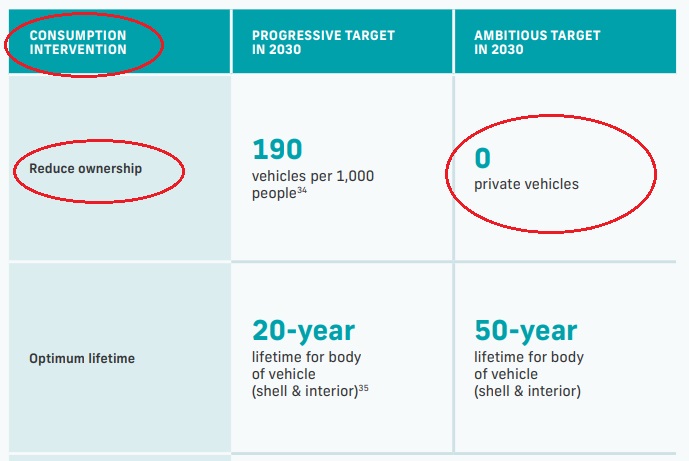

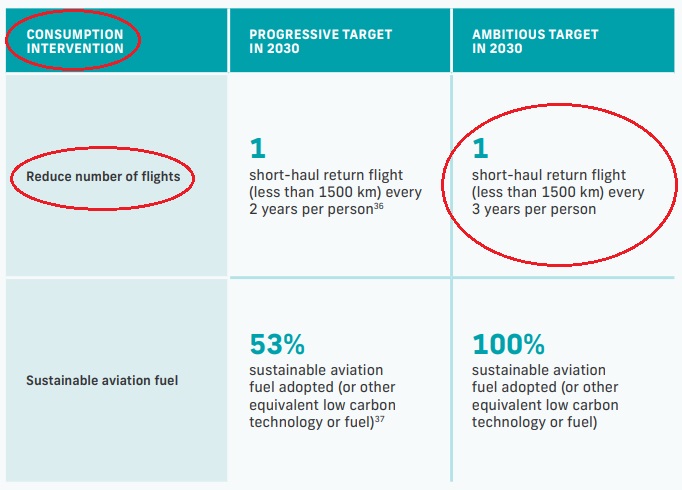

Overall, if you were to look at the macro level jobs report, anything attached to the traditional spending of durable goods (retail stores) is declining. However, the jobs related to the service or life experience are growing. Oddly, and perhaps creepily, this dynamic falls in line with the ‘you will own nothing and be happy‘ cliche’ that has been oft spoken about the new post pandemic ‘Build Back Better‘ economy as espoused by the World Economic Forum.

Job gains in the infrastructure of life such as, building and construction, as well as the labor sector associated with skilled domestic service trades like plumbing, electricians, maintenance, etc are continuing to hold stable. The major shift in the labor market surrounds the buying of durable goods which has disappeared along with the disappearance of discretionary income. Which brings us to the wage portion of the BLS report.

Wage growth was a very high 0.6% for November and brings the annual rate of wage growth to 5.1%. This outcome is almost certainly an outcome of workers demanding higher pay to cope with inflation, and employers needing to raise their wage rates in order to retain employees.

We also see an increase in the number of workers holding multiple jobs, as individuals are taking second jobs to cope with massive price increases in housing, food, fuel and energy. As noted within the BLS data:

“In November, the average workweek for all employees on private nonfarm payrolls declined by 0.1 hour to 34.4 hours. In manufacturing, the average workweek for all employees decreased by 0.2 hour to 40.2 hours, and overtime declined by 0.1 hour to 3.1 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls decreased by 0.1 hour to 33.9 hours.”

Fewer people are working, but more jobs are being worked – with lowered hours.

Higher wages are good; however, higher wages lead to higher prices for goods and services; which drives inflation higher, which creates the need for higher wages. It’s an upward pressure spiral.

The supply side pressure on inflation, almost exclusively created by the BBB energy policy, shows absolutely no sign of lessening, despite the drop in demand for domestically produced finished consumer goods which has lowered overall industrial demand for energy.

The Build Back Better energy driven policy changes are creating very weird economic outcomes.

Prices are rising. Consumers are squeezed. Jobs attached to spending on goods are declining. Jobs attached to life experience and services expanding.

Ex.1 If you are working two jobs, now you might not have time to mow your grass – so you hire a lawn service. The lawn service guys are charging more because the gasoline and business costs are higher…. which means you need to work a little longer at the second job to pay for the lawn service you don’t have time to do on your own because you need to work the second job. That’s the dynamic we are seeing in the quantification of labor and job growth.

Ex.2 If you are working two jobs, you might not be cooking as much at home. So, you grab dinner/lunch away from home. The restaurants are charging more because the business costs are higher…. which means you need to work a little longer, ask for higher wages, in order to offset the time you don’t have to eat lunch/dinner at home.

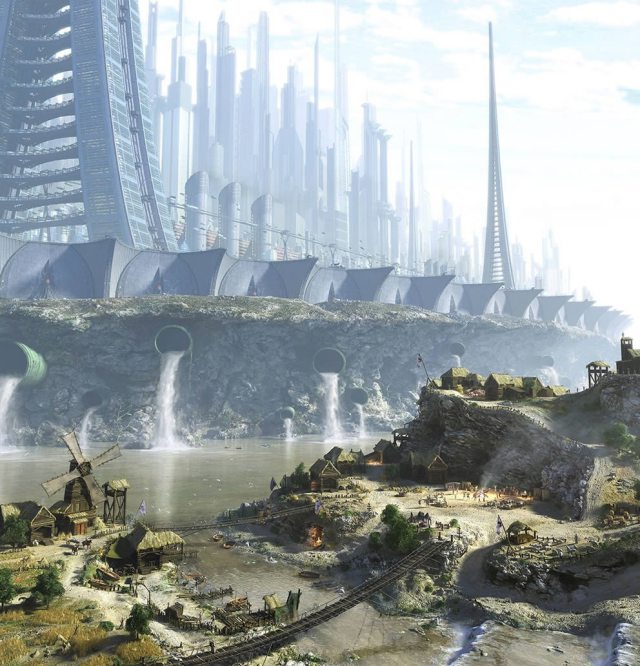

This conflicting duality is what I always called the “serfesque driven economy.” It is an outcome of erosion of the middle-class. A status of individuality where your desires for life experience determine the need for your income.

You don’t own a car, you Uber. You don’t own a house, you rent. You don’t need a kitchen, you eat out. Things seem ok, but you eventually become a serf to the people who control transportation costs, housing costs, food costs, etc. Ultimately you have no control over the time you want to spend in enjoyment, because you don’t own the mechanisms of your life and need to work in order to afford maintaining the costs. It’s a weird mental exercise.

There is a real outcome in this dynamic where the wealth gap increases.