Armstrong Economics Blog/USD $ Re-Posted Apr 23, 2023 by Martin Armstrong

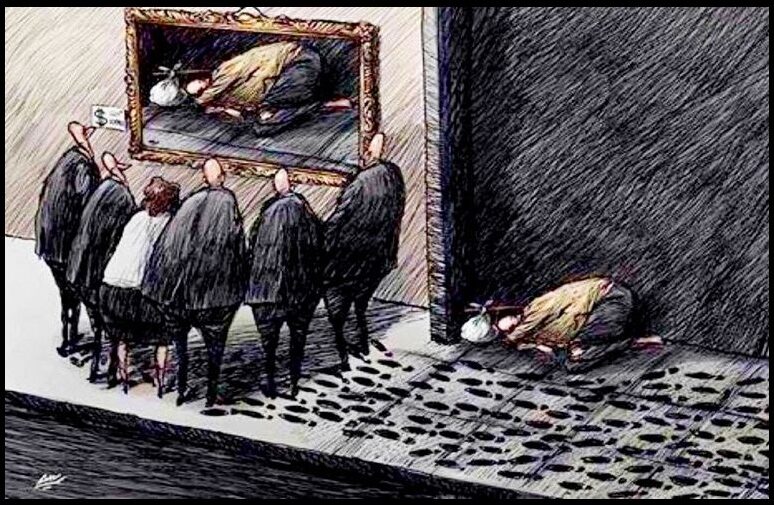

All we hear is the same claims that the dollar is dead and it will be totally worthless any day now. Over the last few weeks, all we hear from the majority now is that the dollar is finished. Virtually every page you turn or site you visit claims the death of the dollar. They are calling this the de-dollarization of the world economy and that the future of the US dollar as well as the American empire itself is now collapsing. The general claim is that the group of economically-aligned nations known collectively as BRICS is a major threat to the greenback. That was the same story we heard about the Euro back in 1997.

As their scenario goes, the BRICS [Brazil, Russia, India, China, and South Africa] have moved to form an anti-dollar colation and Saudi Arabia is considering jumping on board. They insist that once that happens, the “petrodollar” will die and cease to be a reserve currency.

This is then followed by the forecast that the economy will suffer and that any bounce in exports will be short-lived simply because the dollar will be dead for the long term. Of course, this has been the favorite forecast that they keep putting out since Bretton Woods collapsed. They were wrong back then for the dollar rose between 1972 and 1976 against the British pound, with the collapse of Bretton Woods. To try to explain why the dollar did not collapse, that is when they claimed that the dollar was backed now by oil rather than gold. That was just an excuse as always to cover up their wrong forecast.

They sold that story to Newsweek and now the dollar rally was because of oil which replace gold. Suddenly the dollar became de facto backed by oil. They needed an explanation to explain why all the old theories were wrong. They sold this theory and it made the front cover of Newsweek. Everyone said YES! That must be the reason. OPEC priced oil in dollars! Naturally, everything was priced in dollars because, under the fixed exchange rate of Bretton Woods, everything from wheat and corn to copper and gold was all priced in dollars.

Now they are saying the American empire is threatened by the potential commercial real estate collapse and the BRICS anti-dollar venture. So they are forecasting a great depression-style crash is possible in the not-too-distant future. They spin this to forecast the end of the America Empire. The London FT, always anti-American/Pro WEF, reports that the dollar as a reserve currency has declined from 73% in 2001 to around 55% by 2021. Yet the FT did state an obvious fact:

“But if you are a reserve-rich central bank elsewhere that isn’t going to be a lot of comfort. Moreover, would you really feel more comfortable in, say, the renminbi? Even if it was fully convertible and liquid, would you honestly feel more sure that Beijing will behave lawfully than DC? The dollar still looks like the proverbial least dirty shirt in the closet.”

COVID actually has played a major role in shifting the world economy. In 2020, the US economy was 24.75% of the world’s GDP. By the start of 2022, it had fallen marginally to 24.15%. What these dollar-forecasting jockeys do not understand, is that if they were correct and the dollar collapsed, then the very BRICS would collapse even further. Economically speaking, when the United States gets a head cold, the rest of the world catches ammonia. You can’t have it both ways. The strength of the dollar is not gold or oil, it is the American consumer.

The risk to the entire world is runaway inflation thanks to Biden pouring untold amounts of money into the black hole known as Ukraine. The Neocons, who control Biden, are planning to launch a war against Russia and China before 2024. This will only continue to accelerate inflation. That reduces the spending power of the American consumer and in the process, the US economic growth declines in real terms and with it, the rest of the world plunges into recession.

While Macron has figured it out that the Neocons are in charge of US foreign policy and he is telling Europe to stop being the puppet of the USA, that all sounds nice but Europe is marching into war with Russia. NATO is firmly in control of the American Neocons and they need war or face losing power. With Trump in the lead, they must stop him at all costs for he is anti-war, would haul the Neocons out by the necks, and defund NATO, as well as stop the climate change agenda.

The US dollar in the global economy has been supported by the size and strength of the US consumer-based economy. Its stability and openness to trade and capital flows without restrictions and it has never been canceled, are the major foundation of the dollar in addition to strong property rights and the rule of law. That is why Russians and Chinese buy US property for they are secure in their ownership of US property which cannot always be guaranteed outside the US.

Consequently, the depth and liquidity of US financial markets remain unmatched. For institutions parking billions, the United States represents a large supply of extremely safe dollar-denominated assets. Are they really going to switch to China or buy debt from Brazil? Not a single institutional client will take that bait.

China has been divesting of dollar reserves because it KNOWS that the American Neocons want war. You do not fund your adversary who intends to wage war against you. China cannot shift reserve assets to Europe or Japan. They have been buying gold because it is geopolitically neutral territory. They are NOT buying gold as an investor thinking it will rally. That is irrelevant. If gold drops 25%, that does not translate into them becoming a seller.

The dollar in international reserves stood at 60+% at the start of 2022 against the US share of GDP at 24.25%. This comparison belittles the argument that the dollar is finished. Eventually, the US will lose the wars it is starting and the dollar will be replaced perhaps as soon as 2028. The IMF is already licking its lips and rubbing its hands together eager to get control of the reserve currency. But they too will collapse. We have a Directional Change next year and a Panic Cycle in 2025. So buckle up.!

Remember one thing, even with the debasement and collapse of the Roman Denarius between 260AD and 268AD, it still took 224 years for Rome to completely collapse. When war breaks out, capital flight will still be to the dollar. It will not be to public assets, but private. The United States is still supporting the entire world economy. The BRICS need the US consumer to keep their economies functioning. All this talk of the dollar being finished is really nonsense. That day will come, but when the US consumer no longer buys.

Remember 1997? The Euro was going to dethrone the dollar. They claimed the new EU will be a bigger economy than the US. The problem was, they lacked a consumer economy, and low taxes, and they routinely canceled their currency to force people to pay taxes. It is always the same story over and over again.