Posted originally on the CTH on September 22, 2024 | Sundance

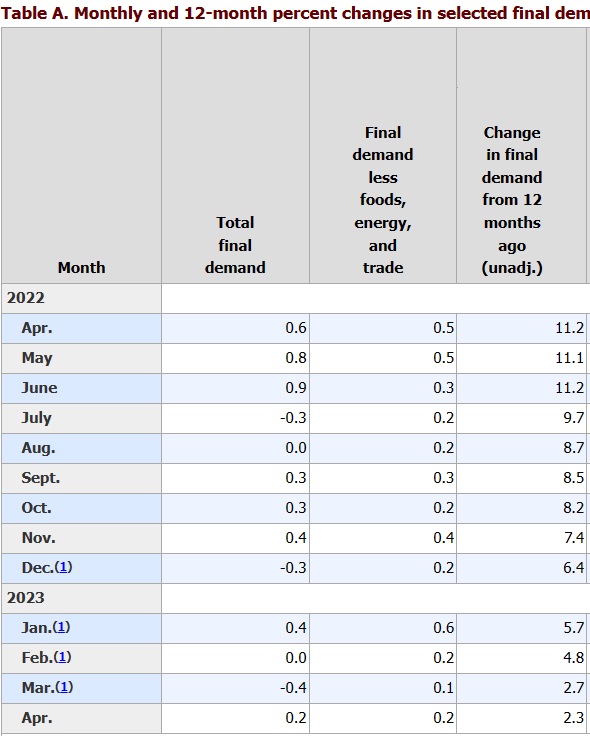

If there is one economic dynamic we have talked about on these pages more than the rest, its inflation. {Background}

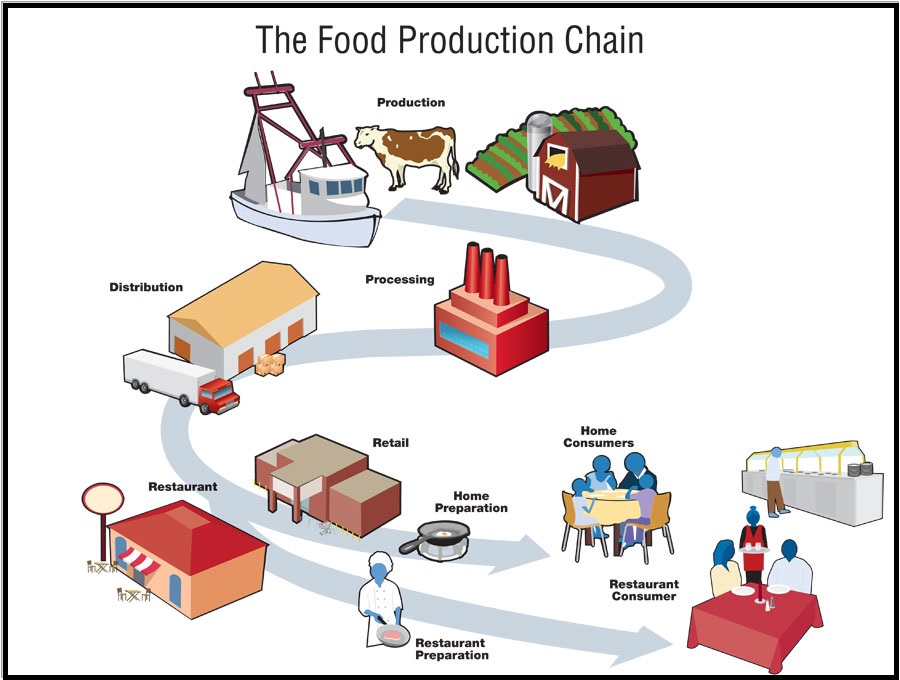

The root causes of inflation are two-fold, monetary policy and energy policy. However, when combined they represent a predictable outcome. Specifically predictable, when it comes to highly consumable goods that require a lot of industrial effort, labor, distribution and warehousing processes. Thus, food inflation was/is worst.

Within all of the sectors most vulnerable to upward price pressure as a result of policy (monetary and energy), the main industry impacted by immediate and severe inflation is food, farming and agriculture. Food, a highly consumable product with a thin supply chain, sees the results of inflation first and fastest. Durable good inflation lags behind high-velocity consumable goods.

It was with this understanding CTH first warned in 2020 of what would happen coming out of the COVID Pandemic economic crisis. We predicted and watched in 2020 as one-third of all food supplies were destroyed because 50% of the food supply chain (restaurants, cafeterias, schools, food trucks, essentially food away from home) was shuttered.

In the middle and latter part of 2020, the retail food supply chain (grocery stores), normally representing 50% of total caloric consumption, struggled to keep pace with massively increased demand on that side of the food supply. The agricultural supply chain was completely screwed up in the USA when half of the normal food distribution (wholesale food away from home) was blocked from their business model. The resulting impacts were entirely predictable for those who did not pretend. We warned, and it happened exactly as we anticipated.

Then, making the predictive nature of food pricing more obvious, we watched as the Build Back Better or Green New Deal was thrust upon the entire western world dynamic. This BBB/GND energy policy shift intentionally and purposefully exploded the cost of manufacturing and distributing food. With massive and immediate increases in energy prices, the price of food skyrocketed quickly; because the impacts are fast in this sector.

Over the next several years the prices of food continued going up as the increased energy cost embedded within the agriculture sector. Nothing about the price of food, or the ancillary processes within the industry, will change unless and until energy costs retreat. In essence, with higher energy costs, food prices stay high; they are directly connected.

No other facet to food inflation is more substantial than the cost of energy to produce the product. Farming and agriculture are energy dependent from fertilizer to farming equipment, fuel, processing, packaging, transportation, warehousing, storage, climate controls in distribution etc, everything is dependent on energy pricing.

High energy costs are why food prices (inflation) would always stay high, regardless of what happens in other sectors. CTH talked about this at length long before the impacts came over the horizon. We talked about preparing our families to offset this issue, but there is only so much you can do.

We are all currently feeling the intense increase in prices at the market, grocery store and supermarket, and the worst aspect to this dynamic is the reality that as long as energy prices remain high, food prices will never drop. [NOTE: There is a smaller supply/demand impact; however, with most of the USA agricultural sector exporting food products (multinational corporations ie. Big Ag) the domestic USA supply is subject to globalized pricing.]

Bottom line. As long as energy prices remain high, food prices will remain high.

The “great reset” per se’, was not a process that began after the pandemic. The pandemic was the beginning, ushering in the “great reset” by being the starting point of the mostly western, global energy shift.

Into this dynamic there is good news, one voice has clear eyes on the problem, and as a consequence, answers. President Donald Trump understands the nature of how the current price pressures that are crushing the middle-class can be reversed and removed. WATCH:

.

Many people have written with appreciation for the CTH forecasts delivered in the fall of 2021. I am thankful to have been of benefit to those who could take proactive measures to avoid the economic issues we faced in 2022 and beyond. However, that financial pain has not subsided. There’s only so much a person/family can do to offset rising energy costs.

I know just about every reader on these pages can relate to how financial fear can eat at you from the inside. The life game of trying to figure out how to get from one week to the next, keep a roof over your head and keep the kids/grandkids safe and fed is fraught with trepidation. I get it. Believe me, I get it…. But you just gotta keep going; whatever it takes.

Our heels are over the cliff, it’s already rough for most working families and people on fixed incomes. We need MAGAnomics more now than any other moments in our lifetime. This is why I was saying in 2023 we needed to focus at home; keep building that bunker safe and secure.

Then look to help/assist the neighbors, then the community, etc. But start by being proactive at home and do not isolate. Fear, worry, trepidation, foreboding etc, is worse when internalized. Do not swallow it – reach out to a loving God, pray, release it, and then embrace the central purpose in life, fellowship.

Be patient, be respectful, be kind and caring. Don’t look for trouble. But when the time comes to fight, drop the niceties and fight for your family with insane ferocity.