Posted originally on the conservative tree house on November 20, 2022 | sundance

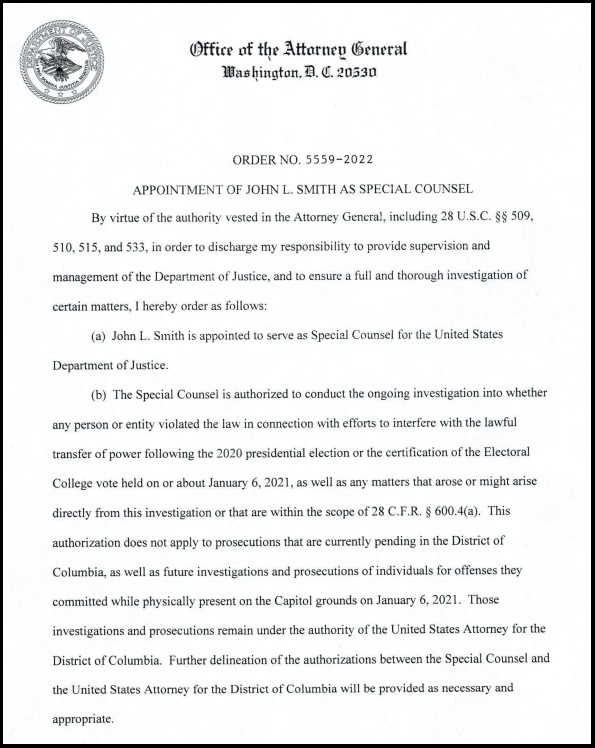

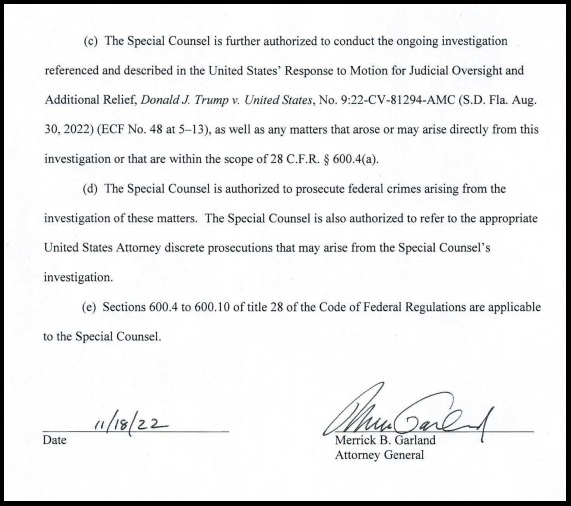

DATA Links: (1) Merrick Garland DOJ Statement on Appointment of Special Counsel ~ (2) pdf of Legal Appointment ~ (3) Statement of John Smith upon Appointment ~ (4) Transcript of AG Merrick Garland Public Announcement.

The pretending is severe as CBS recruits former Deputy Attorney General Rod Rosenstein to discuss the decision by Attorney General Merrick Garland to appoint a special counsel to investigate republicans in congress and President Donald Trump.

You can tell the pretending is severe because neither Rosenstein nor Brennan even touches on the primary aspect to the written instructions by Garland to special counsel John Smith. The primary function of the special counsel is completely avoided in the interview, [again, read the pdf of the appointment]. Instead, the conversation with Rosenstein focuses on the second, lesser included instruction, the Trump-centric portion.

The corporate media engineers, working on concert with the DC agenda, are pulling Rosenstein into the picture to frame the narrative toward an announcement of an indictment against President Trump. WATCH:

In response to the question of the appointment itself, Rosenstein noted he “probably would not” have made the decision to appoint a special counsel. However, don’t get too caught up in the granules of the interview itself. Instead, ask why the media is pulling Rosenstein into the prosecutorial debate? What benefit is there? Within those answers you then overlay the fact the primary function of the appointment itself is not part of the conversation. [Transcript Below]

[Transcript] – MARGARET BRENNAN: We begin this morning with former Deputy Attorney General Rod Rosenstein. He appointed Robert Mueller as special counsel for the investigation into Russian interference in the 2016 election and to determine if there were links between that country and former President Trump’s campaign. And he joins us in studio. It is good to have you here in an extraordinary week.

FORMER DEPUTY ATTORNEY GENERAL ROD ROSENSTEIN: Good morning. Glad to be here.

MARGARET BRENNAN: I want to get right to it. Due to the former president launching his campaign, the current president may also run for president, the attorney general said it is absolutely necessary to have a special counsel oversee this investigation into the classified documents found at Mar a Lago and what happened with trying to change the outcome of the 2020 election. If you were in that old role you once had, would you have appointed a special counsel?

ROSENSTEIN: You know, it’s easy to second guess from outside the department. I don’t know exactly what Merrick Garland knows, what information was available to him. He didn’t say that he was required to appoint the special counsel. He said that he thought it was the right thing to do. I believed the circumstances that I faced, that the appointment of Robert Mueller was the right thing to do with regard to the Russia investigation. But I think in this case, Merrick Garland clearly made a discretionary decision. The department had been handling this itself for two years. Could have continued to handle it itself. But he believed that this would help to promote public confidence. I think it remains to be seen whether that’s the case.

MARGARET BRENNAN: So you wouldn’t have done this to yourself?

ROSENSTEIN: As I said, it’s it’s easy to second guess from outside. I think, you know, my inclination, given that the investigation had been going on for some time and given the stage which they’ve reached, is that I probably would not have, but I just can’t tell from the outside.

MARGARET BRENNAN: So from where you sit, does the appointment of a special counsel indicate at least a willingness on Merrick Garland part to go ahead with a prosecution, or is that overreading the decision?

ROSENSTEIN: I think what it indicates is that, you know, despite the fact the department has been at this for some time, almost two years on the January six investigation, close to a year, the Mar a Lago investigation, that they still believe that they have a viable potential case. It doesn’t mean they made a decision to go forward. But it certainly is an indication they believe it’s a possibility.

MARGARET BRENNAN: Now, one case that’s been going on longer, the investigation into Hunter Biden, which CBS has learned the FBI has gathered sufficient evidence to charge him with tax and gun related crimes, and that is before the U.S. attorney in Delaware. David Weiss, I believe you know him since he was a Trump appointee. Can he independently oversee this or do we need another special counsel?

ROSENSTEIN: Well, yeah, This investigation, as you said, has been going on for a very long time, which is not good for anybody. You know, it promotes conspiracy theories and suspicions. So my hope is the department will make a decision in the near future about whether to go forward. And hopefully that decision will be accepted by the public. I do believe that the U.S. attorney in Delaware- I know has the right experience to make that decision. So I think we can be confident that he’ll make the right decision in that case.

MARGARET BRENNAN: So not in that case. But let me ask you about the content of what is being scrutinized here with the former president. I know when you were U.S. attorney in Maryland, you dealt with individuals who took classified material, sometimes top secret, high level clearances and kept it at home. And you prosecuted them to the full extent of the law. Why should the president be any different?

ROSENSTEIN: Well, you’re right. We did have a lot of federal agencies in Maryland. And so we had a number of cases that came up during my 12 years as U.S. attorney, both under President Obama and President Bush. And we prosecuted those cases because we believe the facts justified it. Now, if the facts justify prosecution, President Trump, I think the department will make that decision. But we just don’t know from the outside. You know, there are extenuating circumstances when it’s the president, when there are a lot of staffers and lawyers involved. And so I think we have to wait to see how that all shakes out.

MARGARET BRENNAN: Former Attorney General Barr sat with PBS, and this was right before Merrick Garland’s announcement. But he said that to indict the Justice Department needs to show Mr. Trump was consciously involved. Let’s hear what he had to say.

FORMER ATTORNEY GENERAL BILL BARR: I personally think that they probably have the basis for legitimately indicting the press. I don’t know. I’m speculating, but but given what’s gone on, I think they probably have the evidence that would check the box. They have the case.

MARGARET BRENNAN: Do you agree?

ROSENSTEIN: Well, I don’t know. I think the Attorney General Barr, that is, you know, mentioned later in that interview that he was speculating. And I think it’s you know, there are multiple levels of issues that the department needs to consider, Margaret. Number one is, you know, is the evidence sufficient to obtain and sustain a conviction? Number two, is, is it an appropriate use of federal resources to bring that case and a case against a former president, obviously, with the extraordinary would raise unique concerns. And so I would hope that Merrick Garland and his team would be very careful about scrutinizing that evidence, not just checking the box, but making sure that they’re prepared to stand behind the decision that they make.

MARGARET BRENNAN: So when you say sustain a conviction, what do you mean by that? Does that mean looking at the courts that are likely to prosecute me, where would you prosecute this case, Florida or Washington, D.C.?

ROSENSTEIN: Well, it means ensuring that, number one, you get past a jury that has been able to persuade 12 random citizens that your case proves the defendant’s guilt beyond a reasonable doubt. And number two, that it will be sustained or upheld on appeal. You know, the department sometimes brings cases in which they use novel theories that prevail in district court but are overruled on appeal if they’re to bring a case against the former president, you want to make sure they had a solid case and they were confident both of conviction and of prevailing on any appeal.

MARGARET BRENNAN: And that there wouldn’t be some national security implication such as political violence?

ROSENSTEIN: Well, you know, that’s and that’s a difficult issue, Margaret, as to whether or not the attorney general should consider the the potential for public unrest if they were to bring a case against the president,

MARGARET BRENNAN: It has to be considered.

ROSENSTEIN: I think it highlights the importance of the department ensuring that they have a solid case that is that they’re going to win a conviction and they’re going to be able to sustain an appeal. The circumstances, the stakes are higher than an ordinary case. You need to make sure if you bring that case that you can persuade people that is meritorious that you deserve to win.

MARGARET BRENNAN: Well, that gets at the fundamentals, the distrust of institution where we are these days. But the former president is already said he’s not going to comply with any investigations. He said that on Friday. So what does this mean for the timeline? Are we running right into the 2024 presidential campaign?

ROSENSTEIN: I’m concerned about about the timing. Obviously, the the new special counsel, Jack Smith, needs to get up to speed in the case. He’s not even in the U.S. so he needs to come back and get engaged and supervise his team. He may need to bring in additional team members, people he trusts to review the circumstances. And then there are other potential delays as well. You know, one of the downsides of appointing a special counsel is the possibility of litigation over the validity of the appointment of the special counsel. And that has always been upheld by the courts. But litigation can impose additional delay. So I think there’s a fair chance that this is going to drag in well into the campaign season.

MARGARET BRENNAN: And then the question of whether the candidate wins or not. Rod Rosenstein, thank you for your insight and for joining us today.

ROSENSTEIN: Thank you.