Posted originally on the conservative tree house on November 11, 2022 | Sundance

They have proposed and refined so many of the carbon trading schemes, it becomes difficult to remember which iteration each new formula replaces. Heck, I’ve lost track of how many of the individual components of the larger plan are already in place. However, John Kerry has introduced the western elites at COP27 to the latest acceptable proposal surrounding coal fired energy.

Against the backdrop of sped-up Build Back Better urgency, this coal-based carbon trading platform is called the Energy Transition Accelerator (ETA).

When you stay elevated to the larger way the Energy Transition Accelerator works you can clearly see the transferring of wealth from your bank account to the global control mechanism that will eventually determine your energy allotment. The companies that provide energy are simply the collectors for the fees you will pay to the World Economic Forum income disbursement group.

(Reuters) – […] The scheme, known as the Energy Transition Accelerator (ETA), was launched at the United Nations’ COP27 conference this week by John Kerry, the United States’ climate envoy, in collaboration with the Rockefeller Foundation and the Bezos Earth Fund.

[…] Voluntary carbon markets, in which companies get emissions credits in return for channeling cash to poor countries that cut their carbon output, have often been riddled with fraud and double-counting. Many critics think rich countries should just fork out the cash themselves to close coal plants – or tax fossil fuel companies to get the money. (read more)

There’s the system in a nutshell. Energy providers must purchase emission credits from the ‘carbon market’ (govt); in the U.S. likely the EPA as they do with RIN credits. The electricity provider puts the carbon purchase credit fee in your electricity bill.

The money generated from that credit purchase system is then delivered to the government who take a cut; then pass along the balance to the central climate control unit who take a cut; then forward the remaining balance to the third-world government who also take a cut; and then the remainder is used to develop clean energy systems; which returns to the starting point with the energy providers.

See how that works?

That’s the basic operational model of all the carbon-trading platforms.

Widget Corp (energy provider) is forced to purchase a credit. Widget Corp. get the fee for the credit from the customers (you). The fee is passed on to govt, then passed on to central control, then passed on to foreign govt, then passed on to Widget Corp. for building the new clean energy system.

Yes, it’s a Build Back Better circle.

The only way to avoid the Carbon-Trading Exchange is not to join the carbon trading system.

Well, that said, what does not joining the carbon trading system look like?

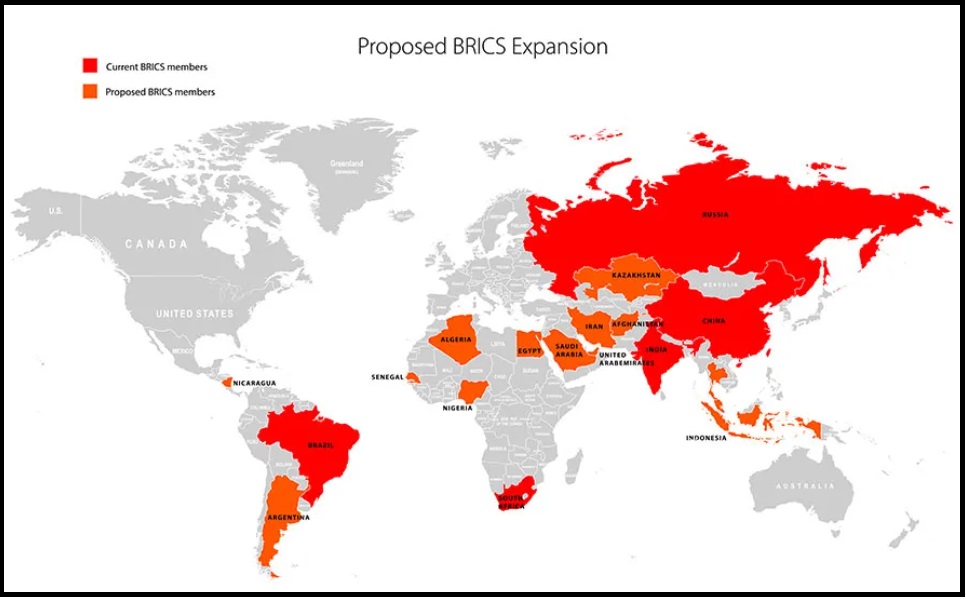

(Silk Road) – The Russian Foreign Minister, Sergey Lavrov has stated that ‘over a dozen’ countries have formally applied to join the BRICS grouping following the groups decision to allow new members earlier this year. The BRICS currently includes Brazil, Russia, India, China and South Africa.

It is not a free trade bloc, but members do coordinate on trade matters and have established a policy bank, the New Development Bank, (NDB) to coordinate infrastructure loans. That was set up in 2014 in order to provide alternative loan mechanisms from the IMF and World Bank structures, which the members had felt had become too US-centric.

The Asian Infrastructure Investment Bank (AIIB) was set up by China at about the same time for largely the same reasons and to offer alternative financing than that provided by the IMF and World Banks, which were felt to impose political reform policies designed to assist the United States in return for providing loans. Both the NDB and AIIB banks are Triple A rated and capitalised at US$100 billion. The NDB bank shares are held equally by each of the five members.

In total, the BRICS grouping as it currently stands accounts for over 40% of the global population and nearly a quarter of the world’s GDP. The GDP figure is expected to double to 50% of global GDP by 2030. Expanding BRICS will immediately accelerate that process.

Concerning a BRICS expansion, Lavrov stated that Algeria, Argentina, and Iran had all applied, while it is already known that Saudi Arabia, Türkiye, Egypt and Afghanistan are interested, along with Indonesia, which is expected to make a formal application to join at the upcoming G20 summit in Bali.

Other likely contenders for membership include Kazakhstan, Nicaragua, Nigeria, Senegal, Thailand and the United Arab Emirates. All had their Finance Ministers present at the BRICS Expansion dialogue meeting held in May. (more)

Can you see it now?

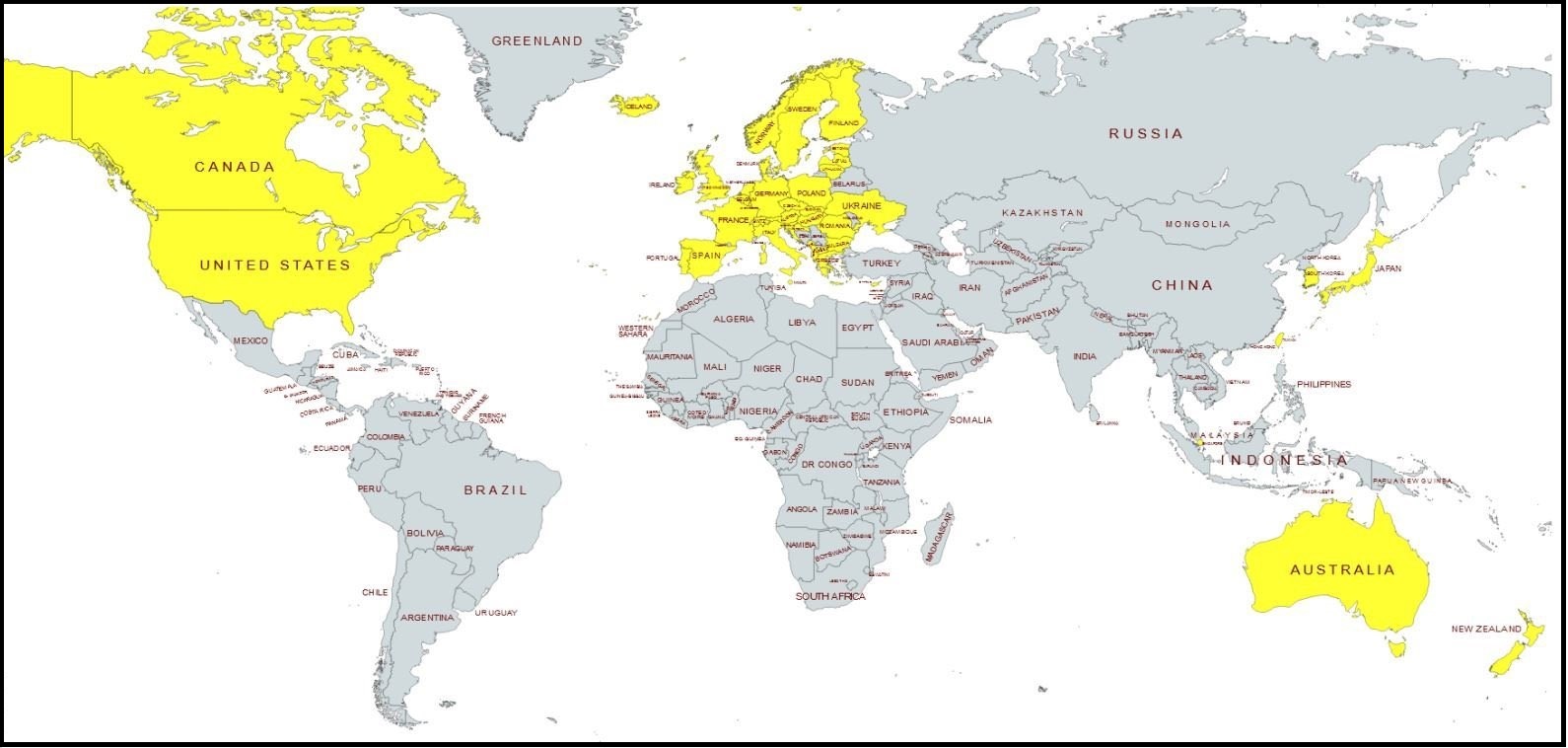

This is the global trade and finance system cleaving as a result of western government’s chasing climate change.

There will eventually be two systems of finance, banking, investment and energy use.

Can you see it now?

Right now, the ‘western’ team is not going to allow any ally to join the BRICS team without punishment.

It’s a battle for global wealth using energy development as the tool.

Last point. With this in mind, does the multinational opposition to President Trump carry a new “trillions at stake” context for you?

.