Armstrong Economics Blog/Civil Unrest Re-Posted Apr 19, 2023 by Martin Armstrong

Any company that is adopting WOKE should be out of business for what they are really doing is dividing the country and completing what our computer has forecast – the breakup of the United States. The WOKE Agenda is attacking the religious beliefs of many and that historically always leads to division, discrimination, and often outright war.

When a company endorses what they think is some political agenda, it will lose the business from the opposition. This whole thing about transgender is out of control. Instead of eliminating discrimination, they are creating it. People will then blame the transgender movement for all sorts of things as they have done to Jews, Catholics, Muslims, and Protestants. There is no solution here. By endorsing WOKE, they are undermining the religious beliefs of others. You end up creating disunity – not unity.

Companies should NEVER take sides in politics especially when they attack religious beliefs. It is one thing to lobby for your business against some regulation. But endorsing this WOKE agenda is part of the Great Divide that is clearly a major factor contributing to the demise of the United States by dividing the people between blue and red. Abortion already offends many religious beliefs. Then there is taxation and war. This WOKE Agenda will be one of the factors historians will look back on for breaking up the United States.

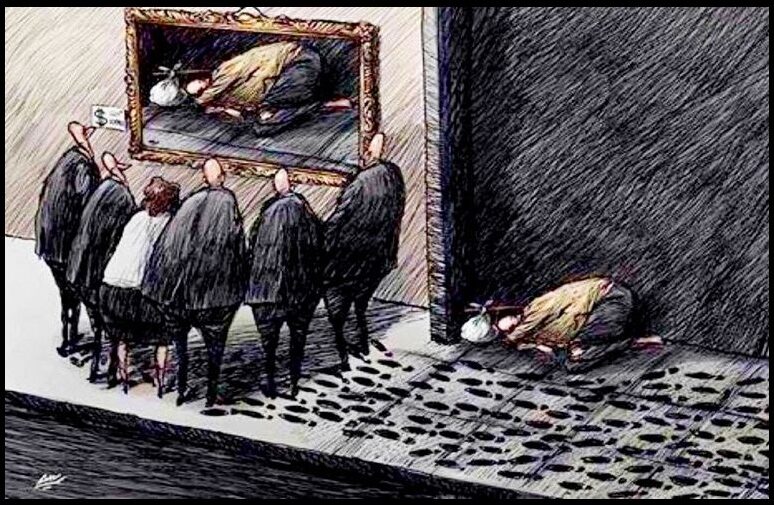

During the Hard Times that followed the Panic of 1837, there was discrimination against the Irish Catholics for taking jobs when they migrated to the States. That led to even gun battles on the street. Just as Germany singled out the Jews, any time you single out any group, you divide your society, undermining the state’s foundation.

We are all equal or we are not. When we are, great civilizations are formed. When Philadelphia was founded by William Penn, a Quaker, it was on the principle of religious freedom. The first Catholic Church was erected there along with the first churches of just about every denomination. The whole slavery issue and the Civil War also involved religion.

This WOKE Agenda is extremely dangerous because it attacks the religious beliefs of many. Besides the American Civil War with its roots in religion, the same was true of the English Civil War which was Protestant v Catholic. India & Pakistan separated over religion – Buddhist v Islam. The Protestant Revolution was actually funded by Catholic bankers who wanted to compete with the Jews but could not get into the trade since lending money for interest was the Sin of Usury.

Arnaud Amalric (died 1225) was a very prominent abbot in the Albigensian Crusade (1209–1229), also known as the Cathar Crusade. They were persecuted because they believed in two Gods or philosophies, with the first one being good and the second being evil. It was during this religious war, which was covertly really for French political gain, that the monk Amalric is best remembered for allegedly advising a soldier who was worried about killing orthodox Catholics in the process of killing declared Cathar heretics. He said:

“NovitenimDominusquisunteius.” (“Kill them. For the Lord knows those that are His own.”)

The historical list goes on and on. The number of wars and civil uprisings that offended religious beliefs are countless. This WOKE Agenda is NOT about discrimination, it is an agenda that undermines the state and will lead to the breakup of the United States precisely as our computer has forecast.

This WOKE Agenda has prompted more than just a boycott of BUD. It has produced Woke Free American Beer. I’m not a beer drinker, I prefer Scotch. So I cannot speak to how it compares to Bud. But you can try it yourself to make that decision at Ultrarightbeer.com.

This is what I mean. This is not really an economic right-wing thing, it has its roots in religious beliefs. A friend from Europe came and we went down to Key West which is a major hangout for the Lesbian, gay, bisexual, and transgender crowd (LGBT/LGBQT). We saw a guy who could have been a linebacker in high heels with a black mini-skirt standing on the corner and people were taking pictures with him. He was obviously making serious cash. He was certainly not very feminine looking and with the heels, he stood over 7ft. Nobody was insulting him, they were lining up to have their photo taken with him.

This Woke Free American Beer commercial starts with Seth Weathers standing outside of a women’s bathroom and saying, “America has been drinking beer from a company that doesn’t even know which restroom to use.”

Welcome to the Great Divide